Bumper investment for Lozi not a guarantee of success

|

| Lozi offers services as diverse as flower delivery, e-pharmacy, and products for family pets (Photo: Le Toan) |

Local fast-growing tech startup Lozi, which operates a consumer-to-consumer (C2C) e-commerce portal and has its own fleet for on-demand delivery called Loship, has just secured tens of millions of USD from Smilegate Investment, supporting its expansion across the country to become a one-stop solution for consumers’ one-hour delivery needs.

Nguyen Hoang Trung, CEO and co-founder of Lozi, said the startup aims to become the fastest-growing intracity e-commerce platform in Vietnam, and the new funding will improve its one-hour delivery services and bring them closer to tripling daily transactions in the next 12 months, gunning for annual revenue of $31 million by 2020 – a figure not improbable with its current driver fleet of 30,000 conducting 1 million transactions a month.

Founded in 2013, Lozi was originally an app for people to find food, beverages, and coffee shops. In 2015, it transformed into a social C2C e-commerce network that serves two million users. In the same year, Lozi received its first investment from Vietnam Silicon Valley, and then later closed a seven-digit funding round with early-stage investor Golden Gate Ventures and Japanese-owned internet media company DesignOne Japan Inc.

However, the investment went little in the way of improving quality, increasing the user base, or gaining market share. The funds were said to be used to develop dozens of sub-applications. Lozi was left behind by its direct competitors in reviewing restaurants like Now (Foody) who went on to dominate the market for several years before the entry of GrabFood and GoFood.

Talking with VIR about Lozi’s expansion strategy, Trung said, “I believe that the current players on the market do not fully meet customer demand. It is easy to see that trade on Facebook and Instagram and the demand for hyperlocal food delivery as well as on-demand laundry services are increasing. However, no apps have been released to cater specifically for these segments.”

|

Covering all bases

This is why Lozi is confident about its expansion plans. At present, the company offers two apps. One is Lozi, supplying one-hour delivery services for hyperlocal C2C e-commerce, while Loship offers a plethora of services including food delivery, laundry service, e-pharmacy, postal service, products for pets, and flower delivery.

As an intracity e-commerce platform, the startup aims to provide faster delivery to consumers with its fleet of on-demand drivers who pick the items up directly from local merchants.

However, according to a financial investment expert, fast delivery is not an outstanding advantage for Lozi as it is the general trend among all delivery platforms. “If Lozi overextends into too many sectors and services instead of focusing on a set of core functions or developing solid foundations in its fleet and a loyal customer base, it will find it very difficult to grow its market share or turn a profit.”

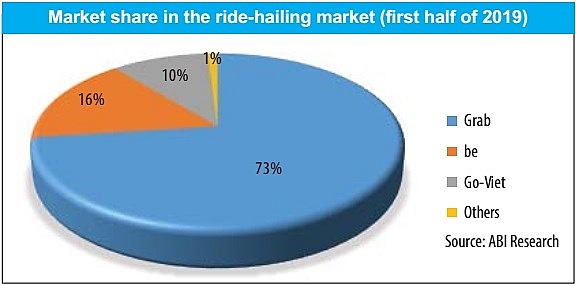

Besides meagre results in delivery after six years of operation and receiving tens of millions of US dollars, the company is also planning to launch a new feature called Lo-Xe to enter Vietnam’s ride-hailing market, which is dominated by Singapore-based Grab, Vietnam local player Be Group, and Go-Viet backed by Indonesia’s Gojek, while also taking on competitors in the delivery sector.

According to the United States-based market-foresight advisory firm ABI Research, in the first six months of 2019, of the 200 million successful transactions conducted via ride-hailing apps, Grab was dominant with 146 million transactions, which translates into a 73 per cent market share. Be Group ranks second with 31 million (16 per cent), followed by Go-Viet with 21 million (10 per cent).

Grab’s strength is underpinned by numerous successful funding rounds mobilising billions of US dollars, and has already kicked out its major competitor Uber in Vietnam. Over the last five years, the parent company has poured around $100 million into Grab Vietnam and is planning to invest $500 million additionally towards 2025. These figures ought to give Lozi food for thought before setting foot in the competitive market.

To maintain market share, most players take on hefty losses. Grab reported a loss of $1 after every transaction, totalling $146 million in the first half of the year, while Be lost about VND1.7 trillion ($73.9 million) since it was launched in December 2018.

Numerous players have entered the playground with confidence but have had to withdraw soon after, or keep operations to a bare minimum. In early-2018, Vietnam’s ride-hailing local startup VATO announced they would be pouring $100 million into the race, but the injection could not extend its market share by a single per cent after almost two years of deployment.

Vying to be different

In the same boat, FastGo was launched over a year ago to great fanfare after receiving funds from VinaCapital and securing around 1 per cent of the market. Similarly, MyGo started operations with 100,000 driver partners, but the app drew complaints for its buggy design.

However, to avoid the war of attrition locking down current competitors, Trung from Lozi said they will ignore competitors to focus on taking care and supporting driver partners, while simultaneously applying technology and optimising planning to increase the number of orders delivered on each route, to ensure service quality. It will also support drivers in approaching preferential loans. Lozi is also striking away from the fold by maintaining its two apps – Lozi and Loship – instead of developing one superapp.

“The idea to separate Lozi into two different apps came from my questions about why founders had to separate Facebook and Messenger or Zalo and ZaloPay? The separation is the right choice because Lozi and Loship operate on wholly different terms,” said Trung.

Responding to questions about the role of investment funds in the company and plans to disburse the new capital, Trung said Smilegate Investment left decision-making in the hands of Lozi and will support the managing board with advice. In addition, Lozi has received support from private investors from Silicon Valley, as well as advisors from Australia, and VIB.

“Lozi will spend the funds implementing new services, especially to get Lo-Xe off the ground. Even after successfully calling for capital, we will continue working from our current garage that we rent at a very reasonable price to save expenses. Besides that, we will continue developing the ecosystem for both customers and drivers by launching our e-payment service,” Trung said.

A common feature of sharing apps is that they boldly take on losses, call for funds, and burn through it to then call for more in the hope of being the last one standing. Each player has gone to great lengths to gain even a small piece of the market through advertising campaigns, as well as offering bonuses to partners, as evidenced by Be and Go-Viet, who lost almost $10 million in a single year. The question now is how Lozi can compete in a market revolving around visibility without extensive marketing campaigns.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Pegasus Tech Ventures steps up Vietnam focus (February 05, 2026 | 17:25)

- The generics industry: unlocking new growth drivers (February 04, 2026 | 17:39)

- Vietnam ready to increase purchases of US goods (February 04, 2026 | 15:55)

- Steel industry faces challenges in 2026 (February 03, 2026 | 17:20)

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

Tag:

Tag:

Mobile Version

Mobile Version