KPMG 2021 Tax & Legal Institute updates on key developments in past year

|

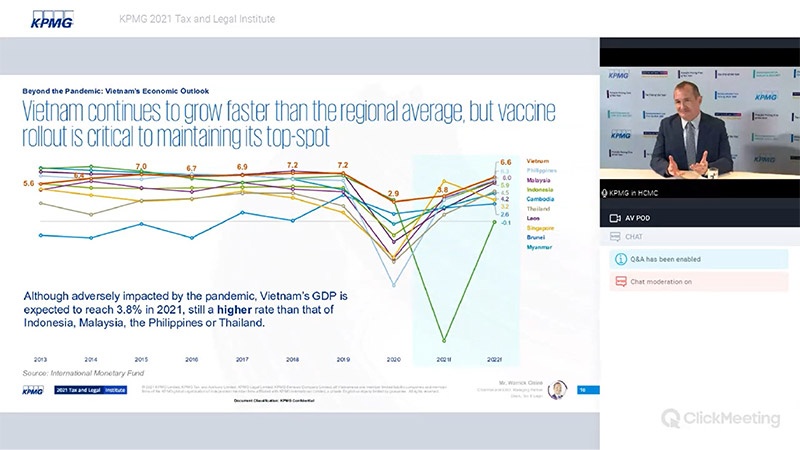

| Warrick Cleine, chairman and CEO of KPMG in Vietnam and Cambodia |

The 2-day conference offered an in-depth exploration of the issues affecting businesses today and helped boost their confidence to the New Normal. At the opening speech on Vietnam Economic Outlook, Warrick Cleine, chairman and CEO of KPMG in Vietnam and Cambodia, commented: “One of the most important contexts is the COVID-19 situation. It is an issue impacting every aspect of our life.”

He admitted the huge challenge COVID-19 put on the economy, yet praised the resilience of Vietnam. With many geopolitical changes and environmental commitments, he predicted there will be a number of policy adjustments to cope with new normal requirements and advised the delegates: “We have to be agile.”

Echoing Warrick’s observations, KPMG’s tax experts and attorneys deep-dived into some key focuses, including COVID-19 related topics (COVID-19 support measures, implication on transfer pricing, immigration and labour), export processing enterprise (EPE) conversion (process, considerations, and VAT refund), personal income tax, tax inspection plans by the authorities, updates on CIT incentives (including incentives for supporting industry), tax issues (relating to advertising and promotion expenses, related party expenses, COVID-19 expenses), free trade agreements, e-commerce taxation, and guidance on investment law, among others

|

| Hoang Thuy Duong and KPMG experts answer questions |

In addition to the discussions led by KPMG professionals, the conference was honoured to invite Nguyen Van Phung, head Bureau of Large Enterprise Management, General Department of Taxation to give an insightful overview of how macro changes in both Vietnam and the world impacted the country taxation policies and how business should prepare for the upcoming tax inspection.

Concluding the event, Hoang Thuy Duong, KPMG in Vietnam’s head of Tax, shared his view: “As we march to a new normal, there are exciting business prospects awaiting us in 2022. For 2022, we can assume that tax policies will continue to support the business recovery, with a lower collection rate than GDP growth. However, over the medium to long terms, given the expenditures to support recovery and growth, including those for infrastructure and social programmes, we expect tax policies and environment to change significantly.”

The programme will be available for online viewing soon on KPMG OnDemand. For more information, please contact KPMG OnDemand.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- KPMG launches tariff modeller in Vietnam to navigate US tariff risks (July 29, 2025 | 12:11)

- Removing hidden barriers to unlock ASEAN trade (June 29, 2025 | 11:31)

- New report charts path for Vietnam’s clinical trial growth (May 21, 2025 | 08:58)

- TTC Agris strengthens market position with investment in Bien Hoa Consumer JSC (May 19, 2025 | 10:14)

- World Bank to help SBV build shared database for banking industry (April 09, 2025 | 08:55)

- New trade alliances and investment hubs are redefining global power dynamics (April 03, 2025 | 17:00)

- ACCA and KPMG forge path for business leaders to pioneer ESG excellence (March 07, 2025 | 10:09)

- VietBank signs MoU with KPMG (February 26, 2025 | 18:47)

- Warrick Cleine MBE: an honour for services to British trade and investment in Vietnam (December 31, 2024 | 20:16)

- KPMG report offers fresh insight into leveraging AI (December 24, 2024 | 09:23)

Mobile Version

Mobile Version