Recession threat for 2023 as interest rates continue to rise

This sharp increase in prices is triggered by several factors. One key factor is the expansionary monetary policy of central banks during the pandemic. Central banks, wanting to help businesses during recession, offered to lend money at extremely low interest rates by printing more money and thereby increasing the cash holdings in the economy.

|

| Dr. Daniel Borer - Programme manager, Global Business, RMIT Melbourne |

But as is commonly known, the more abundant a good is, the less value it has. And as the central banks flooded their economies with freshly printed money, eventually these bills lose value in comparison to what one buys with them, which is goods and services.

Hence, increasing the broad money will eventually lead to increased inflation. Pairing this together with the rise in energy prices, it is not surprising that inflation rates are breaking record numbers globally. As central banks are increasingly worried that inflation may become persistent, they are racing to raise interest rates in an unprecedented manner.

In a single year, the US Federal Reserve raised their rates by 3.75 per cent, something which it has not done since the 1980s. The European Central Bank joined this race by raising rates from zero to 2 per cent within the second half of 2022, which is unprecedented for the Euro.

The rapid raise in interest rates in developed economies, which are considered to offer relatively safe investment opportunities, also has an impact on the Vietnamese economy. As interest rates in Europe and the United States increase, their assets start to look increasingly attractive to global investors compared to Vietnamese assets, where interest rates still remain unappealingly low. As investors abroad and at home give into the temptation of higher foreign interest rates paired with the rising value of their currency, capital is lured out of Vietnam.

This is a change in trend, as investors were eagerly bringing capital into Vietnam in 2020 as the government was successful in shielding the economy from negative impacts from the pandemic. The successful measures allowed Vietnam to be the only country, along with China, to record 2 per cent economic growth in 2020 while all others in the region recorded negative growth rates.

Still, this reverted in 2021. While the economies of most countries in the region are bouncing back impressively, Vietnam’s economy only scores higher growth than Cambodia, Thailand, and Laos. Due to the moderate economic growth and fears of further depreciation of the VND, many investors are rethinking their investment strategy. If capital is relocated out of Vietnam, this may burden the VND further, which has already lost over 6 per cent of its value to the USD within the past three months.

In mid-October, the State Bank of Vietnam (SBV) decided to sell off reserves to stop the rapid depreciation of the VND, which is a measure that can only be maintained for a certain time, as long as reserves are abundant. Some estimates suggest that the central bank has used a minimum of $20 billion of its $109 billion reserves to strengthen the VND.

This recent depreciation, combined with the widespread increase in prices for foreign goods due to their inflation, is increasing prices for imports dramatically for Vietnamese households, adding to inflation pressure.

Inflation, so far, has been kept at bay, recording 2.9 per cent in end August, bringing the SBV’s 4 per cent inflation target for 2022 into reach. Nevertheless, the outlook for next year is rather bleak.

The dynamic of 2020 resembled the one the country experienced in 2005, where the net broad money was increased by the SBV by 5.66 per cent, while the increase in 2020 was of 6.62 per cent. This led to a follow-up inflation in 2006 of 7.4 per cent.

Given these numbers, an inflation in the range of 7-8 per cent could be expected next year. This would have dramatic consequences for interest rates, ranging well above 10 per cent, with its impact on families that have mortgages or other credits to pay.

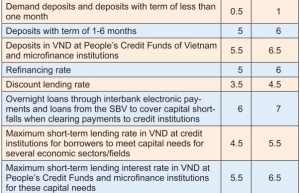

In order to prevent such inflation hikes, the SBV started to follow the example of other countries, racing to raise interest rates. On October 25, it raised deposit rates by 100 basis points to 6 per cent and further increases are expected. These fast hikes in interest rates will discourage economic activity, increasing the risk for an economic slowdown.

Unfortunately, this is not the only bad news looming on the horizon. The largest export market for Vietnamese goods is the United States, with a record $112 billion in 2021, roughly one-third of all exports. But Vietnam’s top customer is most probably facing another harsh recession by next year, as the economy suffers under the current, dramatic interest rate increases imposed by the Fed.

Meanwhile, other countries in the Asian region are looking rather attractive thanks to investment opportunities. Looking at this unfavourable panorama, it is possible that the long-feared stagflation, a recession paired with high inflation, that visited the western world, may soon be creeping into Vietnam as well.

The government and the SBV are indeed in a tricky position. Emulating the harsh interest rate increases implemented in other western countries may be too dramatic, given the moderate expansion of money in Vietnam during the pandemic. Also, expectations of inflation in Vietnam are not as high as in other countries. Hence, they also do not need to be curbed as much.

The recent move to increase interest rates by 100 basis points was deemed appropriate to send the correct message of keeping inflation at bay. But it seems that more of that may be damaging rather than healing.

On the exchange rate front, holding a quasi-fixed exchange rate with VND-USD is difficult to maintain in the medium term. Possibly, it would be wiser to save reserves and allow the exchange rate to depreciate at a certain, pre-announced rate of around 8 per cent per year, for the coming year. This would give some tranquillity into the hectic market and allow businesses to project themselves better, moving into next year. Also, this would keep imported inflation, the inflation due to the rise in VND of imported goods, at bay.

But the most difficult task at hand is to continue creating an attractive business environment. As the Regional Comprehensive Economic Partnership takes shape, the links with the region should be strengthened while moving away from markets like the US or Europe. Also, the digitalisation of trade needs to be further strengthened to make exports and imports more cost-efficient.

| State Bank of Vietnam alleviates market pressures The State Bank of Vietnam adjusted several operating interest rates last week, with the move deemed necessary in the context of a strong USD and increasing domestic pressure on interest rates and exchange rates. |

| Interest rates of auctioned Government bonds continue to rise The Hanoi Stock Exchange (HNX) held 30 auctions of Government bonds (G-bonds) in October, with 55.66 percent of the total G-bonds on offer, worth 31.45 trillion VND (1.26 billion USD) sold. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version