Merger control in Vietnam: safeguarding fair competition

|

| Nguyen Duc Anh, senior associate, Dentons LuatViet |

Merger control generally refers to the process of reviewing economic concentrations in accordance with competition regulations. It is adopted to prevent anti-competitive effects of such economic concentrations and has ex-ante regimes, meaning that competition authority must conduct their review prior to the completion of economic concentrations.

The primary merger control legislations in Vietnam are the Law on Competition and Decree No.35/2020/ND-CP dated March 2020 providing guidelines to the Law on Competition 2018. The law stipulates, inter alia, the definition of economic concentration, notification thresholds, dossier requirements, the review process, and violations of the merger control regime.

The Vietnam Competition Commission (VCC), which was established in April 2023, is Vietnam’s principal competition authority. Under the purview of the Ministry of Industry and Trade, the VCC assumes the functions of overseeing the merger control regime and imposing fines and remedies accordingly.

In the context of "economic concentration," this term encompasses various transactions such as mergers, acquisitions, consolidations, and joint ventures.

A merger refers to the transfer of assets, rights, obligations, and interests from one or more enterprises to another, resulting in the termination of the merging entity's business activities or existence. An acquisition involves the direct or indirect purchase of sufficient capital or assets of another enterprise to gain control or governance over the acquired entity or its business lines.

Control or governance is established when the acquiring enterprise meets specific criteria, such as obtaining more than half of the target's charter capital or voting shares, ownership or right to use over half of the target's assets in a business line, or certain rights over the target's decision-making processes.

Consolidation occurs when two or more enterprises transfer all their assets, rights, obligations, and interests to form a new entity, simultaneously terminating the business activities or existence of the consolidating enterprises.

Lastly, a joint venture refers to multiple enterprises contributing assets, rights, obligations, and interests to establish a new enterprise.

However, Vietnamese competition regulations do not provide any explicit exemptions to transactions that inherently raise no competition concerns and should not be subject to merger filing requirements.

For instance, internal restructuring transactions within enterprises under the control of the same ultimate parent (intra-group transaction) pursuant to which it does not change the control of such group on the relevant market. Another example is that foreign to foreign economic concentrations with no local nexus (e.g., where the target does not generate any revenue on Vietnam market). These transactions are unlikely to raise any competition concerns, but might still trigger merger filing requirements if any notification thresholds are met.

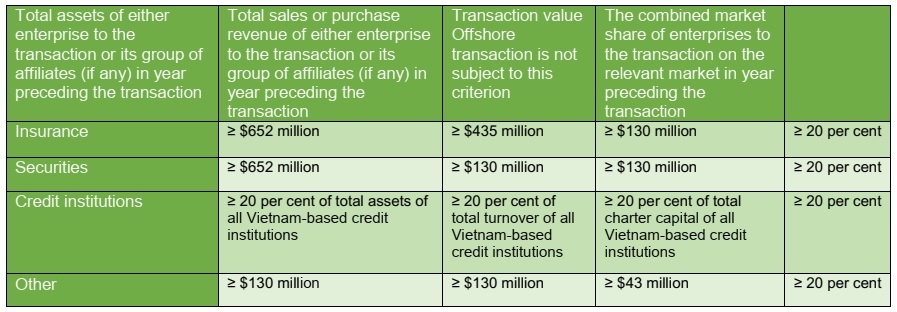

As such, a merger filing requirement is triggered when an economic concentration reaches or exceeds any notification thresholds. All enterprises to the transaction must jointly submit a merger filing dossier to the VCC.

In addition, there are other legislations governing economic concentrations in particular industries. These provisions do not override merger control regulations under the Law on Competition; rather, they exist alongside the law.

Specifically, in the insurance industry, an enterprise must obtain written approval from the Ministry of Finance if it transfers shares or contributed capital resulting in a shareholder holding at least or less than 10 per cent of the company’s charter capital; restructures by way of division, merger, consolidation, dissolution, or conversion of legal form.

For credit institutions, they must obtain written approval from the State Bank of Vietnam if it is restructured by method of division, demerger, consolidation, merger, acquisition, or conversion of legal form.

With respect to telecommunications, prior to economic concentration, telecommunications enterprises that have a combined market share of 30-50 per cent on the relevant market must notify the Ministry of Information and Communications.

|

| Singapore's GIC sets sights on Vietnam, India, and Indonesia Singapore's sovereign wealth fund, GIC, is shifting its investment strategy to focus more on emerging markets like India, Indonesia, and Vietnam. The move was prompted by escalating tensions between the United States and China in a bid to navigate potential trade and capital flow restrictions. |

| Concocting a defensive M&A strategy to build resilience Today’s economic situation can be a catalyst for opportunity through mergers and acquisitions to facilitate businesses to build resilience. Le Viet Anh Phong, financial advisory lead at Deloitte Vietnam, spoke with VIR’s Luu Huong about the strategies expected to prevail this year. |

| Japanese investors won’t shy from possible M&As Despite market turbulence, Japanese investors are stepping up their mergers and acquisitions in Vietnam in 2023 with increasing deal values. Masataka “Sam” Yoshida, head of the Cross-border Division of RECOF Corporation, spoke with VIR’s Thanh Van about dealmaking activities involving Japanese investors in Vietnam. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- New law on telecommunications brings new opportunities (January 30, 2024 | 11:08)

- Vietnam's amended Land Law 2023: some pivotal changes and their impacts (January 25, 2024 | 14:29)

- Getting Vietnam’s carbon market framework ready (December 05, 2023 | 18:09)

- Eva Szurminska Jaworska joins Dentons LuatViet (September 18, 2023 | 17:57)

- Leading tax lawyer Phan Thi Lieu joins Dentons LuatViet (September 11, 2023 | 15:33)

- Best business practices involving KOLs in Vietnam (August 22, 2023 | 18:37)

- Vietnam embarks on green energy revolution with PDP8 blueprint (August 15, 2023 | 15:12)

- Global Minimum Tax: a call for strategic revisions in Vietnam's special zones (July 27, 2023 | 16:36)

- Ambiguous rules dent foreign arbitration process (July 19, 2023 | 10:22)

- Dentons LuatViet advises on groundbreaking deal in healthcare sector (July 12, 2023 | 19:11)

Tag:

Tag:

Mobile Version

Mobile Version