Expo for paint, paper, rubber, and plastics to be held in June

|

| Luu Ngoc Hoang, deputy director of the Vietnam Chemicals Agency |

Speaking at the announcement on April 6, Vinh said, "The inordinate reliance on imported raw materials has diminished the competitiveness of industrial production. How can businesses adapt to satisfy environmental and social responsibilities while simultaneously becoming more competitive, effectively utilise their resources, and access the global value chain?"

Vietnam, a nation whose development is dependent on exports, is presently experiencing a bottleneck in its industrial production due to a lack of production input. According to Dang Van Son, vice president and general secretary of the Vietnam Pulp and Paper Association, the price of cellulose has risen to $700 per tonne, placing a significant strain on the paper industry.

"Vietnam exports more than 15 million metric tonnes (MT) of wood chips annually but imports nearly all the raw materials for paper production," Son said of the current insufficiency.

Vietnam's paper production requires between 500,000 and 600,000 MT of newsprint annually, resulting in price rises of raw materials as demand soars.

"Investing in a pulp mill is a hazardous endeavour with a lengthy return period," Son said, adding the mechanism to stimulate growth in paper manufacturing is a very complicated subject. "Developing the domestic paper material market will reduce reliance on imports and encourage proactive production," he suggested.

In Vietnam, many industries, including paint, paper, rubber, and plastics, are undergoing a digital transformation, allowing for more integration with the international distribution network, the development of sustainable raw material schemes, and the avoidance of external forces that disrupt supply.

Currently, the Ministry of Industry and Trade (MoIT) is concentrating on completing the draft Industrial Development Law for consideration and approval by the National Assembly that should provide a unified legal basis for industrial development initiatives.

The MoIT anticipates that the processing and manufacturing industries will continue to be economic growth engines for Vietnam this year, as they were in 2022, with a growth rate of 8.1 per cent.

| Rubber producers continue to brood over tough prices and tax complexities Vietnam’s rubber industry is facing difficulties from the global market and internal problems in tax policy, with farmers, associations, and businesses alike waiting for much-needed funds. |

| Low input material price to support profit margins of plastic businesses Vietnam is currently heavily dependent on the import of PVC resins - input materials in the construction plastic production chain. In the second half of this year and 2023, Vietcombank Securities Co (VCBS) forecasts that a low PVC price will support profit margins of businesses. |

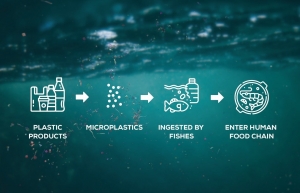

| Understanding biodegradable plastics In the fight against plastic waste, some businesses claim to use biodegradable plastics. However, the reality is that they are only using partially biodegradable plastics, called OXO-degradable plastics. These products don't contribute to sustainable development and are, in fact, directly harmful to the environment. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Vietnam forest protection initiative launched (February 07, 2026 | 09:00)

- China buys $1.5bn of Vietnam farm produce in early 2026 (February 06, 2026 | 20:00)

- Vietnam-South Africa strategic partnership boosts business links (February 06, 2026 | 13:28)

- Mondelez Kinh Do renews the spirit of togetherness (February 06, 2026 | 09:35)

- Seafood exports rise in January (February 05, 2026 | 17:31)

- Accelerating digitalisation of air traffic services in Vietnam (February 05, 2026 | 17:30)

- Ekko raises $4.2 million to improve employee retention and financial wellbeing (February 05, 2026 | 17:28)

- Dassault Systèmes and Nvidia to build platform powering virtual twins (February 04, 2026 | 08:00)

- The PAN Group acquires $56 million in after-tax profit in 2025 (February 03, 2026 | 13:06)

- Young entrepreneurs community to accelerate admin reform (February 03, 2026 | 13:04)

Mobile Version

Mobile Version