Utilising ESG for business resilience and momentum

|

| Truong Hanh Linh - Partner, head of Risk and ESG Consulting KPMG (left), Nguyen Chi Hieu - ESG project director KPMG |

ESG refers to a framework to integrate risks and opportunities into a firm’s strategy to build long-term financial sustainability and value creation. In other words, ESG strategies can help companies achieve long-term sustainability, drive economic vibrancy, and deliver long-term value through effective engagement with all stakeholders.

There are many generic ESG factors used in risk assessment strategies incorporated into risk management processes that enterprises can take into account. Environmental factors include greenhouse gas emissions and ecological impacts; social factors include community relations, product quality, and employee engagement; and governance factors include business ethics and the regulatory environment.

Additional business model and innovation considerations involve lifecycle management, supply chain management, and taking into account the physical impacts of climate change.

|

KPMG’s survey pointed out key reasons that make ESG one of the top discussions for entrepreneurs. There has been increasing pressure from investors, employees, customers, and the general public to drive companies to commit to and act upon an ESG strategy, even in the absence of specific regulatory requirements.

In addition, investors want companies to be transparent about their ESG policies and to be held accountable. ESG-related disclosures are guided by a variety of voluntary frameworks and ratings systems; multiple interpretations exist regarding what ESG means as well as what comprises each of the individual components leaving broad discretion to companies and investment advisers.

Increased focus by investors on ESG when making investment decisions is also vital. Investment objectives designed to address preferences/concerns for ESG factors have grown exponentially. Furthermore, the pandemic has reordered the priorities of businesses, leaning towards ESG becoming a career-defining challenge for most entrepreneurs.

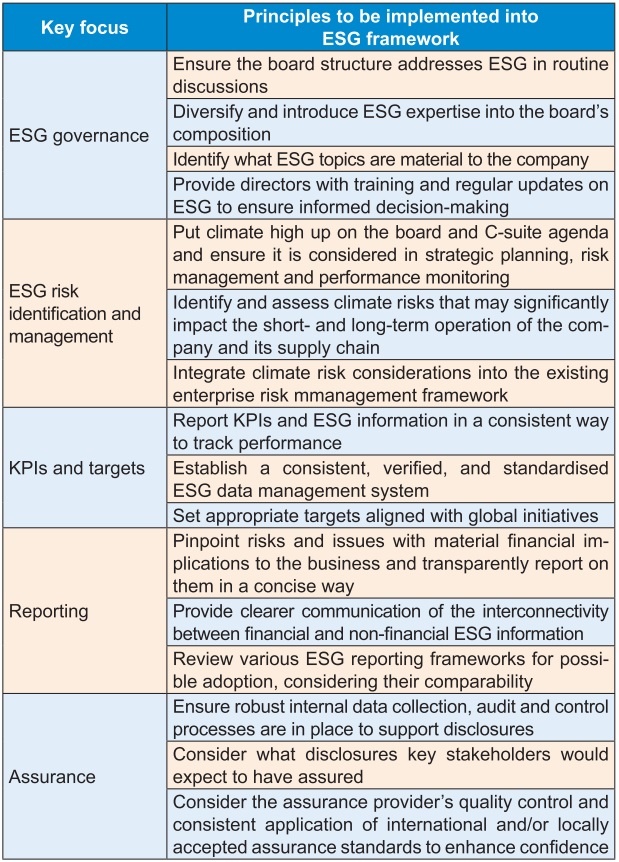

ESG practices can help corporates become more resilient by getting them ready for the impact of emerging issues and helping them maintain robust governance, risk management, and controls. In addition, to build and retain trust among stakeholders in the current environment, it is imperative to ensure transparent and high-quality communication and reporting on ESG performance. In order to implement ESG practices, entrepreneurs should focus on risk management, key performance indicators (KPIs), target setting, reporting, and assurance (see table).

Disruptions and shifts in the business environment have continued to increase the significance of ESG and the opportunity for it to build business resilience. ESG is the new normal and will maintain momentum while the scale and complexity of the sustainability challenges are expanding. Therefore, there will be a greater need for companies to deepen their understanding of the connection between ESG and financial performance, strengthen their leadership on social and environmental issues, and enhance transparency to increase trust.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- KPMG launches tariff modeller in Vietnam to navigate US tariff risks (July 29, 2025 | 12:11)

- Removing hidden barriers to unlock ASEAN trade (June 29, 2025 | 11:31)

- New report charts path for Vietnam’s clinical trial growth (May 21, 2025 | 08:58)

- TTC Agris strengthens market position with investment in Bien Hoa Consumer JSC (May 19, 2025 | 10:14)

- World Bank to help SBV build shared database for banking industry (April 09, 2025 | 08:55)

- New trade alliances and investment hubs are redefining global power dynamics (April 03, 2025 | 17:00)

- ACCA and KPMG forge path for business leaders to pioneer ESG excellence (March 07, 2025 | 10:09)

- VietBank signs MoU with KPMG (February 26, 2025 | 18:47)

- Warrick Cleine MBE: an honour for services to British trade and investment in Vietnam (December 31, 2024 | 20:16)

- KPMG report offers fresh insight into leveraging AI (December 24, 2024 | 09:23)

Tag:

Tag:

Mobile Version

Mobile Version