Long-term growth strategies pushing Japan’s dealmaking

|

| Masataka “Sam” Yoshida, head of the Cross-border Division of RECOF Corporation and CEO of RECOF Vietnam Co., Ltd. |

According to recent information showing that Japanese-listed companies have accumulated as pure deposits to the banks (excluding their investments in government bonds or anything similar to cash equivalent) an amount of $25 trillion which they can use as free cash.

Meanwhile, Prime Minister Suga Yoshihide’s choice of Vietnam as his first country to visit has had a significant positive impact on Japanese companies. If the restrictions on human traffic are lifted, mergers and acquisitions (M&A) transactions between Japan and Vietnam will make a quick recovery.

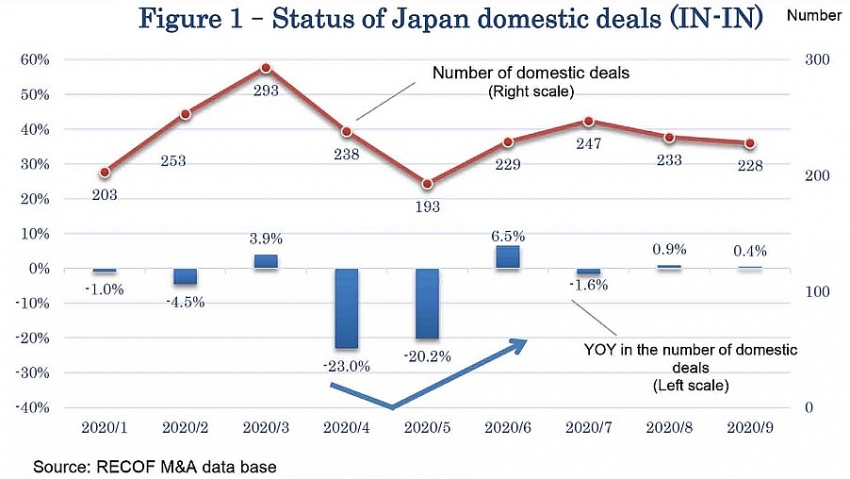

In addition, the monthly number of domestic M&A transactions (IN-IN) in Japan, compiled by RECOF Group, did not fall significantly below the previous year’s level until March, but it started to fall by over by 20 per cent in April and May, respectively. Needless to say, this is due to the pandemic.

However, as early as in June, signs of change began to appear. Although recovery of cross-border deals such as Japan outbound (IN-OUT) and Japan inbound (OUT-IN) was slow, domestic deals (IN-IN) bottomed out in May and began to increase, showing growth over the same month of the previous year (see Figure 1).

There are three reasons for the quick recovery in Japanese domestic M&A transactions. First of all, since the M&A method is now established as an essential means to achieve strategic goals, we do not see an extreme decline in M&A activities. Of course, the 20 per cent declines in April and May were significant, but considering the recovery in June, we can assume that the situation will not continue to fall.

Also, looking at the situation of the M&A on the ground, the growth of Japan domestic deals has already returned to a stable speed, although there had been an emergency decline after the pandemic spread.

|

Pandemic reactions

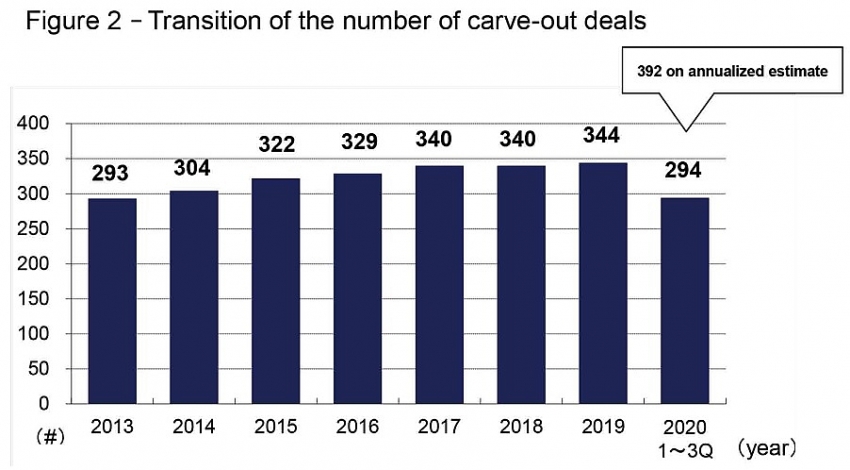

Secondly, even before the pandemic, there was an increase in “carved-out” deals in which listed companies divested their subsidiaries and businesses (Figure 2) and in “intra-group” M&A transactions. In other words, even before the pandemic, many Japanese companies had been selling off or withdrawing from unprofitable divisions and reviewing their business portfolios, and it will be a mistake to attribute the increased sales of businesses to the slump of Japanese companies’ business performances caused by COVID-19.

|

This is the result of the growth strategy that has been continuously implemented since 2014 by the former Japanese prime minister’s administration, which was a long-term stable government. Abe Shinzo’s administration had made serious efforts to increase the return-on-equity of Japanese companies and improve their global competitiveness. In Japan, the increase in the number of “carved-out” and “intra-group” deals is seen as positive activities that will make Japanese companies stronger.

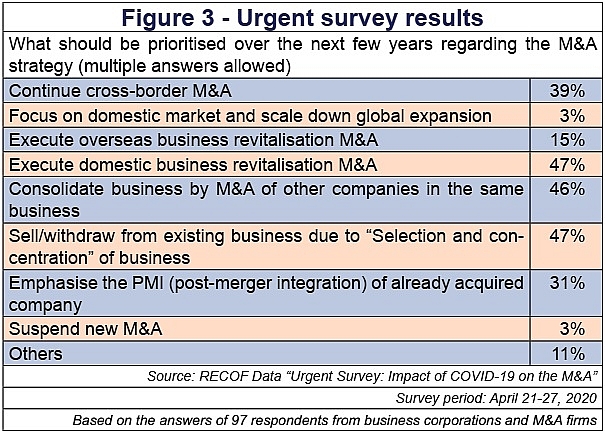

Thirdly, the Japanese companies have made attempts to turn the crisis into an opportunity. In the second half of April, when the pandemic was in a very difficult situation in Japan, RECOF Group conducted an urgent survey and got 97 responses from the persons in charge of M&A at business corporations and the M&A professionals.

According to the responses, although more than 40 per cent were forced to suspend M&A projects due to the influence of the COVID-19, 20 per cent responded that they regard this situation as an opportunity to start considering a new acquisition. In addition, more than 20 per cent said that the status of studying M&A opportunities was the same as in the past. The survey showed positive intentions about M&A. Although we face crises like the financial crash of 2008 and various natural disasters every few years, strong companies are executing their own growth strategies, such as lowering break-even points each time to prepare for the next step, selecting and concentrating their businesses by shrinking once, and executing M&A by taking on opportunity for acquisition.

On the other hand, the number of overseas acquisitions (IN-OUT) has not recovered yet. From January to September, the number of IN-OUT transactions announced was 417, which was only 70 per cent of 617 transactions in the same period last year. However, even with travel restrictions due to COVID-19, the number of cases has been maintained at 70 per cent level compared to last year, and in August a large-scale acquisition of more than $20 billion, the acquisition of Speedway US by convenience store giant 7-Eleven, has been agreed.

Recovering investments

In addition, it should be noted in the aforementioned survey (Figure 3) that 39 per cent of respondents said that they would continue to consider cross-border M&A (IN-OUT), while only a mere 3 per cent responded that they would scale down their cross-border M&A and return to domestic M&A deals (IN-IN). The difference is more than obvious.

|

In the field of cross-border M&A (IN-OUT), there is a tendency of suspending the M&A process until human traffic becomes possible, and it appears in the data that the number of completed transactions decreases, but when human traffic becomes possible, it is certain that cross-border M&A will be resumed by checking the survey results.

Analysing macroeconomic indicators, it is likely the number of overseas M&A transactions (IN-OUT) will increase. From some of the data, it is expected that Japanese companies’ overseas M&A investments will recover. The following points are also reported in Nomura Securities’ Corporate Performance Outlook for 2020-2021 released in September.

In the current fiscal year, according to analysts’ forecasts, sales will decrease by 9.5 per cent on-year and recurring profit will decrease by 19.5 per cent. Recurring profit declined by 22.3 per cent on-year basis in fiscal 2019, so the business performance is expected to decline for the second consecutive year. However, the forecast for the next fiscal year is a 8.6 per cent increase in sales over the previous fiscal year and a 49.1 per cent increase in recurring profit.

On the assumption that the economic activities stagnated by the pandemic will return to normal in Japan and overseas, recurring profit is expected to return to growth for the first time in three fiscal years.

According to the International Monetary Fund’s World Economic Outlook in October, Japan’s real GDP for 2020 is forecast to decrease by 5.3 per cent but is predicted to recover by 2.3 per cent in 2021. Based on this data, it is presumed that the investment capacity of Japanese companies will continue to be strong.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Marico buys 75 per cent of Vietnam skincare startup Skinetiq (February 10, 2026 | 14:44)

- Mitsubishi acquires Thuan An 1 residential development from PDR (February 09, 2026 | 08:00)

- KKR and Singtel step up data centre investment in Southeast Asia (February 06, 2026 | 13:09)

- New rules ease foreign access to Vietnam equities (February 05, 2026 | 17:29)

- Vietnam’s IFC creates bigger stage for M&As (February 01, 2026 | 08:16)

- Game startup Panthera raises $1.5 million in seed funding (January 29, 2026 | 15:13)

- Cool Japan Fund transfers shares of CLK Cold Storage (January 28, 2026 | 17:16)

- Nissha acquires majority stake in Vietnam medical device maker (January 26, 2026 | 15:40)

- BJC to spend $723 million acquiring MM Mega Market Vietnam (January 22, 2026 | 20:29)

- NamiTech raises $4 million in funding (January 20, 2026 | 16:33)

Tag:

Tag:

Mobile Version

Mobile Version