Navigating the transition from LIBOR

|

| By Dinh Hong Hanh - Partner, Financial Services leader PwC Vietnam (left), Sergey Volkov - APAC LIBOR lead partner PwC Consulting LLC, Japan |

According to the Bank of International Settlements, as of March 2020, Asia-Pacific banks’ USD cross-border claims totalled more than $5 trillion. Furthermore, according to Bloomberg, banks in Southeast Asia had more than $250 billion outstanding in floating-rate bonds and syndicated loans that would mature beyond 2021. For Vietnam, the number is close to $58 billion that would mature beyond 2021.

Therefore, it is critical for banks in Southeast Asia to progress with their LIBOR transition programmes.

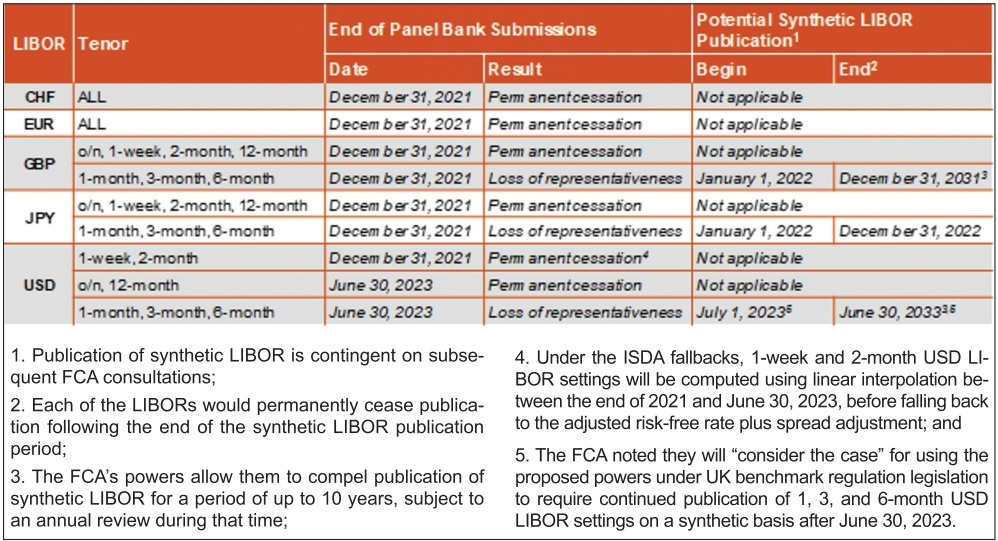

The Financial Conduct Authority (FCA), the regulatory body in the United Kingdom, has formally announced the future cessation and loss of representativeness of the London interbank offered rate (LIBOR) benchmarks. The announcement follows the results of a consultation by the ICE Benchmark Administration, LIBOR’s administrator. Keeping in mind the expected timeline for LIBOR’s demise, we have put together our perspectives and recommendations for banks going forward as they navigate away from LIBOR into the new territories of the risk-free rate (RFR).

Southeast Asia regional landscape

The transition from LIBOR to RFR is a complex undertaking involving regulators, lenders, and customers. Here, we highlighted some of the key considerations from each stakeholder group.

From a regulator’s perspective, a key consideration would be how to spur the market to shift from LIBOR to RFR. Regulators have noted that a disorderly transition away from LIBOR could cause financial instability and diminish banks’ safety and soundness. Regulators in a number of territories across Asia-Pacific have required firms to cease new LIBOR transactions this year, with some expecting firms to stop LIBOR issuance by June 2021 while others target December.

From a lender’s perspective, banks globally are focusing on eight transition areas: issuing new products, remediating IT, remediating contracts, client outreach, conducting risk, tax and accounting impacts, risk and validation models, and remediating treasury.

From a customer’s perspective, it is crucial to receive clear, effective, and timely information from the lenders so they can make informed contractual decisions.

Industry observations from Vietnam

Within the Vietnamese market landscape, we have observed that a few local big banks have significant exposures to the local IBOR indices. While waiting for an official announcement, they have already commenced a high-level assessment of their exposures.

Foreign branches of global banks have limited exposure to the local IBOR indices.

As of the date of this article, Refinitiv, the administrator of Vietnam’s three main IBOR indices – VND VNIBOR, USD VNIBOR, and VNDFX reference rates – are working on a plan to launch the new VND RFR, VNONIA in 2021*.

Outlook and recommendations for 2021

The regulator overseeing LIBOR, the FCA, has announced a clear timeline for LIBOR cessation and loss of representativeness. This announcement helps remove uncertainty from LIBOR’s demise.

|

In light of having a set end date for LIBOR which is not far away, it is recommended not to wait until the enforcement. There are two key recommendations on what banks should do now to better prepare for the cessation.

Firstly, it is important to understand the risks of LIBOR discontinuation and have a plan to address these risks and start engaging the right people within the organisation, including senior management, and driven by the lines of business.

Secondly, considering the timeline, it is high time to understand the gaps in the systems and contracts and work to address these as soon as is feasibly possible. By and large, market participants are striving to meet these milestones.

As the market as a whole continues on its transition path, LIBOR liquidity will diminish. Consequently, failure to stop issuing LIBOR and failure to remediate existing LIBOR risks may create significant legal and operational uncertainty – when LIBOR disappears, loans cannot be reset, and banks are concerned about potential litigation with their clients.

As a result, we are seeing Asia-Pacific banks work hard to reduce their reliance on LIBOR and cease issuing LIBOR products as much as possible, as soon as possible. For existing contracts, banks are reviewing contracts, outreaching to clients and discussing amendments to transition in advance of LIBOR’s demise.

*Provided by Refinitiv at the Webinar “A local market perspective – Vietnam LIBOR transition” on November 17, 2020

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnamese consumers express concern about climate change (October 11, 2025 | 14:06)

- ESG seen as key to Vietnam’s business credibility and capital attraction (September 29, 2025 | 18:38)

- From compliance to strategy: ESG criteria gaining ground (September 29, 2025 | 15:47)

- Vietnamese firms step up ESG game (September 23, 2025 | 15:26)

- Vietnam tax and legal changes set to shape foreign investment landscape (September 16, 2025 | 13:46)

- Vietnamese businesses navigate US tariffs (June 25, 2025 | 12:14)

- The impact of cloud, AI, and data on financial services (April 14, 2025 | 11:20)

- Vietnam 2025 M&A outlook: trends, deals, and opportunities (March 21, 2025 | 08:54)

- Vietnam's M&A landscape mirrors global trends (February 18, 2025 | 17:13)

- Asia-Pacific CEOs enter 2025 with optimism and caution (February 06, 2025 | 17:16)

Tag:

Tag:

Mobile Version

Mobile Version