Lower competitiveness affecting Vietnam's industrial parks

|

At a VIR talk show on the trend of investment in industrial parks (IPs) in the last days of July, experts said that Vietnam’s advantages are dipping due to increasing costs of land rent.

Truong An Duong, general manager of North Vietnam and Residential for Frasers Property Vietnam, said that demands on IPs have been rising sharply over the last 5-7 years thanks to numerous advantages such as China+1 relocations, affordable labour, free trade agreements, and development of transport infrastructure.

"However, the land rent prices are going up quickly, even higher than that in Thailand's IPs, so the competitiveness on costs is mitigating and affecting the growth of the market," Duong emphasised.

Dinh Hoai Nam, director and head of Business Development at SLP Vietnam, said that Vietnam is still in the spotlight in its long-term plans. However, some challenges are ahead due to the high increase in land prices.

"Total land and labour costs in Vietnam may be higher than in China. However, numerous businesses and investors still choose Vietnam as a backup plan, and Vietnam's incentives are quite attractive," Nam said.

For secondary investors like SLP, rising costs are causing some headaches. "It is quite hard for us to find golden land plots at affordable prices, so input costs are going up quickly, and output prices cannot be controlled despite our short-term support to renters. Investment efficiency is getting lower," Nam added.

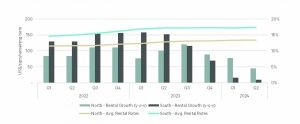

According to a report from CBRE in early July, industrial land prices in tier 1 markets in the north in the second quarter increased by 0.3 per cent on quarter and 4.5 per cent on year, reaching an average of $135 per square metre.

Meanwhile, industrial land prices in tier 1 markets in the south remained steady at just over $170 per sq.m per quarter. This represents no change from the previous quarter and a modest 1 per cent increase on-year.

In the next three years, industrial land rental prices are expected to increase by 5-8 per cent annually in the north and by 3-7 per cent in the south.

Van Nguyen, transactions head for Northern Vietnam at JLL, reviewed the changes in the process of IP development. In the north, before 2015, IP developers sold land plots for businesses/ investors to build their factories. Since then, the market has become more vibrant with the entrance of secondary developers and ready-built factories.

"This time, most factories had a small scale at 2,000-5,000sq.m to meet the demand of investors that relocated from China and needed factories and big support to carry out their production as soon as possible," Van said. "In the last few years, relocated investors have asked for larger areas for factories at about 10,000sq.m or even up to 30,000sq.m, along with stricter requirements."

Duong from Frasers pointed out the increasing relevant of eco-IPs, service and urban hubs, smart IPs, and integrated facilities that cover logistics, warehouses, and ports.

"Infrastructure on electricity and telecoms should be invested in and updated to meet the demand of development in the upcoming years. At the same time, state authorities and administrative procedures should be improved for businesses and investors. This will help Vietnam and its IPs to enhance competitiveness and lure more investment," Duong said.

| Ready-built factory market on the up In the first half of 2024, the industrial real estate market continued to show positive developments. |

| KTG Industrial breaks ground on new phase of Yen Phong IIC KTG Industrial officially held a groundbreaking ceremony for phase 2 of KTG Industrial Yen Phong IIC in Bac Ninh province's Yen Phong Industrial Park on July 10. |

| Vietnam's industrial property sector to benefit from stable growth of FDI Vietnam's industrial property segment is continuing to benefit directly from a steady increase in foreign direct investment (FDI), according to a report by ACB Securities (ACBS). |

| Businesses increase wishes for specialised industrial parks Vietnam’s industrial areas must evolve into more specialised types to meet the increasingly diverse needs of multinational tenants. |

| Real estate developers pin hopes on eco-IP regulations Industrial real estate developers are waiting for a new law to open the path for developing greener models of industrial parks. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Construction firms poised for growth on public investment and capital market support (February 11, 2026 | 11:38)

- Mitsubishi acquires Thuan An 1 residential development from PDR (February 09, 2026 | 08:00)

- Frasers Property and GELEX Infrastructure propose new joint venture (February 07, 2026 | 15:00)

- Sun Group led consortium selected as investor for new urban area (February 06, 2026 | 15:20)

- Vietnam breaks into Top 10 countries and regions for LEED outside the US (February 05, 2026 | 17:56)

- Fairmont opens first Vietnam property in Hanoi (February 04, 2026 | 16:09)

- Real estate investment trusts pivotal for long-term success (February 02, 2026 | 11:09)

- Dong Nai experiences shifting expectations and new industrial cycle (January 28, 2026 | 09:00)

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

- Decree opens incentives for green urban development (January 24, 2026 | 11:18)

Tag:

Tag:

Mobile Version

Mobile Version