Pivotal time for makeup of Vietnamese insurance

|

| Tran Nguyen, financial service consultant Ipsos Strategy3 |

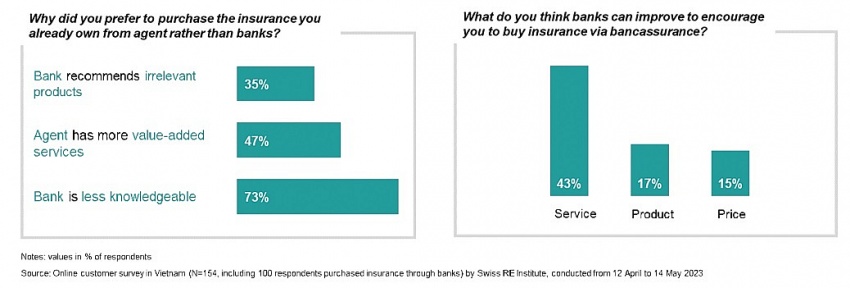

Bancassurance, despite being a significant contributor to the industry’s success, has been at the centre of controversy. Mis-selling scandals shook the market’s foundation, causing public trust to wane. A survey in Vietnam conducted by Swiss RE Institute in April-May 2023 during the peak of mis-selling incidents revealed public dissatisfaction.

The primary complaints centred around poor service quality, irrelevant products, and a perceived lack of knowledge among bank employees about the products they were selling. The primary cause of substandard service quality is often traced back to mis-selling, a problem that can manifest in various bancassurance sales models.

There are two main risk factors that lead to a likelihood of mis-selling. The first risk is when banks operate independently, with their referral teams promoting insurance products that offer high commissions and incentives for the employees. The second risk arises from moments between bank and insurance employees, where both the bank’s referral team and the insurance specialists are neglectful, selling unsuitable products.

In the context of the direct sales model as another example, where the bank’s own employees engage with and sell their bancassurance products directly to the consumer, devoid of any intervention from insurers or other bank specialists. The mis-selling phenomenon is most likely to be encountered in case of lending products.

The bancassurance sales team may resort to aggressive selling tactics, compelling customers to opt for insurance. The most typical instances when mis-selling can transpire include the stages before application appraisal, contract signing, and prior to loan disbursement.

Unlike Thailand, Malaysia, and the Philippines, where agents and brokers lead, Vietnam’s reliance on bancassurance calls for strict management akin to mature markets such as Hong Kong, Taiwan, and South Korea. Bancassurance’s contribution to new life insurance policy premiums dramatically increased from 21 per cent in 2018 to 50 per cent in 2023.

However, Vietnam’s market may face a similar fate to China’s, which saw a significant reduction in sales after tightening regulations. If we have a look at bancassurance in China, after a peak of the contribution to the life insurance premium, the government oversight to tighten and regulate the sales behaviours of bancassurance has resulted in a major decrease in sales of life insurance through the bancassurance channel, from 60 per cent in 2010 to 32 per cent in 2021.

The next chapter of Vietnam’s bancassurance could be like the Chinese market over 10 years ago. Life insurance in Vietnam, although in its nascent stages, presents opportunities for exponential growth. The potential for expansion is immense, despite the bancassurance-led distribution model’s stability challenges, which also opens avenues for new, innovative distribution strategies.

The life insurance penetration rate, currently at 11 per cent in 2022, signifies a vast, untapped market ready to explore life insurance offerings. Its modest contribution of 1.87 per cent to the GDP in 2022 holds promise for significant economic impact in the future. Therefore, while the path to sustainable growth may have obstacles, the future is ripe with possibilities and exciting prospects.

The enactment of a new Law on Credit Institutions, is set to bring stricter regulation and oversight to the bancassurance sector. The law aims to enhance customer protection, improve governance and risk management, and foster collaboration between authorities, banks, and insurance companies.

The law also prohibits credit institutions from packaging insurance products with banking products. This increased oversight will encourage insurance companies to rethink their bancassurance channels and explore alternatives, such as digital, while banks will need to improve their sales models to avoid regulatory infringements.

There will be challenges in rebuilding customer faith and delivering consistent services, and banks will need action plans to reinforce brand image, maintain customer satisfaction, and work on selecting suitable sales models.

|

However, there are opportunities for banks and insurers. One such opportunity lies in the reinvention of distribution channels and sales models. Insurers might reduce their reliance on financial institutions, and instead, explore the potential of self-developed digital platforms like mobile applications. These platforms can streamline processes and improve customer support, thereby enhancing the overall customer experience and building trust and loyalty among customers.

Insurers should also improve existing channels such as agents, direct sales, and professional distributors. When bancassurance is restricted, insurers must know their customers, particularly those transitioning from the bancassurance channel. Insurers need to manage the change of transitioning of customers carefully, provide proper communication about the change while maintain the quality of service to ensure smooth transition.

For banks, a comprehensive reevaluation and reinvention of their bancassurance sales models will be a crucial step in navigating the regulatory landscape effectively. To align with the new scrutiny placed on bancassurance, banks will need to streamline their operations, optimise internal processes, and focus on core banking activities, all while ensuring compliance with stringent regulations.

However, as we reflect on past instances of mis-selling, it becomes clear that rebuilding customer trust is no small task. To overcome this challenge, banks must prioritise transparency in their selling practices, along with providing comprehensive and accurate information about their products.

While the path to sustainable growth may have potential obstacles, the future of the bancassurance is ripe with possibilities and exciting prospects. Banks must foster closer collaborations with insurance companies. This will enable them to offer standalone insurance products designed to meet the unique needs of their customers, thereby enhancing customer satisfaction, cross-selling, and loyalty.

| Hanoi pays attention to improving quality of people’s life As one of the most populous cities in the country with a population of about 10 million people, the capital city of Hanoi has faced a lot of social issues relating to security and order, social evils and employment. |

| Fund for social insurance to be bolstered Efforts are gearing towards improving the relevant regulatory system for social insurance fund efficiency, further fostering economic development as well as social wellbeing. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Insurers accelerate post-typhoon recovery (October 28, 2025 | 15:31)

- Shinhan Life Vietnam builds growth on people strategy (October 07, 2025 | 09:45)

- Insurance sector initiates rapid response after Typhoon Bualoi devastation (October 03, 2025 | 18:25)

- Non-life insurers face mounting pressure after typhoon hits motor sector (October 02, 2025 | 18:59)

- Prudential Vietnam delivers responsible investment package (September 25, 2025 | 10:37)

- Insurers struggle to keep pace with EV rapid adoption (August 29, 2025 | 17:12)

- Non-life insurance market in sees bright spots in H1 despite rising challenges (August 28, 2025 | 16:21)

- Life insurance rebounds with renewed growth and trust (August 06, 2025 | 18:04)

- Global Care launches Vietnam’s first insurance KOL platform (July 25, 2025 | 09:42)

- Liberty Insurance leaves mark at 2025 Insurance Asia Awards with dual wins (July 14, 2025 | 07:27)

Tag:

Tag:

Mobile Version

Mobile Version