Visa supports financial inclusion in Vietnam

|

| Dang Tuyet Dung, newly-appointed country manager for Visa Vietnam and Laos |

Prior to Visa, you worked for 25 years at leading international and local banks. How does this background help you with your current leadership position at Visa?

Such a long relationship with the banking industry really gives me a deep and practical view of bank client requirements and how those link with the overall banking strategy across corporate and retails segments. Joining Visa was a great opportunity for me to learn more of the leading technologies and digital solutions, and I see huge potential of how Visa can work even better and differently with our bank clients, corporate customers, and fintechs to best leverage our capabilities in payment technologies and digital innovations in developing electronic payments and the digital economy in Vietnam.

How does Visa’s work in financial inclusion tie in with Vietnam’s development goal?

The Vietnamese market has made very positive moves in transferring consumers faster from cash payment behaviors to the electronic form. Achieving the cashless society target of 10 per cent cash payments per total PCE (personal consumption expenditure) is challenging and will require a very strong and consistent direction towards financial inclusion.

Financial inclusion is on the prioritised strategic agenda of Visa in Vietnah, and aims at educating financial knowledge, financial planning skills to the larger population, and to create a strong foundation for digital economic growth.

Our company has been actively participating in financial literacy promotion activities to support organisations and government agencies. One eminent example is our co-operation with the Central Committee of the Vietnam Students’ Association in 2012-2018. The programme provided financial knowledge to students from 36 universities across Vietnam. Also, since 2015 Visa has been co-operating with CARE, an international non-governmental organisation, to consecutively support 879 women in the northern highlands areas on financial management training to feed stakeholder production and business needs. About 75 per cent of female participants later informed us of improved family incomes despite the short time of engaging in the programme.

Vietnam has also witnessed a breakneck growth of fintech in recent years. What is your view and how does Visa respond to the craze?

We’re very supportive of fintech firms in Vietnam. The fast growth of fintech in recent years is very encouraging given that it will create a strong impact on the growth of electronic payments and digital services via changing the consumer behavior, especially in everyday buying and spending needs. However, there is a critical need of a complete legal framework to facilitate the healthy and sustainable business model of fintech groups.

To Visa, fintechs are wonderful partners and we are developing business partnership with them in every market, regionally and globally, to support them with better payment and digital capabilities through our Visanet platform. Fintechs are becoming a very strategic partner group for us to expand acceptance, and strengthen acquisition across markets.

A prominent venture from us is the Visa Everywhere Initiative, launched to assist startup and fintech companies in developing and executing their ideas and business models. The programme has been participated in by hundreds of companies from Vietnam. Given the objective, the Fintech Fast Track from Visa is now co-operating and helping Vietnamese fintech companies upgrade capacities in providing e-payment services and their own services, by connecting with Visa’s payment infrastructure and ecosystem.

|

|

Just how much do you think Vietnamese consumers are embracing the digital payment trend?

The latest Visa digital payments report and consumer attitudes survey show that in 2018, the total value of purchases made by Vietnamese consumers on their Visa credit and debit cards is up 37 per cent, while the number of transactions is up by 25 per cent. E-commerce in particular saw strong growth with the total value of purchases up by 40 per cent.

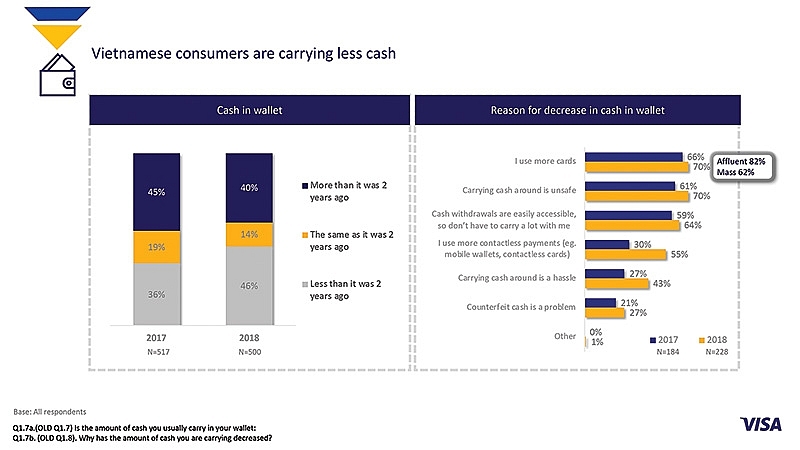

These results highlight that Vietnamese consumers are embracing digital payment as a faster and more convenient way to pay, with consumers using their credit and debit cards more often for in-store and online purchases. Consumers are carrying less cash, and 73 per cent of respondents are using credit and debit cards, up on 59 per cent from the year prior.

The Visa report also pointed out that 82 per cent of respondents have attempted to make transactions on mobile phones and 44 per cent indicated that they are now making payments in mobile apps. Furthermore, about 32 per cent are using contactless payment technologies, and 19 per cent have used QR payments.

As the Vietnamese economy grows and becomes increasingly globalised, commerce here will require ever faster and efficient ways of paying. These recent figures from our network demonstrate clearly that digital payments are now truly a part of day-to-day life for many Vietnamese consumers, regardless of whether they’re buying from an online retailer on the other side of the world, or simply paying for their groceries.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Digital shift reshaping Vietnam’s real estate brokerages (December 31, 2025 | 18:54)

- Allen & Gledhill recognised as Outstanding M&A Advisory Firm (December 18, 2025 | 14:19)

- Inside Lego Manufacturing Vietnam (December 18, 2025 | 11:45)

- The next leap in Cloud AI (December 11, 2025 | 18:19)

- Vietnam’s telecom industry: the next stage of growth (December 11, 2025 | 18:18)

- Five tech predictions for 2026 and beyond: new era of AI (December 11, 2025 | 18:16)

- CONINCO announces new chairman and CEO (December 10, 2025 | 11:00)

- How AWS is powering the next-gen data era (December 09, 2025 | 13:14)

- Outlook in M&A solid for Singapore (December 08, 2025 | 10:31)

- Vietnamese firms are resetting their strategy for global markets (December 05, 2025 | 17:04)

Tag:

Tag:

Mobile Version

Mobile Version