Repairing balance sheet to return to profitable growth

As a result, many businesses in Vietnam, particularly in sectors such as real estate, consumer manufacturing and hospitality, find themselves facing liquidity challenges and unsustainable capital structures.

|

| Repairing balance sheet to return to profitable growth (illustration photo/ Source: freepik.com) |

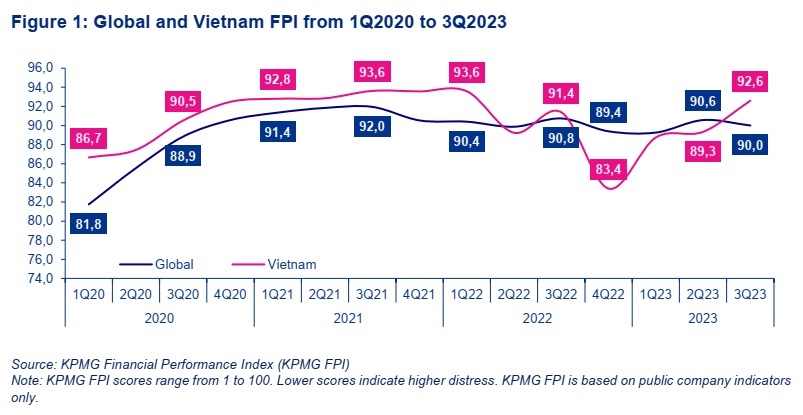

KPMG’s Financial Performance Index suggests that Vietnam’s distress levels in Q4 of last year exceeded levels observed in the early stages of the recent pandemic, albeit with some initial positive indicators in 2023 to date. As a growth market, Vietnam’s overall economy has historically shown less significant signs of distress than the global economy, although this year has proven exceptionally challenging.

|

Businesses must now act decisively to recover, creating adaptive strategies that protect operations and forge pathways back to sustainable growth. One such strategy involves the adept management of working capital, an approach that offers substantial benefits at minimal funding costs.

At its core, optimising working capital leads to cash release and more streamlined operations. Vietnam’s public listed companies have typically maintained around 100-120 days of cash tied up in working capital. Especially in the current economic downturn, businesses need additional liquidity to fund daily operations, debt repayments and internal reorganisations.

|

Working capital optimisation involves improving receivables, payables and inventories management. Standardising procurement processes, for instance, could lead to cash release in the payables cycle. Similarly, accounts receivable optimisation could include minimising overdue receivables, installing robust dunning processes and improving billing processes.

Yet, the key lies not just in the implementation of these strategies but also in their constant vigilance and re-assessment. Regular monitoring of individual working capital components is paramount. Implementing SKU-level reporting, for instance, facilitates the identification of slow-moving inventory items, enabling timely adjustments and informed procurement plans.

Even without a dedicated management information system, businesses can harness available office software or deploy reporting platforms through Business Intelligence tools. These practices, however, necessitate a corporate culture that places liquidity at its core.

In tandem with getting a grip on working capital, it is crucial for businesses to review their financing arrangements, particularly when facing severe financial distress. In many cases, a financial restructuring plan may be required to help the business navigate uncertain times.

The first step towards achieving a successful financial restructuring is assessing the short-term cash flow forecast to ascertain the ability to sustain operations for at least three months, to be maintained on a rolling weekly basis. The subsequent debt restructuring involves rearranging the company’s outstanding debts to reduce near-term financial pressure and reinstate stability. It is not a one-size-fits-all solution; rather, it is about tailoring the strategy to the specific financial needs and goals of the business.

Through financial restructuring, companies aim to ensure that their new capital structure can be sustained by future expected cash flows, considering that cash flow projections may have drastically altered due to the events causing financial distress.

Debt restructuring must always be accompanied by a review of the asset portfolio, ensuring that investments are channelled into core business segments. Fix-sell-close considerations typically come into play at this junction, whereby the company considers whether it can turn around any of its underperforming business units; or alternatively, sell or close these based on the potential value realisation, ease of implementation and time required to execute each available option.

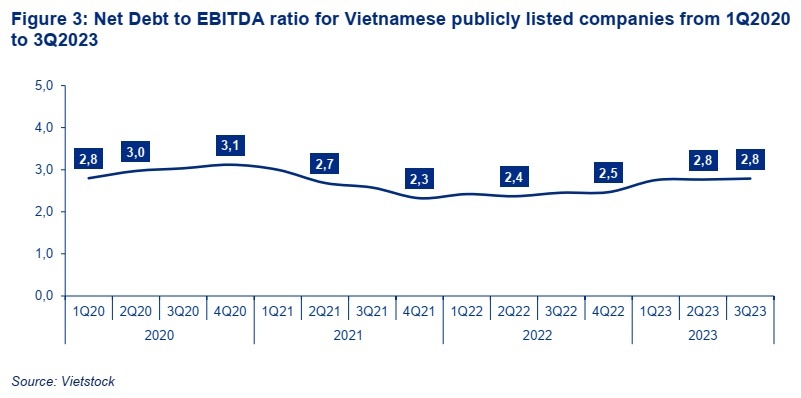

Corporate financial leverage for public companies, as indicated by the net debt to EBITDA (earnings before interest, taxes, depreciation, and amortisation) ratio, is currently at levels similar to early 2020, indicating that companies are weathering the prevailing storm with leveraged balance sheets. This reinforces the burning platform for timely and transparent conversations with lenders and other stakeholders.

|

In the dynamic landscape of contemporary business, challenges are not isolated obstacles but integral components of an ever-evolving ecosystem. However, businesses are not merely passive reactors to challenges. They are active participants on a transformative journey. Proactively addressing challenges is the crucible of growth and resilience. It is not just about weathering storms; it is about using each challenge as a steppingstone for transformation.

This proactive stance allows businesses not only to navigate uncertainties adeptly, but also to secure and fortify their market positions. Challenges become the impetus for innovation, efficiency, and strategic recalibration.

| Vietnam embraces green growth in its sustainable development strategy for 2023 At the Sustainable Development 2023 seminar, Deputy Minister of Planning and Investment Tran Quoc Phuong outlined Vietnam's commitment to green growth and sustainable development, highlighting the challenges and strategies in the new era. |

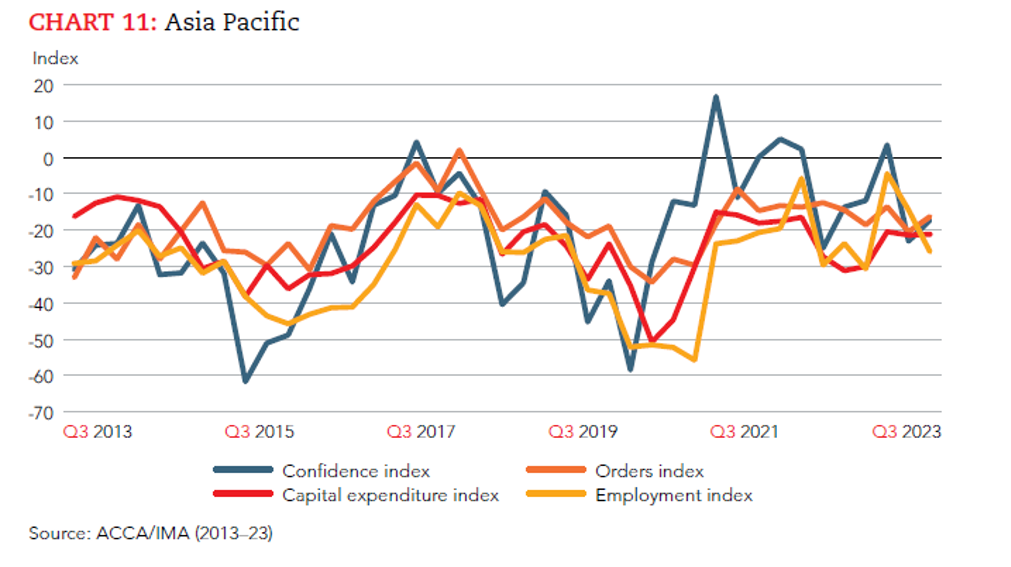

| Vietnam shows outstanding Q3 growth Following its recent impressive economic progress, Vietnam has featured in the Global Economic Conditions Survey (GECS) report for the third quarter of 2023 by the Association of Chartered Certified Accountants (ACCA) and Institute of Management Accountants (IMA). |

| Climate tech startups a catalyst for Vietnam’s net-zero future I remember landing in Hanoi for the first time in early 2010, impressed by endless streams of motorbikes. As a practitioner pursuing sustainable development, I thought about the emissions fuming out of the many vehicles. Over a decade passed, and when I landed again in Hanoi a few months ago, I still found myself surrounded by swarms of motorbikes. But things are about to change. |

| M&A arena expects growth next year Due to an unstable global economy, the merger and acquisition market will face many challenges in 2024, but there will still be great opportunities in several sectors, according to experts. |

(*) By: Tim Kramer, Director and head, Turnaround and Restructuring,

Tran Ngoc Mai, Manager Turnaround and Restructuring and

Pham Hong Van, Senior Turnaround and Restructuring KPMG in Vietnam

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- KPMG launches tariff modeller in Vietnam to navigate US tariff risks (July 29, 2025 | 12:11)

- Removing hidden barriers to unlock ASEAN trade (June 29, 2025 | 11:31)

- New report charts path for Vietnam’s clinical trial growth (May 21, 2025 | 08:58)

- TTC Agris strengthens market position with investment in Bien Hoa Consumer JSC (May 19, 2025 | 10:14)

- World Bank to help SBV build shared database for banking industry (April 09, 2025 | 08:55)

- New trade alliances and investment hubs are redefining global power dynamics (April 03, 2025 | 17:00)

- ACCA and KPMG forge path for business leaders to pioneer ESG excellence (March 07, 2025 | 10:09)

- VietBank signs MoU with KPMG (February 26, 2025 | 18:47)

- Warrick Cleine MBE: an honour for services to British trade and investment in Vietnam (December 31, 2024 | 20:16)

- KPMG report offers fresh insight into leveraging AI (December 24, 2024 | 09:23)

Mobile Version

Mobile Version