Japan taking FTAs seriously

|

Japanese investors started taking interest in Vietnam back in 1986, with the number of companies entering the country increasing year by year, and now reaching more than 3,000 in number.

According to statistics from the Vietnamese Ministry of Planning and Investment (MPI), Japan ranked first among countries and territories with investment in Vietnam, with the total registered capital of $8.59 billion in 2018, accounting for 24.2 per cent of the country’s total.

Looking forward, Vietnam remains an attractive investment destination for Japanese businesses thanks to its stable economic growth, political stability, market scale, cheap labour costs, and growth potential. The latest fiscal year (FY) 2018 survey on the international operations of Japanese companies in Asia and Oceania released in this month by JETRO Hanoi showed that about 70 per cent of Japanese companies in Vietnam have plans to expand operations in the future, mainly driven by revenue growth and high growth potential. They are learning about free trade agreements (FTAs) that best benefit them. Specifically, 65.3 per cent of Japanese companies in Vietnam make a profit, and for those with operations since before 2010, the rate is around 80 per cent.

Vietnam is increasingly deeply integrating into the global market by signing many FTAs. There are more Japanese businesses mulling over investment, shifting from China and Thailand to Vietnam to benefit from the agreements, especially including the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), as well as to ease risks from the US-China trade tensions.

FTA application

The CPTPP is an important deal to Vietnam and Japan which can help companies of the two countries boost business and investment activities.

At present, Japanese companies in Vietnam are still learning about this agreement with the majority not yet aware of it, especially small- and medium-sized enterprises (SMEs).

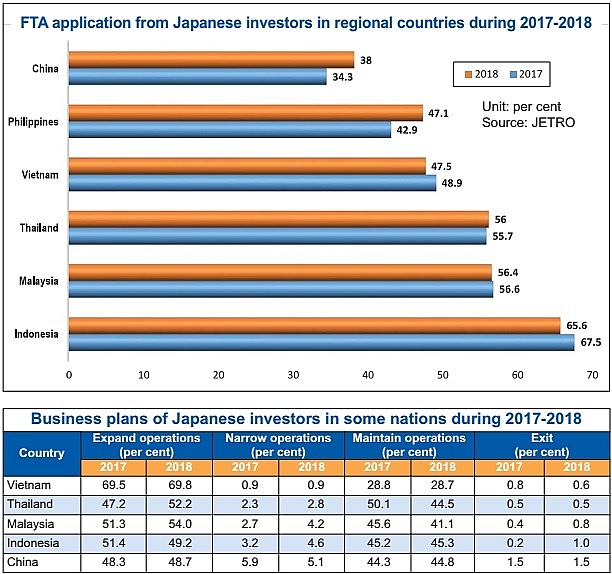

For other FTAs, the latest survey shows that 47.5 per cent of Japanese companies in Vietnam said that they apply agreement regulations, down 1.4 percentage points from the previous survey. The majority of the FTA-applied companies are reported among those having export-import activities.

In comparison with other regional countries, the application of FTAs among Japanese companies in Vietnam is slightly higher than those in the Philippines and China, while lagging behind those in Indonesia, Malaysia, and Thailand.

In terms of business scale, large-scale businesses tend to concentrate more on FTA application than SMEs. Accordingly, 55.2 per cent of large-scale companies said they apply FTAs, while the threshold among Japanese SMEs is 41.1 per cent.

Surprisingly, 40.7 per cent of Japanese companies in Vietnam have no plans to apply FTAs, of which 35.4 per cent are large-scale ones and 45 per cent are SMEs. At the same time, 9.4 per cent of the large-scale companies are considering applying FTAs, while the rate among SMEs is 13.9 per cent.

Japanese companies in Vietnam in textiles and garments, foodstuffs and processed agro-products, trading, machinery, and plastics have higher FTA application rates than others. Specifically, the rate is 83.3 per cent in the textile and garment sector, followed by foodstuffs and processed agro-products (72.7 per cent), trading companies (57.1 per cent), machinery (52 per cent), and plastics (47.6 per cent).

Though the FTA application rate among Japanese companies in Vietnam fell in the 2018 survey, it is not a concerning issue. Simply, they are making considerations into which mechanism of FTAs they should follow to most benefit from because Vietnam has signed a raft of agreements.

|

Business movements

Japanese companies have tended to invest in small-scale projects of $5 million in Vietnam, accounting for 90 per cent of the total, while ventures of over $5 million increase in the manufacturing sector.

In comparison with previous years, there might be no big change in the investment scale of Japanese companies in Vietnam this year. The majority of Japanese companies in Vietnam are SMEs. And in the coming time, more Japanese SMEs will expand in the country.

The number of Japanese-invested projects in services has tended to increase, but in terms of investment capital, that in the manufacturing sector remains of a higher scale.

Manufacturing retained the most attention of Japanese investors in Vietnam in 2018, and the high interest in the sector will continue. It is ruled that the more the economy develops, the more the third industry of services develops compared to the second industry of manufacturing, and Japan is not an exception. Thus, Vietnam should have policies to attract Japanese investment in manufacturing in its targeted areas.

Regarding export and import activities, Japanese companies in Vietnam tend to head to domestic consumption, while the “100 per cent export” form of previous years tended to narrow.

Newly-registered Japanese investment in major projects concentrates in the north, making up 80 per cent. Meanwhile, the number of projects in the south accounts for half of the total, with the number of projects in the northern and central regions tending to increase.

At present, Japanese perspectives about the improvement in the localisation rate will make Vietnam even more attractive. As shown in the survey, Vietnam’s localisation rate has gradually increased since 2010, and in 2018 it rose to 36.3 per cent from 33.2 per cent in 2017, making it the highest rise among the surveyed countries.

While seeing positive changes, regulatory risks remain high among Japanese companies in Vietnam. As shown in the survey, while the four other risk items, including rising labour costs, cumbersome tax procedures, complicated licensing procedures, and infrastructure, all fell, with regulatory risks going in the opposite direction.

In the FY 2017 survey, 46.9 per cent of interviewees named regulatory framework as risks, but in 2018 it pushed up to 48.2 per cent, a rise of 1.3 percentage points. It shows poor results for incompletion of a legal framework and a lack of transparency in performance. In comparison with other regional countries, the 48.2 per cent is lower than Laos, Indonesia, Cambodia, and Myanmar.

To attract more Japanese investors in the future, the Vietnamese government should deal with legal risks and further develop supporting industries in order to increase competitiveness.

| Hanoi targets more Japanese investment By Tung Anh Hanoi is estimated to need $110-114 billion to capitalise its development plans in the 2016-2020 period. Thus the city is working to attract more foreign direct investment, with about $10-15 billion expected to be lured in the 2018-2020 period. According to Hanoi’s foreign direct investment (FDI) attraction strategy, the capital will target high-quality investment capital focussing on supporting industry development projects, hi-tech manufacturing and agriculture, bio-technology, infrastructure development, research and development, banking and financial services, and human resources development. This will contribute to increasing added value to the city’s social-economic development in a sustainable manner. In this strategy, Japan is one of the major foreign investors that Hanoi is targeting to attract. The city aims to lure Japanese funding in IT solutions, the environment, hi-tech agriculture, energy and more. As part of efforts to encourage these moves, the Hanoi-Japan investment promotion conference will take place on March 29 in the city, attracting over 120 Japanese delegates and leaders of ministries, cities and provinces, as well as Vietnamese businesses. A number of memoranda of understanding on investment and business will also be announced at the event. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Themes: CPTPP

Related Contents

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version