ESG promises must be backed up by genuine progress

It is inevitable that doubts will be raised regarding the quality and transparency of some businesses labelled “green” or ESG-friendly, given the numerous challenges surrounding sustainability. How do you foster an ESG framework for meaningful economic and community development?

|

| Andrew Chan, Sustainability Strategy & Transformation leader at PwC Asia-Pacific’s Sustainability Centre of Excellence |

Many years ago, there was more deliberate greenwashing since companies wanted to get green credentials. More recently, it’s shifted to accidental greenwashing. More businesses make bold commitment towards a greener journey. However, accidental greenwashing can occur due to many different terminologies around the sustainability agenda that can be confusing to all involved.

For example, there is net-zero versus carbon-neutral. Some mix up the terms and then some are not clear whether they mean carbon or they mean greenhouse gas. It can get confusing, even for experts. That’s why we always advise our clients to be clear what your definitions are.

The second point to note is that sustainability requires a lot of collaboration. And there are many different stakeholders – it’s not just about the shareholder. In looking at the response to sustainability by a company, you want to understand what the company has done to gather views from different stakeholders.

So, the company is not setting their sustainability response just by themselves. They’re looking at finance providers, they’re looking at employee interest, and they’re looking at the business partners and customers. What are the key ESG areas most important for the company? So, to avoid greenwashing, businesses should listen to different stakeholders’ views. ESG commitments need to be made in an informed manner, including understanding stakeholder expectations, responding based on linkages to business strategy and value creation.

Some may mistake philanthropy or pure community for sustainability response, but these are only part of a structured sustainability programme. Sustainability includes philanthropy, but should not be mistaken for philanthropy. That is one of the common mistakes for many Asian companies. From a business perspective, if sustainability isn’t linked to business strategy, it’s unlikely to return value to shareholders.

Finally, commitments should be backed up by real progress and operationalisation, such as annual measurements explaining how corporate functions are supporting the commitments, training staff on ESG, and how operations are increasing efficiency/reducing energy use. For instance, if Vietnam introduces a carbon tax, how ready will finance departments be, and will they have the skills on how to assess carbon tax filings?

Foreign investors are showing a stronger appetite for ESG-related compliance. What do you think about the importance of such criteria in mergers and acquisitions?

Fresh statistics from S&P 500 reveals that 90 per cent of a company’s value is from intangibles. Furthermore, ESG-centric funds often outperform the market’s average. Fund manager BlackRock noted its fiduciary duty to its members covers sustainability in its investment decision-making and performance monitoring.

This mindset can differ depending on the type of investor and duration of the investment. For instance, pension funds have had a stronger focus on sustainability, but venture capital funds are also considering opportunities in ESG growth sectors now.

ESG can be considered for sector targeting. Cross-sector ESG policies can cover thematic areas, such as climate change and labour rights; and sector-specific policies can be defined, such as for energy, construction, and agriculture. Related due diligence requests in Southeast Asia have been on an upward trajectory. Some investors have defined the standards for ESG compliance in their portfolios, seen in the case of Malaysia’s Employees’ Provident Fund defining criteria for their portfolio companies to adhere to by 2030.

In summary, investors are taking more active positions on stewardship over ESG, such as voting against director reappointment.

Aside from corporate responsibility, what is PwC’s purpose in investing substantially in ESG?

PwC in Southeast Asia started its sustainability practice in 2007, well ahead of demand, as we felt this is an increasing agenda that business and governments must respond to. As a leading global organisation, sustainability is aligned to our purpose and is a key pillar in our New Equation Strategy.

ESG is increasingly relevant for PwC’s clients. This is an area we are continuing to lead, to support client demand. We’ve committed to increasing ESG hiring, as well as upskilling our existing team members. I’m part of a newly created Asia-Pacific ESG Centre of Excellence to support colleagues across the region on more technical areas and we’ve expanded our own ESG curriculum.

We are also launching more upskilling services for clients, such as partnering with recognised business schools on executive ESG education. In fact, I have shared views recently to business schools in Asia on the role they can play to support the demand for sustainability talent.

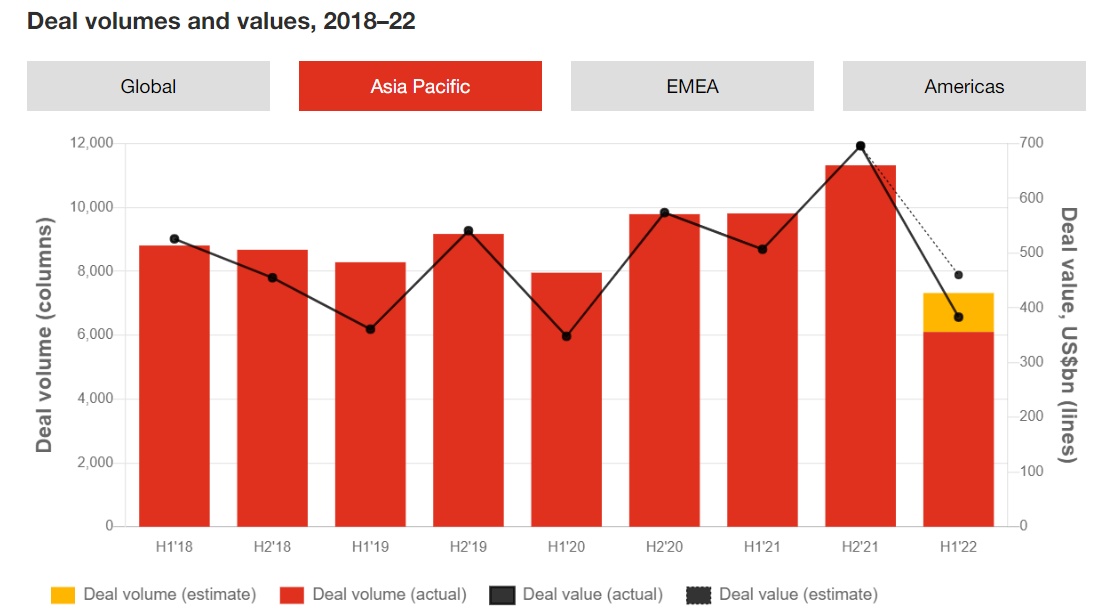

| Report depicting global M&A market performance in first half of 2022 PwC Vietnam on July 15 released a press statement reviewing global mergers and acquisitions (M&A) performance in the first half of 2022, noting that private equity and technology demand fueled deals during the period. |

| Preparing MNCs for a global tax rate The introduction of a global minimum corporate tax on the foreign profits of multinational corporations will affect Vietnam’s own tax plans. Annett Perschmann-Taubert, tax partner at PwC Vietnam, discussed with VIR’s Luu Huong the current tax landscape and how policies should be reformed in order to maintain momentum. |

| Empowered consumers prepared to make changes As reported on July 29, the PwC June 2022 Global Consumer Insights Pulse Survey has found that consumers are continuing to adapt to supply chain disruptions and increasing inflation. The survey captured the views of over 9000 consumers across 25 countries and territories, including Vietnam. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnamese consumers express concern about climate change (October 11, 2025 | 14:06)

- ESG seen as key to Vietnam’s business credibility and capital attraction (September 29, 2025 | 18:38)

- From compliance to strategy: ESG criteria gaining ground (September 29, 2025 | 15:47)

- Vietnamese firms step up ESG game (September 23, 2025 | 15:26)

- Vietnam tax and legal changes set to shape foreign investment landscape (September 16, 2025 | 13:46)

- Vietnamese businesses navigate US tariffs (June 25, 2025 | 12:14)

- The impact of cloud, AI, and data on financial services (April 14, 2025 | 11:20)

- Vietnam 2025 M&A outlook: trends, deals, and opportunities (March 21, 2025 | 08:54)

- Vietnam's M&A landscape mirrors global trends (February 18, 2025 | 17:13)

- Asia-Pacific CEOs enter 2025 with optimism and caution (February 06, 2025 | 17:16)

Tag:

Tag:

Mobile Version

Mobile Version