Empowered consumers prepared to make changes

Consumers who are experiencing supply chain issues, such as a lack of product availability or later than expected delivery, say they are not hesitant about making a change.

37 per cent say they would go to different retailers to meet their needs, or if they are in-store shoppers, would switch to online. Nearly a third (29 per cent) of online shoppers say they would give in-store retail a chance to better meet their needs, and 40 per cent would use comparison sites to check product availability.

Global uncertainties and supply chain issues are also leading many consumers to look more to their home markets. Eight out of ten respondents expressed a willingness to pay a higher than average price for products produced locally or domestically.

So far, the majority of consumers surveyed are coping with higher inflation. Over 75 per cent expect to maintain or increase their current levels of spending across most categories in the next six months. Notably, 47 per cent of respondents expect to spend more on groceries.

However, in what may be a sign of things to come, more than a quarter of consumers plan to reduce spending in a number of categories, including luxury and premium goods (37 per cent), dining out (34 per cent), arts, culture, and sports (30 per cent), and fashion (25 per cent).

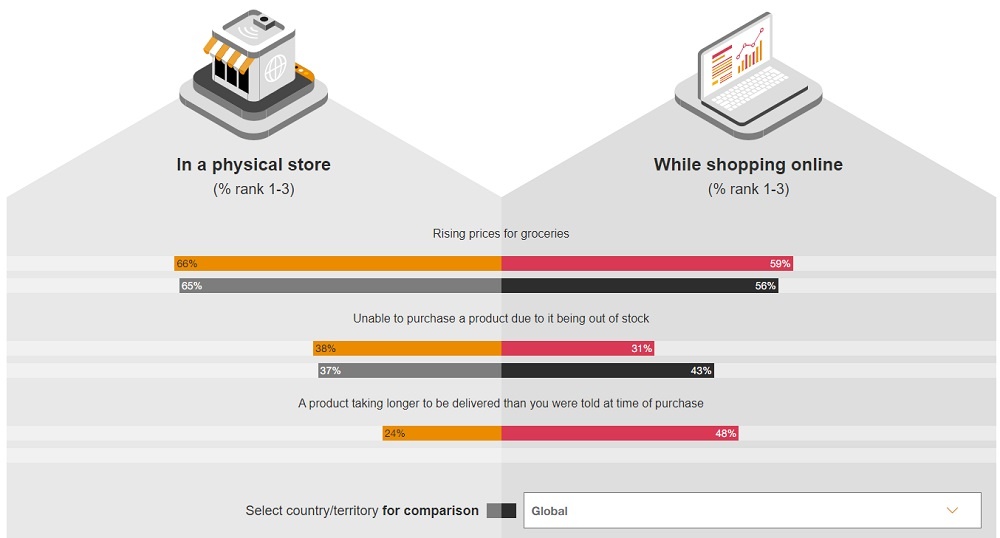

Overall, the rising price of groceries was the most prevalent issue cited by consumers shopping in-store (65 per cent) and online (56 per cent). More than half of consumers surveyed said they almost always or frequently experience rising prices for groceries.

At 69 per cent, the US and Canada trail only South Africa (76 per cent) and Brazil (74 per cent) for countries with the most respondents experiencing grocery inflation. Meanwhile, in Vietnam, the proportions reported in both in-store and online shopping were slightly higher than the global average.

|

| Vietnamese consumers’ answers about the issues that have the greatest impact on them when shopping compared to global data |

Supply chain issues were also seen as affecting the shopping experience globally, most notably being unable to purchase a product due to it being out of stock (online 43 per cent and in-store 37 per cent). Consumers also cited longer delivery times for online purchases (42 per cent) and longer lines or busier in-store locations (36 per cent).

Supply chain disruptions were seen to have a greater impact on Vietnamese consumers regarding delivery times with 48 per cent for online purchases and 24 per cent for in-store shopping.

|

| Responses from Vietnamese consumers under supply chain disruption and inflationary pressure |

Advisory director at PwC Vietnam Mohammad Mudasser said, “Vietnamese consumers are adapting to newer ways of purchasing, especially in Tier 1 cities. In the midst of supply chain disruptions, customers have quickly manoeuvred their shopping behaviours, especially in the current inflationary environment. They haven’t compromised on quality, choice, or service, actively switching between channels to ensure their fit-for-purpose shopping experiences."

"Disruption presents new opportunities for businesses in mining green shoots that are emanating out of the challenging economic environment. Opportunity mining in the business of today and tomorrow will test the agility of enterprises and the robustness with which organisations adapt will ensure they handle the turbulence and do not degrade the customer experience, expectations, and associations,” added Mudasser

New consumer habits are taking hold

Consumers have changed their lifestyle and purchasing habits as a result of the pandemic and it appears many of these have become ingrained and will actually strengthen over the next six months.

Due to the pandemic, 63 per cent of consumers surveyed said they had already increased their online shopping, while 42 per cent decreased shopping in physical stores. Half of the respondents were cooking at home more and 50 per cent were more focused on home-based recreation and leisure activities.

Looking ahead, these consumers expect to do more of the same:

● 50 per cent expect to shop more online – this figure was highest among core millennials (58 per cent), young millennials (57 per cent) and Gen Z (57 per cent), but lower among baby boomers (32 per cent), Gen X (42 per cent). 39 per cent expect to continue online shopping at their current levels

● 46 per cent plan to cook more at home

● 41 per cent will do more recreation and leisure activities at home

● 41 per cent will buy more from retailers that provide efficient deliveries and collections

● 22 per cent will shop less at physical stores.

ESG factors along with data security strongly influence brand trust

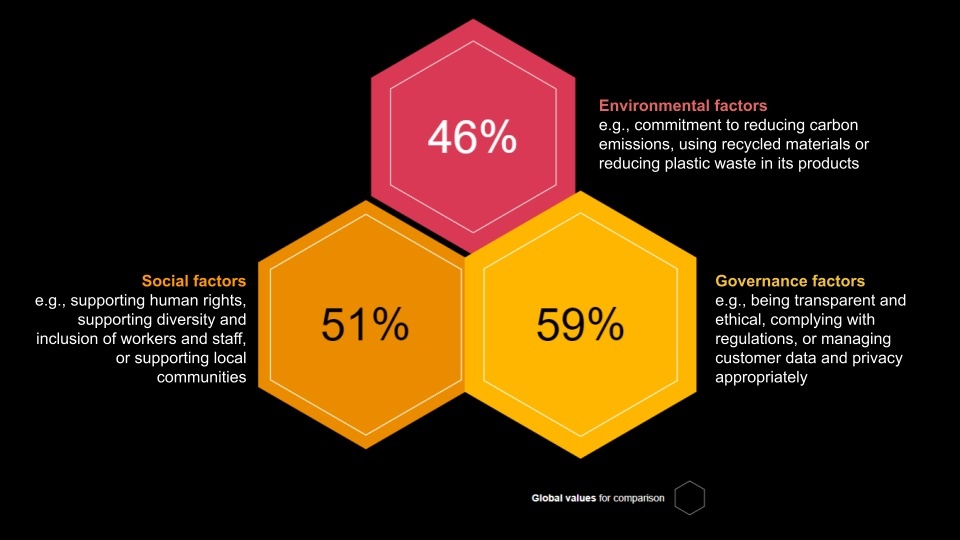

Environmental, social and governance (ESG) factors continue to influence consumer perceptions. For about half of consumers surveyed, a company’s actions related to ESG often or always influence their trust in the company or the likelihood to recommend the company or brand to others.

Among the 25 countries or territories in the survey, ESG factors are most likely to affect the shopping behaviours of respondents in India, the Philippines, and Vietnam, and least likely to affect respondents in Japan, France, and Hong Kong.

For Vietnamese consumers, governance (59 per cent) and social (51 per cent) factors outweigh a company’s environmental commitment (46 per cent). ESG factors carry more weight for Gen Z and young millennials and less for Gen X and baby boomers.

|

| Vietnam witnessed a higher rate of consumers who are influenced by ESG factors |

The most significant factors identified for fostering brand trust are data security and the customer experience. Protecting personal data ranked top (58 per cent of respondents) for impacting brand trust to a great extent – an increase of 11 points over the past six months. Always meeting expectations and providing exceptional customer service were highly ranked by over half of the respondents as well (53 per cent and 52 per cent respectively).

Mudasser noted, “Using ESG criteria for measuring performance is not optional anymore and it will become an absolute necessity in times to come. ESG will only grow as both a filter criterion to evaluate businesses and a driver of value generators. Investors are clamouring for more insight into ESG risk and performance, and global regulators are converging around common non-financial reporting standards."

"The Vietnamese government has recently made a stronger commitment to tackling climate change and is moving ahead with new regulations. Such changes will impact all industries, specifically consumer product companies and retailers operating in Vietnam, affecting the way they do business, how products reach consumers, which products are launched, and how well they grow. Inflation is expected to continue to push prices up and will be a threat to the consumer commitment to ESG in the short to medium term,” he concluded.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnamese consumers express concern about climate change (October 11, 2025 | 14:06)

- ESG seen as key to Vietnam’s business credibility and capital attraction (September 29, 2025 | 18:38)

- From compliance to strategy: ESG criteria gaining ground (September 29, 2025 | 15:47)

- Vietnamese firms step up ESG game (September 23, 2025 | 15:26)

- Vietnam tax and legal changes set to shape foreign investment landscape (September 16, 2025 | 13:46)

- Vietnamese businesses navigate US tariffs (June 25, 2025 | 12:14)

- The impact of cloud, AI, and data on financial services (April 14, 2025 | 11:20)

- Vietnam 2025 M&A outlook: trends, deals, and opportunities (March 21, 2025 | 08:54)

- Vietnam's M&A landscape mirrors global trends (February 18, 2025 | 17:13)

- Asia-Pacific CEOs enter 2025 with optimism and caution (February 06, 2025 | 17:16)

Tag:

Tag:

Mobile Version

Mobile Version