SLP at the forefront of changes in Vietnam's industrial property market

|

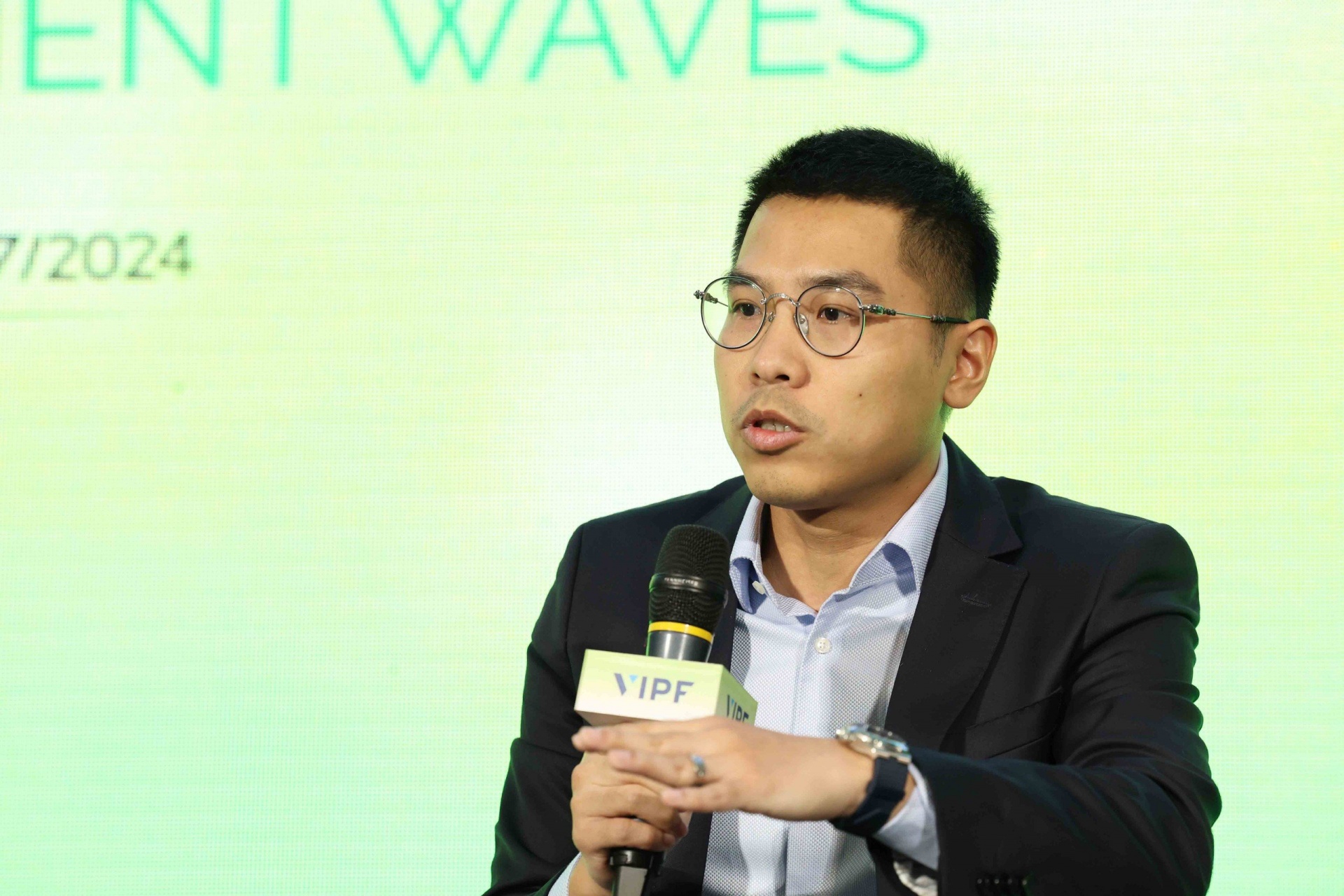

Speaking at the first panel of Vietnam Industrial Property Forum (VIPF) 2024, Dinh Hoai Nam, director and head of Business Development, SLP Vietnam, said, "Over the past four years, more professional investors have ventured into Vietnam's industrial real estate market, setting a new bar on the industry. It is expected that they will shape the competition focusing on quality products, which will benefit tenants and new investors coming to Vietnam, in terms of product quality and price. This trend will improve the Vietnamese real estate market and optimise costs for new investors in the market. We will be able to enjoy better products at good costs, which will invisibly make the Vietnamese market more attractive in the long term."

When SLP invested in Vietnam in 2020, the company successfully raised $1.1 billion to invest in the Vietnamese market. At that time, the company’s focus was on warehouses and logistics facilities for rent. During the implementation process, the company sees that the demand for warehouses still exists. However, it is subject to the domestic consumption market and objective factors globally, which including a decline in production and output.

|

"SLP's core strength remains in warehouses, and the company has adapted itself to the change of the market by launching ready-built factories," Nam said. "In light of the relocation trend driven by the China Plus 1 strategy and unpredictable geopolitical environment, we forecast the factory segment, especially ready-built factories will explode in the next 2-3 years. Meanwhile, the warehouse segment has a certain delay. When manufacturers enter Vietnam, Vietnamese consumption is expected to gradually recover. Thus, the absorption rate of warehouses is expected grow better in the next 2-3 years."

The representative of SLP also pointed out new types of products arising from both objective and internal factors. Objectively, the investment cost in Vietnam's industrial infrastructure is quite high. Thus, SLP and some investors think about building high-rise buildings to optimise project efficiency. This leads to the wave of multi-story factories and warehouses.

The market has recorded better absorption for this product. Another new product is built-to-suit factories instead of ready-built factories. These new products serve large investors shifting production to Vietnam and renting large warehouses and factories with customised requirements. The new wave of built-to-suit products, including factories or warehouses, will serve tenants in the fields of electronics, e-commerce, and pharma, he added.

| SLP commits to long-term investment in Vietnam SEA Logistics Partners (SLP), an industrial and logistics infrastructure developer and GLP’s operational platform in Southeast Asia, has committed to making a long-term investment in Vietnam as a bright spot in the regional industrial real estate market. |

| Foreign developers account for three-quarters of Vietnam's warehousing Foreign developers dominate the modern warehouse market in Vietnam, accounting for over 75 per cent of the market share by net leasable area (NLA) in 2023. |

| Lower competitiveness affecting Vietnam's industrial parks The competitiveness of industrial parks in Vietnam is currently weak, at the same time as most need to evolve into specialised or green-oriented facilities. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Ho Chi Minh City's industrial parks top $5.3 billion investment in 2025 (January 06, 2026 | 08:38)

- Sembcorp Development secures licence for VSIP in Khanh Hoa (December 31, 2025 | 18:54)

- Prodezi Long An advances towards integrated eco-centric industrial park model (December 26, 2025 | 11:16)

- Amata to develop $185 million Amata City Phu Tho (December 23, 2025 | 17:49)

- Work starts on Nhat Ban – Haiphong Industrial Zone Phase 2 (December 19, 2025 | 16:43)

- Becamex – Binh Phuoc drives sustainable industrial growth (November 28, 2025 | 15:22)

- South Korean investors seek clarity on IP lease extensions (November 24, 2025 | 17:48)

- CEO shares insights on Phu My 3 IP’s journey to green industrial growth (November 17, 2025 | 11:53)

- Business leaders give their views on ESG compliance in industrial parks (November 15, 2025 | 09:00)

- Industrial parks pivot to sustainable models amid rising ESG demands (November 14, 2025 | 11:00)

Mobile Version

Mobile Version