Advanced search

Search Results: 837 results for keyword "State Bank of Vietnam".

The short-term implications of SBV credit room lift

23-12-2022 11:06

Lifting the credit room may be a temporary solution. Tran Thi Khanh Hien, director of VNDirect’s Analysis Division, talked to VIR’s Hong Dung about the central bank’s move on credit.

How the SBV deals with climate risks

16-12-2022 12:16

Around the world, central banks are increasingly worried about climate change. Rising temperatures, lengthy droughts, weather disasters and high sea levels have deep economic and financial consequences. Pierre Monnin, senior fellow and Patrick Lenain, senior associate of the Council on Economic Policies, share their view on what the State Bank of Vietnam can do to limit those risks.

Central bank to raise credit limit, banks slash interest rates

06-12-2022 21:00

The State Bank of Vietnam has raised the domestic banking system’s credit growth by 1.5-2.0 percentage points from the previous 14 per cent limit on December 5.

Commercial banks asked to lend more for production and business

23-11-2022 21:48

The State Bank of Vietnam (SBV) requires credit institutions with room to actively disburse loans for production and business, especially in priority areas.

Credit growth high amid hikes in LDR

22-11-2022 15:00

Most of the listed commercial banks in the country recorded a sharp increase in the loan/deposit ratio (LDR) at the end of the third quarter of 2022 compared to last year.

Recession threat for 2023 as interest rates continue to rise

22-11-2022 13:27

Despite overcoming the pandemic much better than most other countries, Vietnam is not exempt of another sort of virus that is creeping into the country: inflation. While European Union countries recorded an unprecedented 10.9 per cent in September, a number unheard of for the Euro currency so far, the US recorded 9.1 per cent in June, the highest figure in 40 years.

Textile enterprises face difficulties in 2023

18-11-2022 06:59

The economic downturn and high inflation in many major export markets exerts difficulties on Vietnam’s textile exporters for 2023.

Message from government about resolving corporate bond issue

14-11-2022 16:14

The Government has issued Resolution 143/NQ-CP of its regular meeting in October.

SBV adjustments calm liquidity of currency

14-11-2022 11:52

While the problem of the VND’s liquidity has been stabilised, the economy is still facing challenges regarding macro-stability and exchange and interest rate pressure, according to financial experts.

US removes Vietnam from monetary manipulation monitoring list

13-11-2022 19:48

Vietnam has been removed from the US's monetary manipulation monitoring list, according to the State Bank of Vietnam (SBV).

Central banks brace after new Fed move

11-11-2022 08:00

Central banks across the globe have announced their recent rate hike in a bid to tame inflation, but market watchdogs predict that the tempo of rate rises is starting to slow down.

SBV moves in line with global money-tightening tendency

03-11-2022 14:00

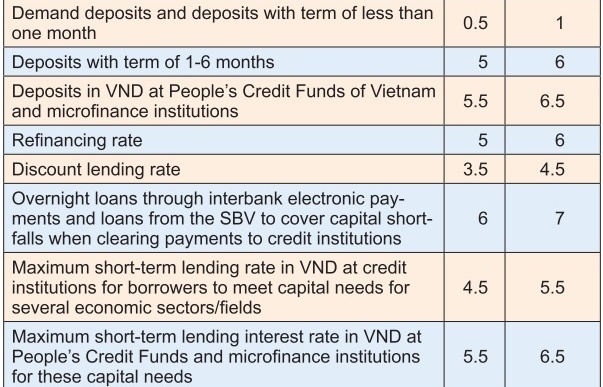

To stabilise the currency rate in the face of fluctuations in the international market, the State Bank of Vietnam (SBV) early last week raised the operating interest rate for the second time in a month.

State Bank of Vietnam alleviates market pressures

03-11-2022 11:00

The State Bank of Vietnam adjusted several operating interest rates last week, with the move deemed necessary in the context of a strong USD and increasing domestic pressure on interest rates and exchange rates.

Hiking deposit interest rates helps ensure capital mobilisation for economy

30-10-2022 20:22

Increasing deposit interest rates is in line with the general trend, ensuring liquidity safety and capital mobilisation for the economy, Deputy Governor of the State Bank of Vietnam (SBV) Pham Thanh Ha has said.

Chairman of EuroCham Vietnam: The SBV's efforts were commendable

27-10-2022 16:09

As exchange rate pressure grows when circumstances are unfavourable, the State Bank of Vietnam (SBV) has raised the operational interest rates by 100 basis points (1 per cent) before the November Fed meeting on October 24, according to a report recently provided by the SSI.

Mobile Version

Mobile Version