Considerations for regional investment in Southeast Asia

|

| Dean Rolfe - Partner, head of Market Entry KPMG in Vietnam |

According to recent trade data, the US imported $540 billion worth of goods from China, whereas China imported only $120 billion from the US in 2018. This escalating trade imbalance resulted in growing trade tensions and ultimately resulted in the imposition of trade sanctions by the US last year. Currently, nearly half of all imports into the US from China are subject to levies up to 25 per cent. The Trump administration is also now threatening to apply tariffs on all remaining imported Chinese goods.

China has been quick to retaliate, having recently applied tariffs to $110 billion worth of US goods imported into China. This tit-for-tat application of levies and trade sanctions by both parties does not appear to be an issue that can be resolved quickly, if at all.

As uncertainty grows, many companies with manufacturing capacity in China are now exploring a manufacturing diversification strategy commonly referred to as a “China plus one” strategy. The basis of this strategy is retaining a foothold in China, but expanding into a new jurisdiction for cost reduction or other reasons.

Indeed, many Chinese manufacturing enterprises have already started a diversification strategy to take advantage of Vietnam’s affordable labour costs. This is evidenced by China’s foreign direct investment (FDI) into Vietnam which reached 65 per cent of 2018 levels in only the first four months of 2019. Manufacturing enterprises located outside China are also turning their attention to Vietnam as well as other countries that comprise the ASEAN bloc.

The establishment of any new greenfield manufacturing activity carries risk. This risk is amplified in new locations where the rule of law is weak, or regulation is poor. According to the latest annual World Bank survey on the ease of doing business, many ASEAN countries have improved their overall global rankings, but more work is needed on digital transformation to reduce the administration burden of carrying out business in the region.

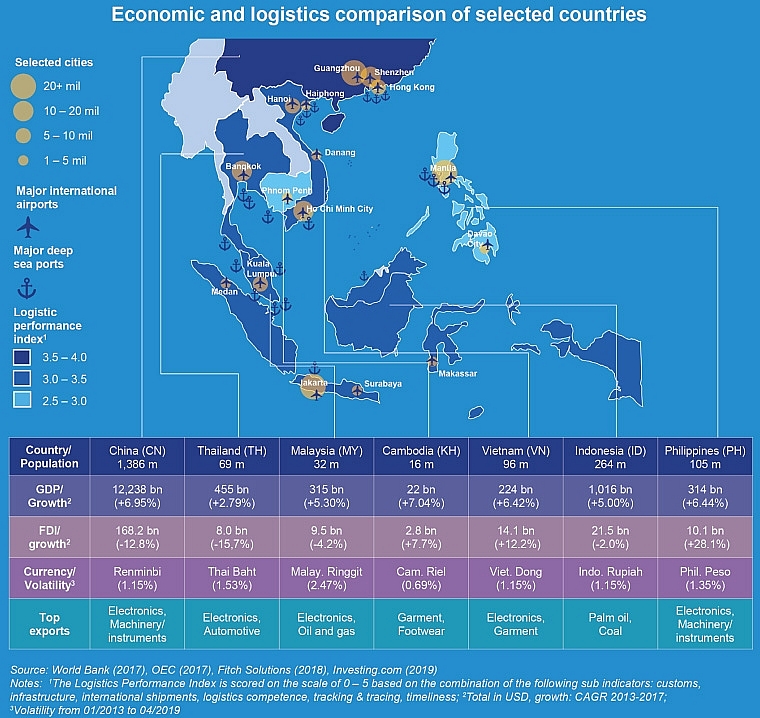

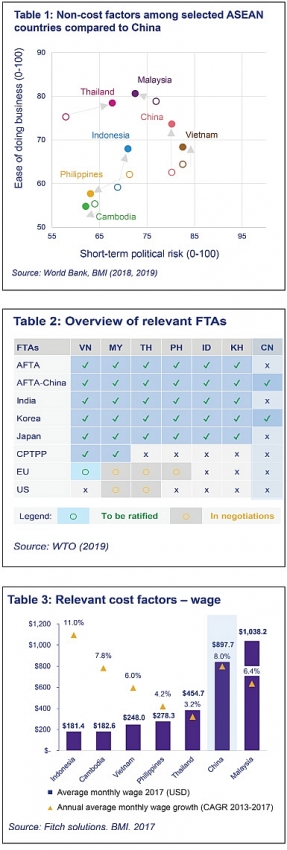

Countries that have implemented automated compliance processes for example have achieved higher overall rankings. As expected Singapore, as one of the most developed countries, scored highly followed by Malaysia and Thailand (see Table 1).

On a different metric of political risk, Vietnam has ranked second among its peers, after Singapore. Both countries have benefited from a stable political system.

|

Global trade integration

Free trade agreements (FTAs) have a direct impact the movements of goods across international borders. Such agreements can reduce trade barriers and import taxation costs. While China has entered into a large number of FTAs, they tend to be bilateral agreements. Malaysia and Vietnam on the other hand have more multilateral FTAs in place. This multilateral trade approach arguably provides access to more countries with larger markets (see Table 2).

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) is also a key consideration. Malaysia and Vietnam have signed the CPTPP whereas Thailand, Indonesia, and the Philippines have not. Vietnam will also sign a multilateral FTA with the European Union which will provide unparalleled market access.

While qualitative considerations are important, a key consideration for manufacturing is cost and a primary component of the manufacturing cost is labour. Malaysia and China have significantly higher wage costs compared to, say, Indonesia and Cambodia. Vietnam and the Philippines have similar wage costs which are significantly lower than China (see Table 3). However, while Indonesia’s wage cost is the lowest noted, it has also experienced some of the fastest rates of increase.

It is worth highlighting that low wages need to be considered in light of a range of other factors. For example, lower wage costs are usually associated with less developed locations and infrastructure. For example, low wages may be available in areas which are not suitable for manufacturing because the location presents too many adverse supply chain considerations.

Furthermore, it needs to be highlighted that wage costs and labour costs are two different things. Labour costs are a tax inclusive cost, whereas wages are not. Many enterprises overlook the fact that a comparison of wage costs alone ignores the very significant cost of taxes which apply to employment, like compulsory insurance, pensions, or other taxes or levies. Taxes of course vary between jurisdictions which makes a regional comparison very difficult.

Utilities, taxes, and land rental costs are other key cost considerations. Some of these cost elements are country-driven, while others are driven by geographic and strategic locations.

Taxation considerations

|

The annual World Bank survey on paying taxes provides a useful jurisdiction by jurisdiction benchmarking exercise on overall taxation, because the hypothetical taxpayer is a manufacturing enterprise. The overall ranking is based on a combination of two elements, those being the time to comply with tax laws, and the total tax burden. Thailand and Malaysia achieved a good ranking in 2018 due to the automation of tax compliance processes, while Vietnam and Cambodia scored poorly overall for the same reasons. The introduction of electronic invoicing in Vietnam will likely improve its overall ranking going forward.

However, when the total tax metric (as in, overall tax cost) is reviewed, China has a very high total, more than double of Thailand or Indonesia. Vietnam and Malaysia also have a low total tax cost when compared against China. But the survey has limitations as it does not include cross-border taxes like customs duties or withholding taxes. So while this is a useful preliminary guide, it can be misleading for international investors.

Needless to say, China has significant competitive advantages when it comes to supply chain management. Most inputs can be sourced locally which may reduce transportation costs and result in fewer supply chain disruptions. As a result, China has a strong advantage in this regard. However, cost escalations, regulation, and recent trade levies imposed on exports into the US need to be considered against these qualitative factors.

Vietnam’s shared border with China and direct road connections arguably reduces supply chain disruption arising from a “China plus one” manufacturing strategy. The ability to use roads creates a significant time advantage over sea freight. When looking at specific industry sectors like textiles, automotives, chemicals, equipment, and electronics, each jurisdiction will have its own advantages and disadvantages.

The Philippines has long been an attractive location for American investment, but its geographical location and limited physical connectivity to the wider ASEAN region imposes supply chain challenges. However, the Philippines have had some success with heavy industries like shipbuilding. Thailand is the largest automotive manufacturer in the region and second-largest exporter of computer hard drives in the world. Vietnam is also a rising electronics manufacturer and is the largest exporter of Samsung phones globally. It also has a very significant garment manufacturing sector. Malaysia and Singapore have a focus on higher value-added industries and hi-tech manufacturing.

A “China plus one” strategy opens a range of considerations that will require detailed analysis of cost and non-cost factors based on individual commercial and economic drivers. It seems clear however, that Vietnam is likely to be a net beneficiary from this shift in regional strategy.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- KPMG launches tariff modeller in Vietnam to navigate US tariff risks (July 29, 2025 | 12:11)

- Removing hidden barriers to unlock ASEAN trade (June 29, 2025 | 11:31)

- New report charts path for Vietnam’s clinical trial growth (May 21, 2025 | 08:58)

- TTC Agris strengthens market position with investment in Bien Hoa Consumer JSC (May 19, 2025 | 10:14)

- World Bank to help SBV build shared database for banking industry (April 09, 2025 | 08:55)

- New trade alliances and investment hubs are redefining global power dynamics (April 03, 2025 | 17:00)

- ACCA and KPMG forge path for business leaders to pioneer ESG excellence (March 07, 2025 | 10:09)

- VietBank signs MoU with KPMG (February 26, 2025 | 18:47)

- Warrick Cleine MBE: an honour for services to British trade and investment in Vietnam (December 31, 2024 | 20:16)

- KPMG report offers fresh insight into leveraging AI (December 24, 2024 | 09:23)

Tag:

Tag:

Mobile Version

Mobile Version