The lessons of EVN’s incompetence

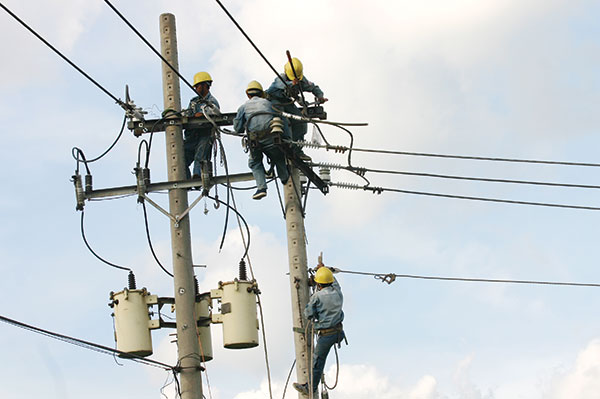

The poor examples previously set by state-owned enterprises like EVN provide all the lessons the country needs for the restructuring process Photo: Le Toan

Electricity of Vietnam or EVN has made important contributions to constructing and operating Vietnam’s electricity system. However, why has the government’s sound plan to create a competitive power market been delayed so many times? By July 1, 2012 this market began to operate. But a year later, only 40 per cent of power makers producing over 30 megawatts have joined the market. At present, EVN remains a power monopolist, and this has caused problems.

Like other state-owned groups and corporations, EVN is tasked by the government to make Vietnam’s power plans. This position allows EVN to do what is best for itself, at the expense of other firms.

State agencies are responsible for making economic development plans in order to make use of resources in each development stage. Master plans are made by the Ministry of Planning and Investment, and sectoral plans are conduced by specialised ministries.

The Ministry of Industry and Trade (MoIT) is accountable for drawing up plans for developing the power sector. EVN can participate in making such plans, not host the plans, because it is a business enterprise. If state-owned groups and corporations are tasked with making sectoral plans, there would be no differentiation between state management and business performance functions.

It requires great efforts and money to make sectoral plans. However, after getting approval from the prime minister, the plans usually fail to churn out the desired results post-implemented, as they are not adjusted to suit the realities.

On September 3, 1997, the government approved the master plan for power development for 1996–2000 with a vision to 2010. Under this master plan, it was expected that by 2010, Vietnam would have total power capacity of 19,000 megawatts. However, due to delayed projects and citing a lack of investment capital, EVN abandoned 13 projects in 2008. By late 2010, no results from the implementation of the master plan had been announced by the government or MoIT.

EVN regularly increases power prices, citing a lack of investment capital. However, this argument is unpersuasive, because the power sector can reduce power prices. The country needs stable power prices to prevent the price of other goods and services from increasing. Moreover, EVN has used large sums of capital to invest into non-core sectors, while the capital should have been invested into power projects.

In a recent report, the Government Inspectorate announced that EVN had used over VND121.79 trillion ($5.8 billion) to invest in non-core business, while its charter capital was just VND76.74 trillion ($3.65 billion).

As a result of irresponsible and unnecessary investments in non-core sectors the monopolist’s seven companies drew up losses of nearly VND3.67 trillion ($174.76 million). EVN has applied many types of unreasonable fees to power prices. For example, in the building of its six power projects, EVN used more than 355,000 square metres of land and nearly VND600 billion ($28.6 million) to build villas, high-rise buildings, tennis courts and swimming pools.

It is also needed to raise power prices to 10 cents per kilowatt hour, equal to the world average, in order to attract foreign investment in future projects. However, the world price is often applied to such goods as petrol, steel, food, machinery and industrial materials. For power price, it largely depends on structures of power sources, and construction and operational costs. In many nations whose power is made from hydropower, the power price can stay low. Thus, Vietnam’s power price must be calculated based on production costs and the government’s energy policy.

At present, EVN’s existing selling price is about eight cents per kWh (exclusive of value added tax). Many urban households have to spend 10-15 per cent of their monthly incomes to pay power bills. They also have to pay more for each EVN price hike, including additional VAT payments.

In the face of the company’s past negligence and incompetence, it is necessary to remove EVN’s monopoly. EVN must be a viable business without any right to decide to develop power sources and power consumption markets. The maintenance of a monopoly in a market-based economy is a major cause behind backward technology, weak human resources and out-dated administration, leading to ineffective business performance.

During its transition to a market-based economy, Vietnam’s information and communication technology (ICT), and telecommunications have developed well thanks to sound business strategies. The Vietnam Post and Telecommunications Group (VNPT) and the military-run Viettel Group have been playing an important role in this development.

In 1991, VNPT co-operated with Australia’s Teltra to import modern equipment, which also helped VNPT with technical training and administration.

During Vietnam’s international integration, VNPT has boosted co-operation with many leading groups in the world. It also took the lead in applying digital technology. It shifted from monopoly to competition. This has helped it reap high growth, and helped Vietnam sit among the top nations in terms of ICT and telecommunications development.

The appearance of Viettel and many other companies in the market made the ICT and telecommunications sector become more competitive. Mobile charges reduced from VND3,500 ($0.16) to VND1,000 per minute, with an ever increasing number of subscribers.

However, over recent years, VNPT has been suffering from slow growth and asset problems. Meanwhile Viettel has been expanding its business both locally and overseas. At present, Viettel is outpacing VNPT in terms of profits and tax payments.

Despite these great successes, in mid October 2013, Viettel, VinaPhone and MobiFone, which are Vietnam’s biggest mobile network operators, suddenly raised their Minmax, Max and MIU package charges by 40 per cent. This has caused anger from subscribers as the operators’ move has been reported to violate the Law on Competition. It is necessary to continue to fight monopoly to create a transparent and competitive ICT and telecommunications market for the benefit of consumers.

The telecommunications history can provide lessons for the power sector. These include the benefits of establishing competitive market between two state-owned enterprises, as well as between foreign and local enterprises. They also may refer to each enterprise’s business strategy and absorption of modern technology. Also, the lessons may center around enterprises’ selection of partners for co-operation and nations for investment.

*Professor Nguyen Mai is former vice chairman of the State Committee of Co-operation and Investment, now the Ministry of Planning and Investment.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Carlsberg Vietnam delivers Lunar New Year support in central region (January 28, 2026 | 17:19)

- TikTok penalised $35,000 in Vietnam for consumer protection violations (January 28, 2026 | 17:15)

Mobile Version

Mobile Version