Plastic tax proposal meets opposition

In mid-August, Ho Duc Lam, chairman of the Vietnam Plastics Association sent a document to the Ministry of Finance (MoF) to protest a request from Hyosung Vina Chemicals to increase the import tax for two models of polypropylene (PP), which is used in a wide variety of applications.

Two months previously, Hyosung Vina Chemicals – a South Korean-invested chemicals company with about $1.3 billion investment capital in Vietnam – proposed to adjust import tax for the PP Homo model to 6 per cent and PP Copo type to 6.5 per cent compared to the existing 3 per cent. The company’s request is still waiting for the opinion of the MoF.

According to Lam, the supply of PP production, which is a core material used in making plastics for packaging, automotive parts, and more, is currently 850,000 tonnes per year in Vietnam. The majority of the figure comes from Nghi Son Refining and Petrochemical LLC at 400,000 tonnes per year, Binh Son Refining and Petrochemical JSC, and also Hyosung Vina Chemicals.

|

The official supply for the domestic market is 550,000 tonnes per year because Nghi Son is committed to exporting an annual capacity of 300,000 tonnes overseas. Meanwhile, the demand for PP production in the domestic market in 2020 was 1.85 million tonnes, a figure that is forecasted to increase. According to the calculation of adjusted present value, the import cost of PP is an average of $1,300 per tonne.

“The ability to meet the demand on domestic PP production for manufacturers in 2020 was 41.55 per cent only, and the figure in 2021 was forecasted at 26.89 per cent, thus, increasing the import tax for these products will cause pressure on manufacturers, especially as they suffer damage from the ongoing pandemic,” Lam said.

“If Hyosung Vina Chemicals’ proposal is approved, the added expenditure for manufacturers’ import tax payment is estimated at VND3 trillion ($130.4 million) in the next five years, which not only impacts the selling price of finished products but also makes manufacturers more cautious in expanding their operations,” he added.

Statistics from the General Department of Customs Vietnam showed that in the first five months of this year, the total import turnover of PP Homo was $600 million, up 23 per cent on-year, $315.6 million of which came from China and South Korea (0 per cent import tax). Meanwhile, the import value of PP Copo was $154.97 million, up 24 per cent on-year.

Responding to the association’s concerns, Song Kyoo Tak, deputy general director for the trading segment at Hyosung Vina Chemicals, told VIR that the company’s proposal is based on its facility’s manufacturing capacity, and is simultaneously expected to increase the localisation ratio of this production and encourage manufacturers to expand operations.

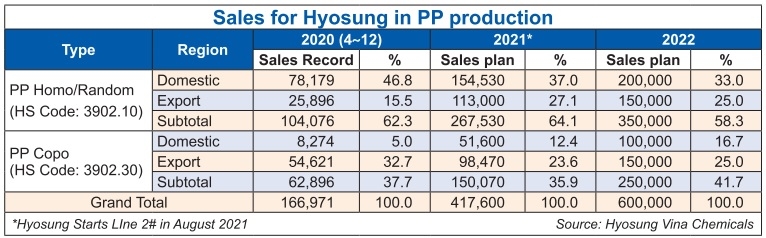

This month, the company officially took into operation its PP5 manufacturing facility, which deals with both PP Homo and PP Copo, in the southern province of Ba Ria-Vung Tau, with an annual capacity of 300,000 tonnes. With its first PP plant in the region kicking off operations in April last year, the company’s combined annual output of PP in Vietnam jumped to 600,000 tonnes, the biggest PP supplier in the country.

“The company forecasts that next year the demand on PP production in Vietnam will be 1.64 million tonnes, including 1.27 million tonnes of PP Homo and 370,000 tonnes of PP Copo. Thus, Hyosung’s two facilities will contribute to increasing the ability of the domestic PP Homo production to 72 per cent and PP Copo production to 68 per cent, and the supply ability will also continue to increase,” Tak said.

“If the domestic PP production supply increases, domestic plastics manufacturers will reduce the cost for imported materials and they will also decrease the expenditure for customs clearance, saving time for delivery and storage materials, which often last between one and two months,” Tak added. “The entire benefit will contribute to improving the competition of plastic products compared to imports as well as those using imported materials. Furthermore, being proactive in raw materials will help plastics manufactures reduce their reliance on imports.”

According to Tak, raising the import tax on these materials is also a way to protect PP manufacturers and encourage them to expand the operation. “For example, Indonesia’s domestic supply of PP is 51 per cent, which means the country depends on imported PP, however, it still issues an imported tax of 10 per cent on PP imports,” he said.

PP production is a basic product of the petrochemical industry that can be used for a variety of applications, maintaining the production capacity of many high-quality products for medical masks, automobile/home appliance parts, and high-quality food containers, thus it is considered an important factor for the country’s long-term growth.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Hanoi sees launch of new innovation centre with state-private model (February 27, 2026 | 16:45)

- Banks roll out God of Wealth Day promotions (February 26, 2026 | 17:10)

- Entire financial sector steps firmly into a new spring (February 17, 2026 | 13:40)

- Foreign executives assess Vietnam business outlook for 2026 (February 16, 2026 | 09:00)

- VIFC in Ho Chi Minh City officially launches (February 12, 2026 | 09:00)

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

Tag:

Tag:

Mobile Version

Mobile Version