Vietnam embarks on green energy revolution with PDP8 blueprint

|

| Kang Seungho, special counsel at Dentons LuatViet |

PDP 8: Energy transition

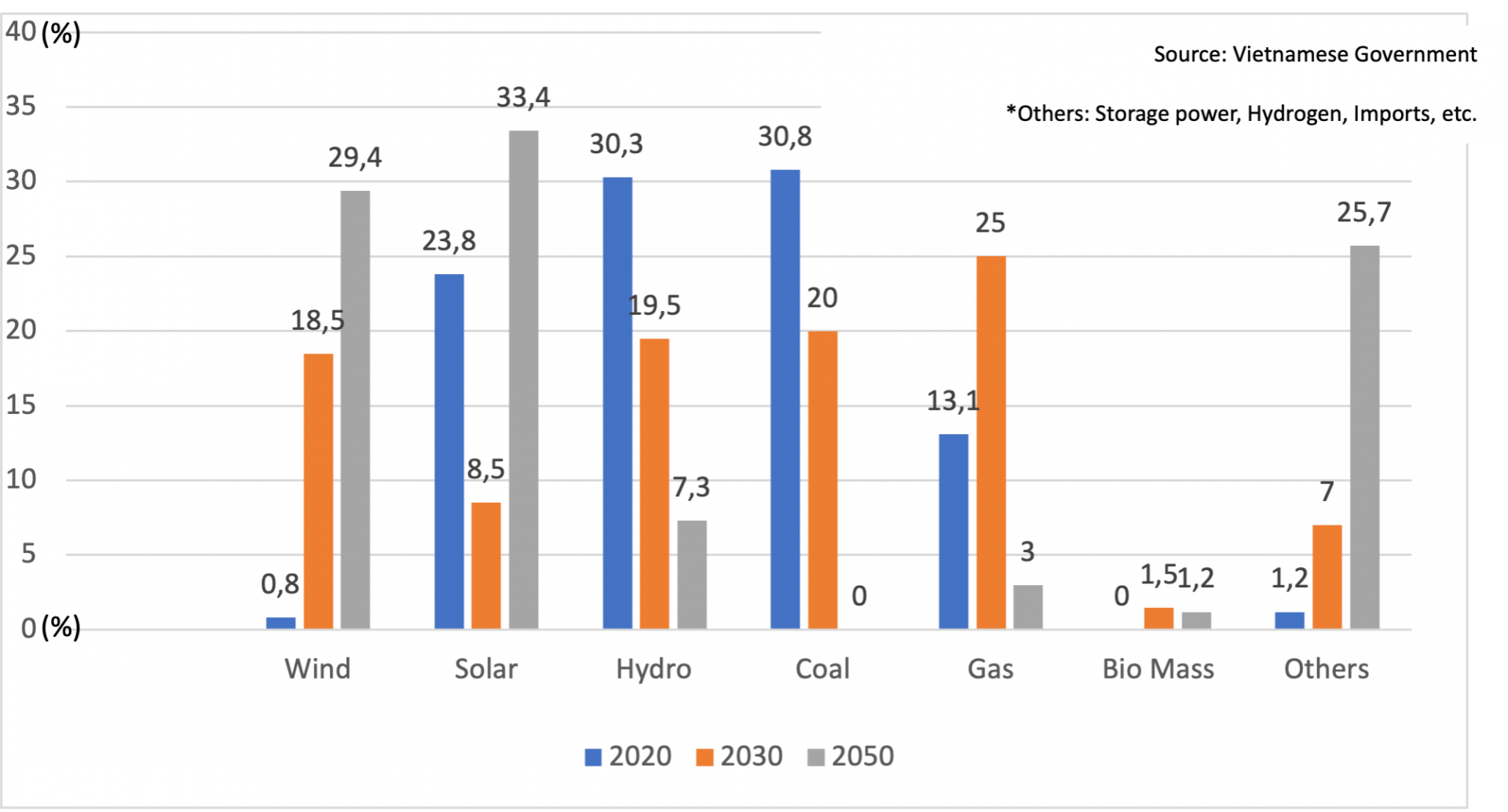

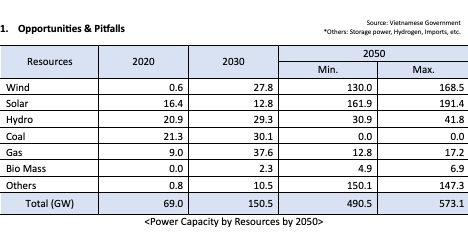

The Vietnamese government, through Power Development Plan VIII (PDP8), is prioritising renewable energies like wind and solar. Though coal and hydropower dominate today, by 2050, coal will be phased out in line with net-zero goals.

Wind and solar are projected to constitute 62.8 per cent of power by then. Gas, while expected to be a major source at 25 per cent in 2030 during the energy transition, will diminish to just 3 per cent by 2050. The projected investment reaches $135 billion by 2030 and between $400-$523 billion from 2031-2050. Global investors are needed to meet these costs, and while opportunities abound, potential risks and the current investment climate should be considered.

|

| Source: Dentons LuatViet |

|

| Source: Dentons LuatViet |

Wind

By 2030, onshore wind power in Vietnam is projected to rise from 4,118 MW in 2021 to 21,880 MW, while offshore capacity will jump from 0 MW to 6,000 MW. These expansions offer vast investment opportunities due to Vietnam's prime wind quality in Asia. However, the legal framework for offshore wind power is still underdeveloped.

Most viable wind speeds are found in southern Vietnam. Transmitting power from south to north is challenging due to unavailable grid infrastructure and delays in 500KV transmission lines from PDP7. Existing grid connections face issues like unclear policies, technical challenges, land rights, and the need for EVN’s cooperation.

Investors should note that offshore wind farms fall under Vietnam's Law of the Sea and regulations concerning marine natural resources and the environment. The development process is laden with complex regulations and fees, including “sea area usage fees” for wind exploitation and cable installation, ranging from VND 4,000,000 ha/year to VND 7,500,000 ha/year. Additional infrastructure, like ports, entails extra costs, impacting project bankability.

Given the four to five year development time for wind farms, Vietnam's ambitious target of over 20GW in seven years necessitates clearer policies and legal guidance to draw in investors.

Solar

By 2030, solar power in Vietnam is expected to reach 12,840MW, soaring over 13 times to 189,300 MW by 2050, making it Vietnam's primary power source. PDP8 highlights rooftop solar for self-production and consumption with unrestricted capacity development.

This grid-independent solar approach will drive Vietnam's energy shift, though PDP8's definition of “self-consumption” remains unclear. If broadly interpreted, off-grid solar could be a viable resource, especially in industrial zones and rural areas.

Transparent pricing systems, set by the Ministry of Industry and Trade (MOIT), are essential for solar project financing and attracting private investors. A clear pricing mechanism is crucial for fostering a robust renewable energy ecosystem in Vietnam.

The surge in solar capacity, over 16GW between 2019 and 2020, was bolstered by government incentives. However, many solar plants aren't fully operational due to grid constraints. Establishing pricing mechanisms must also address fee collection for direct power purchase agreements (DPPA), benefiting both the government and investors.

Hydro

In 2020, the second-largest power resource in Vietnam was Hydro power, but its proportion will be decreased gradually from 30.3 per cent to 7.3 per cent by 2050. But Vietnam will continue to maximise the potential of hydropower sources as much as the economic and technical conditions allow up to 36,016MW (total potential of Vietnam is about 40,000 MW).

This year, 11 hydropower plants were shut down due to water shortage, and the northern area suffered an electricity shortfall of almost 5GW. It indicates that Vietnam needs more diverse power resources in the northern area.

Coal and others

By 2050, Vietnam will not have any coal power generation, completely converting fuel to biomass and ammonia, even if it is the largest power source currently. Vietnam continuously tries to meet its commitment towards net-zero emissions by 2050 encouraging this transition. But Vietnam should develop more details because there are still no clear legal framework and policy for new energy resources such as hydrogen, ammonia, bio-mass and others yet.

Gas

Gas will be the largest power resource in 2030 and perform as a major power resource during the energy transition from fossil to renewable. There are many opportunities during this period. Vietnam is planning to reduce the proportion of coal-fired thermal power gradually, prioritising the development of domestic gas power and developing imported liquefied natural gas (LNG) gas power sources if the domestic gas production is not sufficient. By 2030, the maximum total capacity of LNG power sources will reach 22,400 MW and the total capacity of domestic gas-using plants will reach 14,930 MW.

Transmission grids

In Vietnam, the northern area generally needs more power than its current, its generation capacity. And wind and solar qualities in the south are better to generate electricity. So, transmission grids between the south and north are very critical to achieve the development.

PDP8 estimates costs of $15.0 billion (average $1.5 billion/year) by 2030 and $34.8 billion - $38.6 billion (average $1.7-1.9 billion per year) by 2050, for this transmission.

Electricity of Vietnam (EVN) had been responsible for these transmission grids almost exclusively, but since 2022, the Vietnamese Electricity Law has allowed non-state economic sectors (private sector) to operate the transmission grid if built by themselves.

PDP8 also provides a policy for socialisation of investment in the transmission grid, and EVN is not capable for all transmission grids financially because it lost more than 1.12 billion in 2022. So, the private sector and investors’ role is important in developing the transmission grids.

Conclusion

PDP8 is a milestone for the energy transition in Vietnam. But, without foreign investment and private sector involvement, it is impossible to achieve such massive development. Vietnam needs to establish a better environment in terms of legal frameworks and regulations, including Public Private Partnership (PPP) law in 2021, green credits, project financing, foreign direct investment, and transparent pricing mechanism to secure bankability and feasibility for foreign investment and the private sector. These developments are important to create a sustainable market itself by balancing public and private players.

| DBS Bank empowers Vietnam's green revolution In an exclusive interview with VIR’s Luu Huong, Yulanda Chung, head of Sustainability, Institutional Banking Group at DBS Bank discussed how the bank has embraced the opportunity in Vietnam to harness the power of banking to create a positive impact. |

| Power plan a leap in the right direction for 2050 ambitions Vietnam’s Power Development Plan VIII (PDP8) will enable the power sector to align with the nation’s international commitments, including the Just Energy Transition Partnership. It is the dawn of green and sustainable development for the sector, with the hope of restarting pending power projects and contributing to net-zero commitments by 2050. |

| Effective mechanisms will ensure an efficient PDP8 Vietnam’s National Power Development Plan VIII (PDP8) creates an important basis for developing the framework for investment and introducing new and significant enhancements to regulations for the energy industry in Vietnam over the next decade, toward a greener path. |

| Decades-long delays trigger power supply shortages Northern Vietnam is grappling with a severe energy deficit brought about by several delayed power projects, according to Nguyen Anh Tuan, a representative from the Vietnam Energy Association. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- New law on telecommunications brings new opportunities (January 30, 2024 | 11:08)

- Vietnam's amended Land Law 2023: some pivotal changes and their impacts (January 25, 2024 | 14:29)

- Getting Vietnam’s carbon market framework ready (December 05, 2023 | 18:09)

- Eva Szurminska Jaworska joins Dentons LuatViet (September 18, 2023 | 17:57)

- Leading tax lawyer Phan Thi Lieu joins Dentons LuatViet (September 11, 2023 | 15:33)

- Best business practices involving KOLs in Vietnam (August 22, 2023 | 18:37)

- Merger control in Vietnam: safeguarding fair competition (August 04, 2023 | 10:53)

- Global Minimum Tax: a call for strategic revisions in Vietnam's special zones (July 27, 2023 | 16:36)

- Ambiguous rules dent foreign arbitration process (July 19, 2023 | 10:22)

- Dentons LuatViet advises on groundbreaking deal in healthcare sector (July 12, 2023 | 19:11)

Tag:

Tag:

Mobile Version

Mobile Version