Appetite increasing for mega-deals in insurance

On March 22, PYN Elite Fund, an investment fund from Finland, announced the purchase of 500,000 shares of Military Insurance Corporation (MIC), increasing its ownership stake from 4.99 to 5.29 per cent. Following this transaction, PYN became the second-largest shareholder in MIC, with Military Bank retaining the majority of shares.

Established in 1999, PYN Elite Fund is an investment fund that targets Asian markets. MIC, on the other hand, boasts a charter capital of $56.4 million and almost 2,000 employees, placing it among the top companies in the industry. As part of its development strategy for 2020-2025, MIC aims to rank among the top three non-life insurance enterprises in Vietnam.

The previous month, DB Insurance officially acquired a 75 per cent ownership stake in Vietnam National Aviation Insurance Corporation (VNI), following the transfer of shares from a group of shareholders consisting of 19 individual investors and one institutional investor.

DB Insurance has been active in the Vietnamese insurance sector for over a decade. In addition to its recent investment in VNI, they are also the major shareholder of the Post and Telecommunication Joint Stock Insurance Corporation (PTI), with a 37 per cent stake.

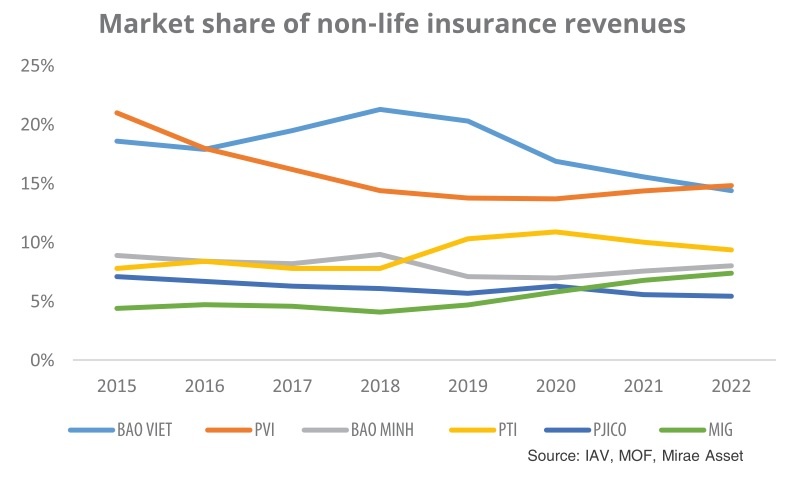

With expertise in motor insurance, DB has focused on investing in PTI’s retail segment of motor vehicle insurance, contributing to maintaining PTI’s position as the top market shareholder in the segment in Vietnam.

VNI was one of the top 10 enterprises in the non-life insurance market in 2022, ranking second in terms of revenue for compulsory auto civil liability insurance and third for motor vehicle insurance collection.

Hanwha Group, one of South Korea’s largest corporations, is also expanding its footprint in Asia. On March 29, Hanwha Life Indonesia and Hanwha General completed the acquisition of a 62.6 per cent stake in Lippo General Insurance, a subsidiary of Lippo Group, an Indonesian conglomerate.

|

Vietnam is also a focus for Hanwha’s Asian market penetration strategy, with 10 member companies having a total investment capital of almost $2 billion. Hanwha Life Vietnam insurance company is a prominent member of the group’s presence in Vietnam and was the first to establish its presence there.

Despite profits of Vietnam’s non-life insurance sector declining last year, foreign groups still find the sector appealing. Moreover, given the low level of insurance penetration in the country and the fast pace of digital transformation, investors interested in Vietnam’s non-life insurance sector can see much potential.

“The impact of digitisation and the trend towards modern financial services has created significant changes in the finance and insurance industry,” said Hwang Jun Hwan, general director of Hanwha Life Vietnam.

“In response, Hanswha Life Vietnam has made active investments in highly digitised products and services to offer customers new experiences and diverse utilities. This is part of the Hanwha Group’s global strategy, and Hanwha Life Vietnam is proud to play a role.”

According to SSI Research, premium growth in the non-life insurance sector in 2023 is projected to be lower than in 2022 by around 10 per cent, while operating expenses are projected to rise, primarily due to high losses caused by inflation.

It also predicted that micro-insurance products will be the significant focus for many insurers in the future. “Some notable firms, such as Bao Viet Insurance Corporation, Military Insurance Corporation, and PTI have proactively encouraged micro-insurance products regarding illness, cancer and accident risks, and educational support, with low costs,” it said.

DSC Securities noted that the potential of car insurance would be substantial in 2023 due to surging demand from the middle class and the Ministry of Transport’s directive to restrict motorcycle numbers.

In another development, with PVI Insurance’s credit rating upgraded from B++ to A- by AM Best, the insurer now has the foundation to facilitate business beyond Vietnam. The new rating enhances PVI Insurance’s credibility with partners and customers in its ability to fulfill insurance obligations.

In a recent investor meeting, HDI Global SE, the largest shareholder of PVI, reaffirmed its commitment to support and create better conditions for the insurer to strongly expand beyond Vietnam.

“In the near future, we will witness PVI Insurance’s growth in regional and global markets. This growth is sustainable, just as it is in the domestic market,” said Jens Holger Wohlthat, chairman of the board at PVI.

Merger and acquisition activities have become more prevalent among Vietnamese companies, as insurance businesses are expected to add more synergy for financial groups.

Elsewhere, in its latest proposal, AAA Insurance plans to put a major emphasis this year on digital transformation to bring seamless services for customers, expanding its nationwide network to capture a larger portion of the market, and upgrading customer support.

The firm expects to increase original premium revenue to over VND500 billion ($21.3 million) in 2023.

AAA Insurance is the initial step contributing to Bamboo Capital Group’s financial ecosystem, which may comprise banking and fintech services.

Last year, VPBank raised its ownership ratio in non-life insurer OPES Insurance to 98 per cent, showing its ambition to take advantage of VPBank’s ecosystem.

In Q4/2022, Tasco, a local transport infrastructure developer, acquired Groupama Vietnam General Insurance Company from its French owner for an undisclosed sum, and changed the brand to Tasco Insurance.

Tasco believes that the deal is an important step in its development strategy to provide personal insurance products for vehicles and their owners.

Earlier this month, Tasco Insurance partnered up with Saigon General Service Corporation (Savico) in oder to launch a “one-touch” insurance model, focusing on providing customers with motor vehicle insurance products.

Savico currently boasts the largest vehicle distribution network in Vietnam, with 75 showrooms, and distributes more than 10 brands nationwide, such as Volvo, Toyota, and Ford.

“This insurance model will provide services to a large number of customers and at the same time offer a different experience and best value to customers throughout the life of their vehicle,” said a representative from Savico.

The market is also anticipating developments in State Capital Investment Corporation’s divestment roadmap for Bao Minh Insurance. The structure of the company has undergone significant changes in recent years, and observers predict that with the new movements in the market, competition in the motor insurance segment will increase.

| Le Viet Anh Phong, Financial advisory lead Deloitte Vietnam

Last year was a low point for Vietnam, and the global merger and acquisition market has become uncertain due to geopolitical conflicts and a high-interest rate environment. However, private equity still has a lot of dry powder to deploy and we anticipate for them to be highly active in the market. Although Vietnam’s economy is expected to experience slower growth in the short term, all the macro factors are well intact in the long run. The general sentiment among the private equity houses is that this year will be an interesting time to do a deal in Vietnam. From my viewpoint, deal value in 2023 will be higher, mainly driven by more mega deals. However, in terms of deal counts, the volume may drop as investors in general are still very selective. |

| Evaluating the elements at heart of non-life insurance Customers should carefully consider the terms of non-life insurance contracts to ensure optimal benefits before buying any products. Vo Manh Tin, deputy general director of AAA Insurance Company, chatted to VIR’s Le Luu about the current trends in the sector. |

| Awareness must blossom for insurtech to prosper Vietnam’s insurance market, particularly digitally non-life insurance products which cater to the specific needs of customers, is still in its infant stage. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Insurers accelerate post-typhoon recovery (October 28, 2025 | 15:31)

- Shinhan Life Vietnam builds growth on people strategy (October 07, 2025 | 09:45)

- Insurance sector initiates rapid response after Typhoon Bualoi devastation (October 03, 2025 | 18:25)

- Non-life insurers face mounting pressure after typhoon hits motor sector (October 02, 2025 | 18:59)

- Prudential Vietnam delivers responsible investment package (September 25, 2025 | 10:37)

- Insurers struggle to keep pace with EV rapid adoption (August 29, 2025 | 17:12)

- Non-life insurance market in sees bright spots in H1 despite rising challenges (August 28, 2025 | 16:21)

- Life insurance rebounds with renewed growth and trust (August 06, 2025 | 18:04)

- Global Care launches Vietnam’s first insurance KOL platform (July 25, 2025 | 09:42)

- Liberty Insurance leaves mark at 2025 Insurance Asia Awards with dual wins (July 14, 2025 | 07:27)

Tag:

Tag:

Mobile Version

Mobile Version