VIB shareholders approve 35 per cent dividend payment

|

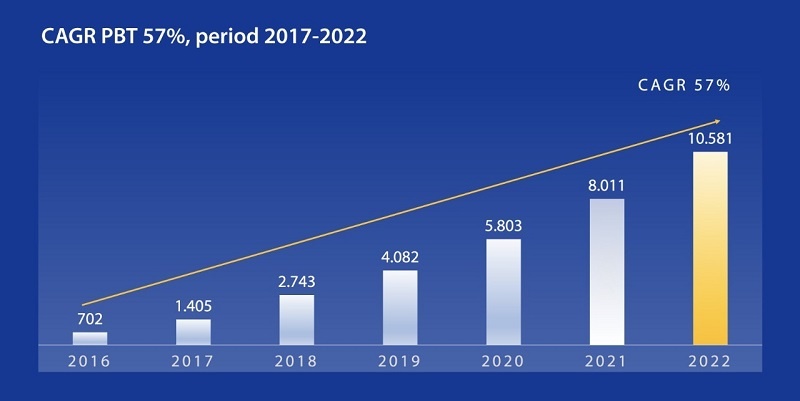

Profit increased with an average growth of 57 per cent/year, affirming the bank's leading position in business efficiency in the industry

VIB has established a solid foundation for outstanding growth in scale, quality and brand value during the first six years of the 10-year strategic transformation roadmap (2017-2026), according to the report delivered by the Board of Directors at the event.

That has helped VIB become one of the leading banks in terms of business efficiency, asset size and revenue growth, effective cost management, and tight risk control. VIB's profit has grown at an annual compound growth rate of 57 per cent per year over the past six years. The bank has also recorded a return on equity ratio of over 30 per cent for three consecutive years, far exceeding the average rate of the Top 10 listed banks.

|

| VIB’s annual profit growth, 2017-2022 |

VIB currently leads the retail sector of the industry thanks to its strategy of becoming the top retail bank in terms of scale and quality. The bank’s outstanding retail loans account for over 90 per cent of its total loan portfolio. It also the market leader in core businesses such as home loans, car purchases and credit cards.

In 2022, VIB developed market-leading credit cards with outstanding product features that were a first for Vietnam. The spending made by customers through VIB credit cards grew nine-fold, from nearly VND9 trillion ($382 million) in 2018 to VND75 trillion ($3.12 billion) in 2022. VIB also leads the country in Mastercard growth rate.

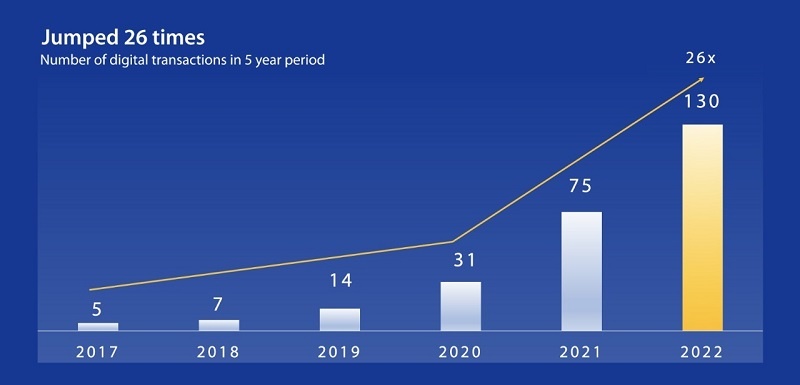

Sapphire account packages and MyVIB 2.0 digital banking application are considered VIB’s outstanding products and services that helped the bank win one million new customers last year, reaching the milestone of four million earlier than expected. They have also contributed to raising the transaction rate on the bank’s digital platforms to over 130 million in 2022, up 73 per cent on-year, marking a 26-fold increase over five years.

|

| Growth in digital banking transactions, 2017-2022 |

Robust risk management, increasing brand reputation

According to the Board of Directors' report, VIB has the highest ratio of outstanding retail loans in the market, with 90 per cent. It also has one of the lowest proportions of corporate bonds to total outstanding loans in the industry, accounting for only 0.8 per cent.

In 2022, the State Bank of Vietnam ranked VIB among the highest in the industry based on assessments of capital adequacy, asset quality, governance capacity, profitability efficiency, liquidity management, and other financial indicators. VIB has always adhered to the indicators set by the State bank and has pioneered in applying international standards, including Basel II, Basel III and International Financial Reporting Standards.

The independent assessment and analysis report from Moody's and Credit Suisse released in early 2023 showed that VIB held a safe and strong balance sheet. The ratio of corporate bonds and loans for real estate investment to equity was among the lowest of the Top 20 Vietnamese banks.

|

| Selected VIB risk indicators |

Approval of profit plan, dividend payment and charter capital increase

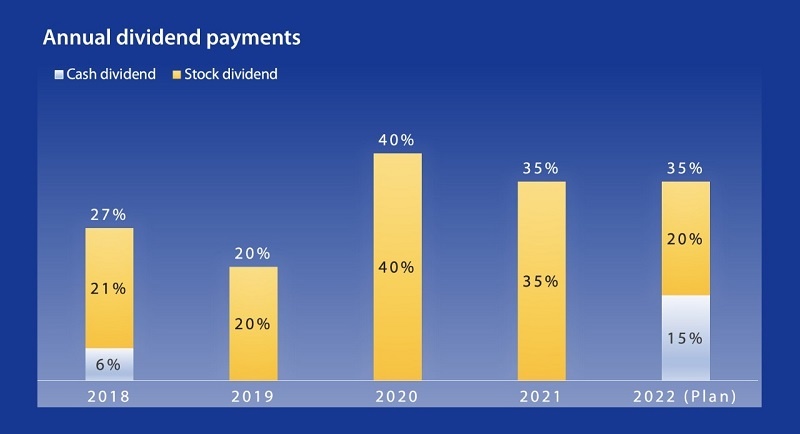

VIB's General Meeting of Shareholders allowed for the increase in charter capital to approximately VND25.4 trillion ($1 billion) in 2023, up 20.36 per cent on-year. The plan to pay 35 per cent dividends to shareholders, with a maximum of 15 per cent cash dividends and 20 per cent bonus shares, was also approved by shareholders.

According to VIB, the high dividend payout ratio has been maintained over the years, increasing shareholders' trust in the bank.

|

| VIB's dividend payout ratio, 2018-2022 |

For the next period, VIB has set sustainable growth targets, is pioneered a strong governance foundation and leads in digitalisation. The bank aims to attract 10 million customers by 2026, and archive an annual compound profit growth of 20-30 per cent each year from now until 2026, thereby sustainably increasing the market capitalisation for shareholders.

To this end, VIB’s Board of Directors will focus on the following seven directives:

|

| VIB's strategic directions |

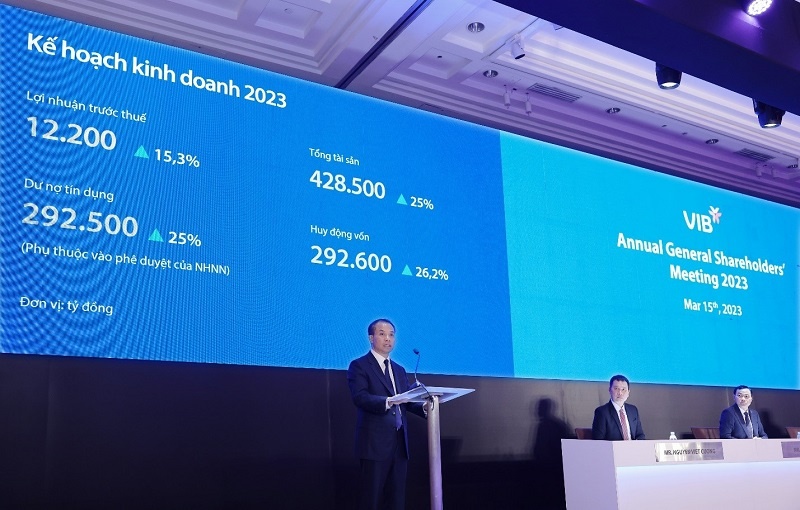

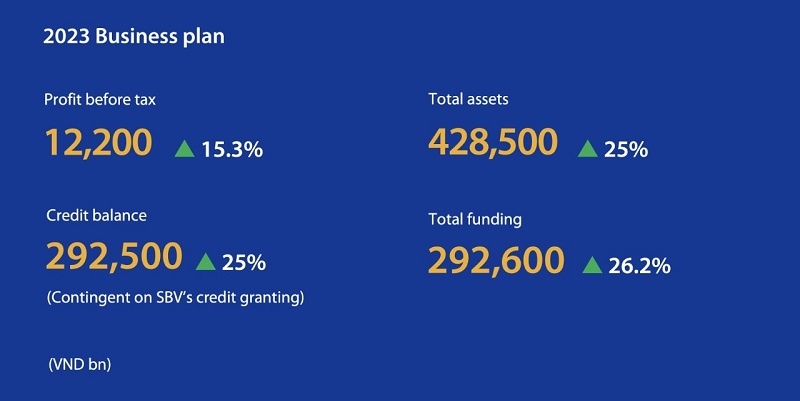

The AGM approved the 2023 business plan, including the growth of total assets, outstanding loans, capital mobilisation and profit. In particular, the growth rate of its credit balance can be adjusted depending on the allowable limit of the State bank.

|

| 2023 business plan |

At the meeting, shareholders voted to elect the Board of Directors and Supervisory Board for the IX term (2023-2027). With a high consensus rate, they approved five members of the Board of Directors, including one independent member and two members of the Supervisory Board.

| VIB records 32 per cent increase in 2022 profits Vietnam International Bank (VIB) has announced its business results in 2022 with pre-tax income of over $459.75 million, up 32 per cent against the previous year. Its return on equity (ROE) performance is consistently over 30 per cent. |

| VIB to announce dividend payment plans at its upcoming AGM After six years of implementing strong and extensive strategic transformation, Vietnam International Bank (VIB) has marked important milestones in its journey to becoming the leading retail bank in Vietnam. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version