Industrial property rental prices set to rise

At the event “2025 Vietnam Real Estate Market Outlook” on January 8, Le Trong Hieu, director of Offices and Industrial Services at CBRE Vietnam said that in 2024, the industrial real estate sector continued to be a bright spot in the overall real estate market.

|

In recent years, major global manufacturers such as Samsung, LG, Foxconn, Hyosung, and Nestlé have announced plans to expand and launch many projects in various areas in Vietnam.

"Their strong commitment to expand factories, affirmed by the record-breaking foreign direct investment (FDI) disbursement of $25 billion, is the driving force for the positive results of Vietnam's industrial real estate in the past year," Hieu said.

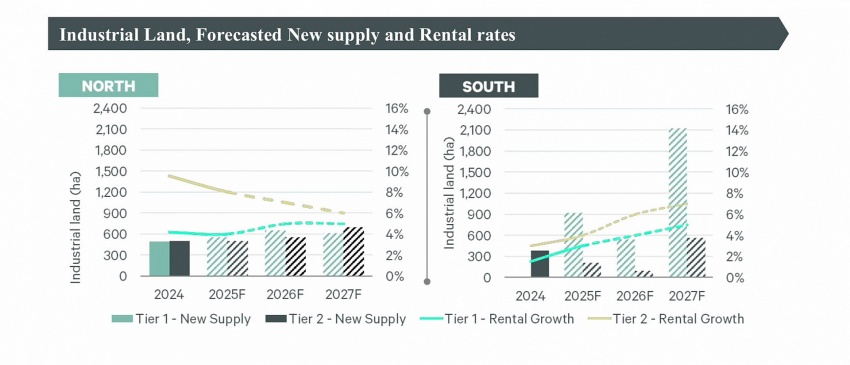

Industrial parks in tier 1 markets in the north reported an average occupancy rate of 80 per cent, while the south reported 89 per cent. The absorption area of the north reached over 400 hectares in 2024, driven by large transactions in such industries as electronics and electric vehicles.

Meanwhile, due to limited industrial land in key markets, the south recorded an absorption area of 265ha, 52 per cent lower than in 2023, mainly in Ba Ria-Vung Tau and Long An.

The gap in rental prices between the north and south is gradually narrowing due to strong rental growth in Hai Duong province and Haiphong city. By the end of 2024, the average rental price of industrial parks in the north reached $137 per square metre per term, up 4.2 per cent on-year, while that in the south was $175, up 1.4 per cent on-year.

In recent years, the central region, especially Nghe An province, has attracted numerous large manufacturers such as Luxshare ICT, and Foxconn. This has changed the industrial development landscape of Nghe An and neighbouring central provinces, such as Thanh Hoa. With advantages such as an abundant labour force and competitive rental prices at $60 - 90 per sq.m, the industrial market in the central region is expected to develop strongly in the coming years.

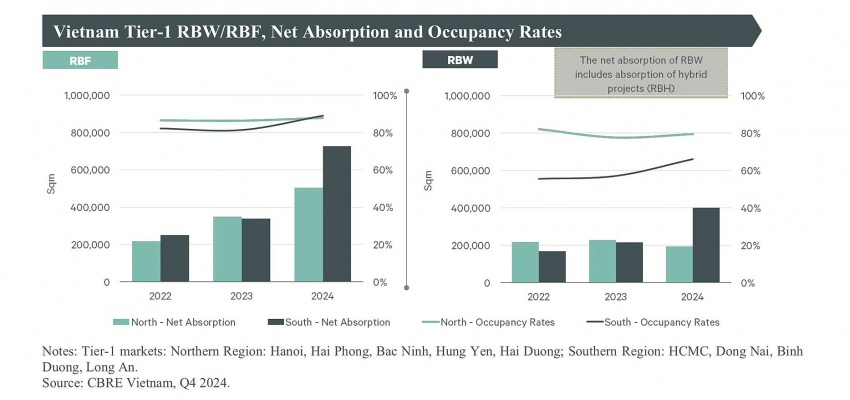

The warehouse and ready-built factory market also had an impressive growth in 2024. For the ready-built factory (RBF) segment, both regions reported the highest absorption over the past three years. The occupancy rate of RBF projects in the north reached 88 per cent, up 1.5 percentage points on-year, while the occupancy rate of RBF in the south increased by 7.7 percentage points on-year to 89 per cent.

"This is an impressive result, especially when both regions received the highest new supply in the past three years, with each region receiving approximately 0.5 million sq.m of new supply," Hieu said. "In terms of rental prices, both regions reported an increase of 2 per cent on-year to $4.9 sq.m per month in the North and $5 in the south.

For the ready-built warehouse (RBW) segment, while projects in the north maintained a net absorption of around 0.2 million sq.m, similar to the past two years, net absorption in the south doubled last year to 0.4 million sq.m. Positive leasing results led to rental growth of 5.3 per cent on-year in the south, while the north reported a moderate growth of 2.1 per cent.

By the end of 2024, the average rental price of RBW projects in both the north and south reached $4.7 per sq.m per month.

|

In terms of tenant nationality, according to CBRE, tenant groups are diversified. In the north, along with stable demand from Chinese and Vietnamese companies, European manufacturers are the group of customers actively looking for industrial land and warehouse space. Meanwhile, in the south, Chinese manufacturers account for a quarter of leasing inquiries sent to CBRE, up from 10 per cent last year.

"The more diverse demand from different countries shows the healthy development of the industrial real estate market nationwide," Hieu said.

In the next three years, industrial land rental prices are expected to increase by 4-8 per cent annually in the north and 3-7 per cent in the south. New industrial parks are expected to be concentrated in markets such as Haiphong and Vinh Phuc in the north or Binh Duong, Dong Nai, Long An in the south.

In addition, the central provinces of Thanh Hoa, Nghe An, Ha Tinh and Quang Nam are expected to have new industrial parks developed by professional investors, supporting the development of these emerging industrial markets.

RBW and RBF rental prices are forecast to increase slightly by 0-4 per cent per year over the next three years, as new supply is expected to remain high in both key industrial regions.

"2025 is forecast to be a challenging year in the context of continued geopolitical changes. Domestic economic growth drivers, FDI capital, as well as active investment in infrastructure and improvement of the investment environment, are expected to be key foundations in the coming development period," Hieu said.

| Hanoi condo supply hits highest peak since 2020 Abundant new supply during the second quarter was matched with a strong buying momentum in Hanoi's condominium market, as total sold units in the first half of 2024 alone already surpassed the full-year sales figures for 2023. |

| Ready-built factory market on the up In the first half of 2024, the industrial real estate market continued to show positive developments. |

| Lower competitiveness affecting Vietnam's industrial parks The competitiveness of industrial parks in Vietnam is currently weak, at the same time as most need to evolve into specialised or green-oriented facilities. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Sembcorp Development secures licence for VSIP in Khanh Hoa (December 31, 2025 | 18:54)

- Prodezi Long An advances towards integrated eco-centric industrial park model (December 26, 2025 | 11:16)

- Amata to develop $185 million Amata City Phu Tho (December 23, 2025 | 17:49)

- Work starts on Nhat Ban – Haiphong Industrial Zone Phase 2 (December 19, 2025 | 16:43)

- Becamex – Binh Phuoc drives sustainable industrial growth (November 28, 2025 | 15:22)

- South Korean investors seek clarity on IP lease extensions (November 24, 2025 | 17:48)

- CEO shares insights on Phu My 3 IP’s journey to green industrial growth (November 17, 2025 | 11:53)

- Business leaders give their views on ESG compliance in industrial parks (November 15, 2025 | 09:00)

- Industrial parks pivot to sustainable models amid rising ESG demands (November 14, 2025 | 11:00)

- Amata plans industrial park in Ho Chi Minh City (November 04, 2025 | 15:49)

Tag:

Tag:

Mobile Version

Mobile Version