Promoting pharma technology transfer with more policy support

The Vietnamese government is looking to develop the pharmaceutical industry and domestic vaccine production to ensure health security and sufficient local supply, and reduce dependence on imports.

|

| Policymakers, businesses, and experts discuss technology transfer in pharmaceuticals and vaccine manufacturing in Vietnam. Photo: Bich Thuy |

The National Strategy for the Development of Vietnam's Pharmaceutical Industry sets ambitious goals for Vietnam to become a regional hub for innovative drug technology transfer within ASEAN.

In late 2024, the National Assembly adopted the amended Law on Pharmacy, with one of the new policies being price and investment incentives for the development of the pharmaceutical industry, including technology transfer to produce new drugs and original brand-name drugs.

Barriers remain

At a policy dialogue held by the Health Strategy and Policy Institute under the Ministry of Health (MoH) in late 2024, businesses and experts highlighted the pivotal role of technology transfer in drug and vaccine production, and assessed the current opportunities and challenges in Vietnam, while sharing international success stories.

According to experts, technology transfer is a key driver for the development of Vietnam's pharmaceutical industry and provides comprehensive economic and social benefits, contributing to the nation's sustainable development goals. Specifically, it enhances the manufacturing capacity of the pharmaceutical industry, enabling Vietnam to achieve its strategic objectives. Technology transfer facilitates access to modern technology, reduces research and development costs, and enables the production of high-tech medicines, ensuring health security and supply autonomy.

Moreover, it strengthens the competitiveness of the pharmaceutical sector, attracts international investment, and expands export potential, thereby affirming Vietnam's position in the regional market.

Thuy Nguyen, director of Pharma Group Vietnam, said, “Technology transfer for innovative medicines and vaccines brings a multitude of benefits. Besides skills enabling Vietnam to accelerate the acquisition of knowledge and experience related to advanced, innovative products and processes, build the local workforce, and create new employment opportunities, these transfers will help to drive economic and social development and enhance access to quality medicines.

Sharing the same view, Atul Tandon, general director of AstraZeneca Vietnam, said that the legal framework for technology transfer needs specific guidelines for businesses. "AstraZeneca was one of the first companies to take up the efforts to establish a tech transfer framework. You may recall that in 2022, we committed our intentions of doing tech transfers even long before the legal framework was clarified. Now, we have the legal framework becoming clearer, and it is obvious the development of clarity guidelines and follow-up measures are based on the principles which have been defined in the new pharma law. However, unless those principles are clear, it will be difficult for us to navigate through and quickly make this a reality.”

|

| Atul Tandon, general director of AstraZeneca Vietnam. Photo: Bich Thuy |

Businesses in the local pharmaceutical industry have been facing challenges in technology transfer, stopping them from taking the next steps to contribute more to the industry's development.

In reality, the results of technology transfer in the pharmaceutical sector are still quite limited. As of 2024, only 20 new drugs had been transferred to Vietnam, of which three have been granted registration numbers. Vietnam's pharmaceutical production technology has only reached level three out of the four levels according to the World Health Organization assessment scale.

Domestic drug production only meets 70 per cent of the quantity of domestic demand, and 46.3 per cent of the value, far from the target set for 2030. The number of drug factories has increased to 238, all of which meet WHO-GMP standards, but mainly focus on producing generic drugs. This situation requires strong policies to promote technology transfer in the pharmaceutical sector.

An expert from the MoH said that a lack of resources and legal barriers is a reason. Administrative procedures are still complicated. Legal regulations related to registration and licensing are not favourable for businesses, although in recent times, the health sector has implemented solutions to simplify procedures. There is also a lack of attractive policies and special priorities to attract foreign investors and large pharmaceutical corporations to transfer technology.

|

| Thuy Nguyen, director of Pharma Group Vietnam. Photo: Bich Thuy |

Thuy Nguyen, director of Pharma Group Vietnam, added that in the pharmaceutical sector, the transfer of technology typically requires far more than sharing a “recipe” or building a factory. It is a complex undertaking with sharing knowledge, scientific know-how, and embarking on projects requiring significant resources and time from companies.

“As such, careful consideration must be given to the selection of countries that offer a supportive and attractive environment. Enabling factors include robust regulatory systems, political stability and governance, a trusted partner adhering to high ethical standards, a viable and accessible local market, an innovation-friendly environment with sound intellectual property rights, proper access to information, a skilled workforce, and clear economic development priorities,” she suggested.

Seeking close partnership

Experts agreed that the challenges underscore the critical need for collaboration with the government, agencies, and various stakeholders to solve.

Nguyen Khanh Phuong, director of the Health Strategy and Policy Institute, added that technology transfer would contribute to achieving the pharma industry's goals by 2030. These include increasing domestically produced drugs to 80 per cent in quantity and 70 per cent in market value, carrying out tech transfer for at least 100 original brand-name pharmaceuticals, and increasing Vietnam's pharma manufacturing technology to level four.

|

| Nguyen Khanh Phuong, director of the Health Strategy and Policy Institute. Photo: Bich Thuy |

“International experience shows that the success of this depends heavily on government support. The key is that the government needs to improve regulations to ensure the interests of the parties involved – specifically the mechanism on protecting intellectual property rights, creating stronger conditions for parties in terms of registration of documents and related legal procedures,” Phuong said.

Atul Tandon, general director of AstraZeneca Vietnam, stated, "The journey of technology transfer in the pharmaceutical sector, which AstraZeneca and our partners are integrating, is complex and fraught with risks and challenges. Looking ahead, we hope to continue collaborating with the Vietnamese government and stakeholders to achieve our shared objectives in cross-border technology transfer. With cooperation across various sectors of society, we can effectively overcome these challenges, ensuring our efforts align with Vietnam's healthcare priorities and ultimately benefit the Vietnamese people."

To effectively promote technology transfer, Vietnam must establish and harmonise related policies. Priority measures include comprehensive incentives throughout the technology transfer process, refinement of intellectual property regulations to protect the rights of both transferors and transferees, and the issuance of detailed guidelines to implement existing incentives.

Many important policies to encourage technology transfer, create a favourable environment, attract technology transfer projects, drug circulation registration certificates, purchase incentives, price maintenance and discount policies; investment incentives on taxes, loans, land, and human resource development were also discussed at the event.

| Overhaul anticipated for transfer of pharma tech Domestic and multinational corporations are expected to enjoy specific incentive policies for their tech transfer plans in Vietnam's pharmaceutical industry. |

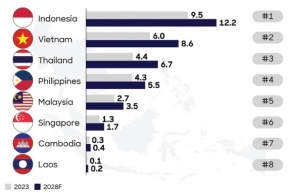

| Pharma to experience robust growth Vietnam healthcare market size is estimated to reach $23.7 billion and grow at an average rate of 7.5 per cent annually from 2023 to 2028. Healthcare expenditure per capita is also projected to increase from $237 to $328 in that time. |

| Competition within ASEAN for pharma investment With an aging population, rising disease burden, and advancements in healthcare science, the global pharmaceutical market has seen significant growth in recent years. In 2023, the total market was estimated at $1.6 trillion, an increase in over $100 billion compared to 2022. As one of the largest and fastest-growing industries, the sector drives healthcare innovation globally. |

| Promoting technology transfer for drug and vaccine production in Vietnam The Health Strategy and Policy Institute (HSPI) under the Ministry of Health held a conference on December 25 to promote technology transfer for drug and vaccine production in Vietnam. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Themes: Healthcare Platform

- PM outlines new tasks for healthcare sector

- Opella and Long Chau join forces to enhance digestive and bone health

- Hanoi intensifies airport monitoring amid Nipah disease risks

- Cosmetics rules set for overhaul under draft decree

- Policy obstacles being addressed in drug licensing and renewal

Related Contents

Latest News

More News

- Agro-forestry and fisheries exports jump nearly 30 per cent in January (February 09, 2026 | 17:45)

- Canada trade minister to visit Vietnam and Singapore (February 09, 2026 | 17:37)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- Vietnam forest protection initiative launched (February 07, 2026 | 09:00)

- China buys $1.5bn of Vietnam farm produce in early 2026 (February 06, 2026 | 20:00)

- Vietnam-South Africa strategic partnership boosts business links (February 06, 2026 | 13:28)

- Mondelez Kinh Do renews the spirit of togetherness (February 06, 2026 | 09:35)

- Seafood exports rise in January (February 05, 2026 | 17:31)

- Accelerating digitalisation of air traffic services in Vietnam (February 05, 2026 | 17:30)

- Ekko raises $4.2 million to improve employee retention and financial wellbeing (February 05, 2026 | 17:28)

Mobile Version

Mobile Version