Dual lightning strikes to turn Vietnam’s e-commerce equilibrium upside down

|

|

After leaving the industry to stew for nearly a year, the two local e-commerce platforms of Tiki and Sendo finally agreed on a merger deal two weeks ago. A VIR source revealed that the two sides are finishing the last steps of the deal that is expected to be completed this July.

According to local market research company Asia Plus, Shopee is leading the Vietnamese e-commerce playground with the market share of 35 per cent, while Lazada holds 20 per cent. Following them is Tiki with 17 per cent.

The remaining 28 per cent is shared by the rest of the competitors, however, a long line-up of players including Leflair, Adayroi, and Lotte.vn have thrown in the towel, implying that a large portion of this is held by the fourth member of the Big Four, Sendo. If Sendo’s market share is similar to Tiki’s 17 per cent, they would hold about 34 per cent combined, which would make them a significant contender to both Shopee and Lazada. Thus, the two overseas rivals could see fierce competition in the coming time.

However, the market share of the two local companies spells trouble, as even without getting a clear reading on Sendo, Tiki’s market share is more than triple of what is allowed for horizontal merger and acquisition (M&A) deals (5 per cent) – essentially disqualifying it from any sort of merger.

Neither party to the deal has replied to media queries regarding the issue and it remains to be seen how the two would go about justifying the economic concentration. One point in their favour though, with other players holding 35 and 20 per cent, the merger would not necessarily result in an overbearing force in the market that could batter down any opposition.

New shopping competitor

While it remains unclear whether the Tiki-Sendo alliance would be strong enough to beat Lazada and Shopee, Facebook’s Shops appearing in the market promises to throw a titanic wrench into the works for the Big Four.

The global social network Facebook in the middle May launched its new feature named Shops which is very similar to other e-commerce platforms.

With 2.6 billion users globally and more than 60 million local users, Facebook’s Shops will have a great competitive edge right from its launch.

According to CEO Mark Zuckerberg, Shops will improve on the standard web commerce experience by storing user payment credentials in a single place that they can then use on any Facebook or Instagram storefront. There are currently more than 160 million small businesses using the company’s apps.

Additionally, Facebook’s new e-commerce feature will be integrated into existing Facebook business profiles and Instagram profiles, and they can also appear in Stories or be promoted in adverts. Items that businesses have made available for purchase will appear within the shop, and users can either save items or place an order.

Customers and sellers will be able to use Shops for free. Companies running business on the platform can adjust the layout and design of the store to promote the products they want to highlight. As of now, nearly one million companies registered to use the alpha version of Facebook’s new service.

Obviously making good use of its advertising prowess, sellers will be able to purchase advertisements for their virtual stores and products.

At least initially, Facebook will not charge merchants for sales made on the platform unless they use the company’s checkout process. In the latter case, sellers will pay 40 US cents for orders of up to $8 or 5 per cent for orders above $8.

As a result, local sellers will have one more option to run business on e-commerce platforms. While the current e-commerce firms do not really sport advertisement features, Facebook will clearly use this advantage to gain a foothold. This could take a sizeable chunk out of the market shares of other e-commerce firms in the country.

Hence, both Tiki and Sendo would see their slice of the pie diminish due to the appearance of Facebook’s Shops – along with Lazada and Shopee, and every other competitor small or large.

Financial incapacity

As e-commerce is still a new sector and all players in the race are rolling ahead tremendous losses, Tiki and Sendo have been constantly calling for investment, resulting in fragmented shareholder structures.

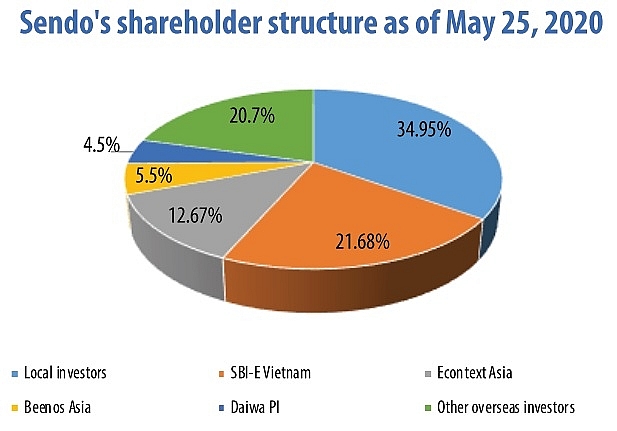

As of now, overseas investors hold 65 per cent of Sendo’s shares. In addition to FPT, Sendo’s stakes have been picked up by SBI, Beenext, Econtext Asia, and Daiwa.

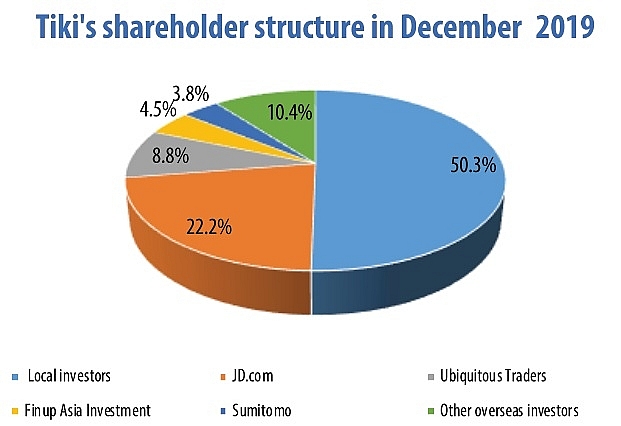

Regarding Tiki, in addition to VNG’s 24.6 per cent and JD.com’s 22.2 per cent, Ubiquitous Traders Pte., Ltd., CyberAgent, STIC, and Sumitomo have all bought into the platform. As of the end of 2018, Tiki recorded VND1.4 trillion ($60.87 million) in accumulated deficit and Sendo reported VND1.3 trillion ($56.5 million) in losses. However, continually selling shares to gain more funding cannot be maintained forever. Breaking new ground on angling for finances, Tiki a few weeks ago announced plans to stage an initial public offering (IPO).

Sendo, while not showing any wish to list on the stock exchange, could easily find itself pressed for money.

Nevertheless, after the failure of WeWork, which received billion-dollar investment but went bankrupt last year due to the ineffective use of the capital, many investors are now focusing on the profitability of startups instead of their potential. Therefore, funnelling money into e-commerce may not be as appetising as in the past. Thus, forming alliances and proposing an IPO could both be meant as remedies for the financial conundrum.

| Facebook’s Shops may find it hard to compete with e-commerce giant Amazon. Experts say that the playground seems too cramped to welcome any player, even one with 2.6 billion users. “Success will not only be made through the large quantity of users, it also depends on the way Facebook satisfies customers,” said Ngo The Vinh, an expert working in e-commerce for over a decade. According to the latest survey from US-based Peel Research Partners, nearly 40 per cent of US adults use Facebook to explore news and contact friends, but not for shopping. Amazon and eBay, in their minds, are the places for such a task. Also in the US, according to a survey by Minnesota Public Radio, around 55 per cent of total users access Amazon for searching goods, 28 per cent using Google, and only 17 per cent using other methods. That means a product showcased on Amazon can be sold out more easily, because users load up Amazon for shopping without being disturbed by social media. Moreover, advertisements on Amazon are one of the most efficient functions to bring in money, which has yet to be developed on Facebook. Users said that sponsored products on Amazon are of better quality than on Facebook, so merchants and their shops are visited much more. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- New rules ease foreign access to Vietnam equities (February 05, 2026 | 17:29)

- Vietnam’s IFC creates bigger stage for M&As (February 01, 2026 | 08:16)

- Game startup Panthera raises $1.5 million in seed funding (January 29, 2026 | 15:13)

- Cool Japan Fund transfers shares of CLK Cold Storage (January 28, 2026 | 17:16)

- Nissha acquires majority stake in Vietnam medical device maker (January 26, 2026 | 15:40)

- BJC to spend $723 million acquiring MM Mega Market Vietnam (January 22, 2026 | 20:29)

- NamiTech raises $4 million in funding (January 20, 2026 | 16:33)

- Livzon subsidiary seeks control of Imexpharm (January 17, 2026 | 15:54)

- Consumer deals drive Vietnam’s M&A rebound in December (January 16, 2026 | 16:08)

- Southeast Asia tech funding rebounds on late-stage deals (January 08, 2026 | 10:35)

Mobile Version

Mobile Version