VinaCapital appeals to foreign investors despite COVID-19

“Our message is very clear. The government's success in controlling the COVID-19 pandemic has helped Vietnam recover quickly and, in fact, is predicted to be one of the few countries with positive economic growth in 2020,” Lam said at the press briefing on the sidelines of the annual 2020 Investor Conference held last week in Ho Chi Minh City.

|

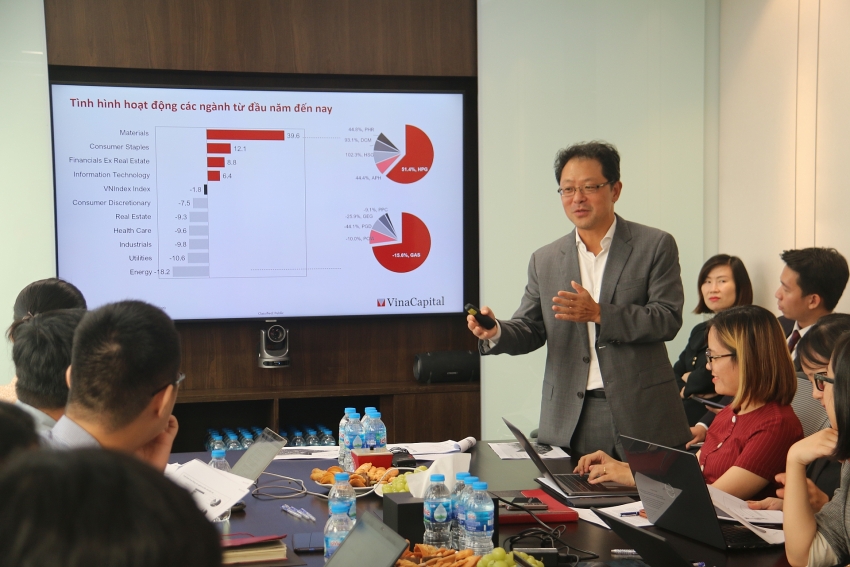

| Don Lam, founding partner and CEO of VinaCapital shared with the press on the sidelines of VinaCapital's annual 2020 Investors Conference |

“We provide investors with an overview of the trends and prospects of the economy, the operation of investment funds managed by VinaCapital, and help them get more information on other potential areas that we are focusing on such as clean energy, renewable energy, and venture capital,” Lam added.

Andy Ho, managing director and CIO of VinaCapital added that the company’s goal over the past three weeks of online meetings was to confirm the position of the Vietnamese market as an attractive investment destination amid the global fluctuations.

|

| Ho predicted that GDP of Vietnam this year would be at from 1 to 2 per cent and hoped that the economy would be resumed next year with GDP ranging from 6 to 7 per cent. |

Among different sectors, construction material has seen good growth as many real estate projects were given permission to resume after long reviews, allowing them to sell products to the market.

“In fact, our funds still recorded good growth results in 2020. VOF, the fund specialising in investing in Vietnam, had the best performance since the beginning of the year,” Ho said.

Especially VinaCapital is looking for more partners to co-develop its first LNG-to-power projects located in the southern province of Long An.

“VinaCapital is expanding its portfolios into the energy sector with the commencement of a $3.1 billion LNG power factory located in Long An province and we set the target to develop at least 1GW of renewable power in the next five years,” Lam said.

To develop this project, VinaCapital had cooperated with General Electric from the US. This would be one of the biggest power projects in southern Vietnam, able to meet around 8 per cent of the country’s energy demand.

However, more investment needs to be mobilised to ensure that the project can be developed with the latest and most advantaged technology, he said.

Previously, VinaCapital signed a cooperation agreement with Bechtel Corporation to develop renewable energy projects in Vietnam.

According to Khoa Nguyen, head of the Energy and Infrastructure Department of VinaCapital, in the coming time, VinaCapital’s portfolio in energy would include LNG-to-power, solar, and wind power assets.

In solar energy, in March this year, VinaCapital set up SkyX Solar in cooperation with Saigontel to build and operate rooftop solar projects for industrial facilities within the industrial parks affiliated with Saigontel.

The joint venture will initially focus on 10 industrial parks to develop and operate more than 50MW of rooftop solar assets. Six of these industrial parks are in the Central and South regions which have the highest irradiation levels.

It also offers an end-to-end renewable energy solution to creditworthy client partners which entails zero capex and zero opex from them while at the same time bringing cost savings and carbon footprint reduction benefits, while ensuring that there is zero disruption in their main operations.

For wind power, VinaCapital is giving priority for ready-built factories and will invest in greenfield projects.

According to the company's estimations, in the 2020-2022 period, power demand would increase by an average of 10 per cent per year, while supply will only increase by 8.5 per cent per year.

“We estimate that by 2030, Vietnam would need $150 billion of investment in renewable energy development to meet the increasing demand of the whole nation,” Khoa said.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Mondelez Kinh Do renews the spirit of togetherness (February 06, 2026 | 09:35)

- Seafood exports rise in January (February 05, 2026 | 17:31)

- Accelerating digitalisation of air traffic services in Vietnam (February 05, 2026 | 17:30)

- Ekko raises $4.2 million to improve employee retention and financial wellbeing (February 05, 2026 | 17:28)

- Dassault Systèmes and Nvidia to build platform powering virtual twins (February 04, 2026 | 08:00)

- The PAN Group acquires $56 million in after-tax profit in 2025 (February 03, 2026 | 13:06)

- Young entrepreneurs community to accelerate admin reform (February 03, 2026 | 13:04)

- Spring Fair 2026 launches national fair series (January 30, 2026 | 16:17)

- SnP celebrates 10th anniversary with new brand identity (January 30, 2026 | 14:41)

- Sci-tech sector sees January revenue growth of 23 per cent (January 30, 2026 | 11:20)

Mobile Version

Mobile Version