Myriad of benefits already clear with UK-Vietnam pact

Under the British Embassy to Vietnam’s study on cooperation in agriculture between Vietnam and the UK released last week, there are exciting grow opportunities from trade agreements, especially the UK-Vietnam Free Trade Agreement (UKVFTA) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), for both nations.

“The UKVFTA since 2021 has brought immense opportunities for the agriculture, and food and drink sectors. The majority of food and beverage (F&B) product categories now benefit from a phased reduction and eventual elimination of tariff rates by 2031 (subject to relevant tariff quotas),” stated the study.

|

Building upon this, the UK’s full accession to the CPTPP, scheduled to take place in 2024, will pave the way for even more exciting agri-food trade opportunities, according to the embassy.

For Vietnam, the benefits have already been clear. Exports of agro-forestry-fishery exports to CPTPP member countries increased 32 per cent in just three years, from $2.2 billion in 2019 to $2.9 billion in 2022.

The UK is also off to a strong start. In 2022, the UK exported $63.5 billion of goods and services to the CPTPP countries (7.5 per cent of the UK total) and imported $54 billion (5.8 per cent).

In Vietnam specifically and previously, UK exporters of F&B products post-Brexit were subject to Vietnam’s most-favoured nation tariff rates. These were up to 60 per cent.

Under the CPTPP, tariff rates for UK imports have already dropped. Tariff rates on pork have dropped from 22-25 to 8.1 per cent, while tariffs on seafood have largely disappeared. Long-term advantages will continue to develop. Vietnam is expected to benefit from increased exports of agricultural and seafood products, while the UK should see a boost to meat exports.

According to the study, as the trade relationship continues to flourish, a variety of renowned and sought-after food products from the UK have found their way into Vietnam. Whisky and gin are prevalent, featuring in the top five UK exports to Vietnam. Specific regions of the UK have also experienced success. The Scottish trade scene is particularly vibrant, collectively shipping $105.4 million of F&B goods to Vietnam in 2022; among which whisky and seafood stand out.

The UK is also feeding demand in Vietnam. Vietnam exported nearly $300 million of fish and shellfish to the UK last year, making seafood Vietnam’s fifth-biggest export product category for the UK.

Fruits have also witnessed export success. In January 2023, the inaugural shipment to the UK of seven tonnes of Cao Phong oranges, renowned for their distinctive fragrance, rich sweet taste, and abundant juice, was celebrated in a big ceremony attended by the People’s Committee of Cao Phong district and the Department of Agriculture and Rural Development of the northern province of Hoa Binh. This was followed in May 2023 with the first five-tonne shipment of iconic Ri6 Durian landing on British supermarket shelves nationwide.

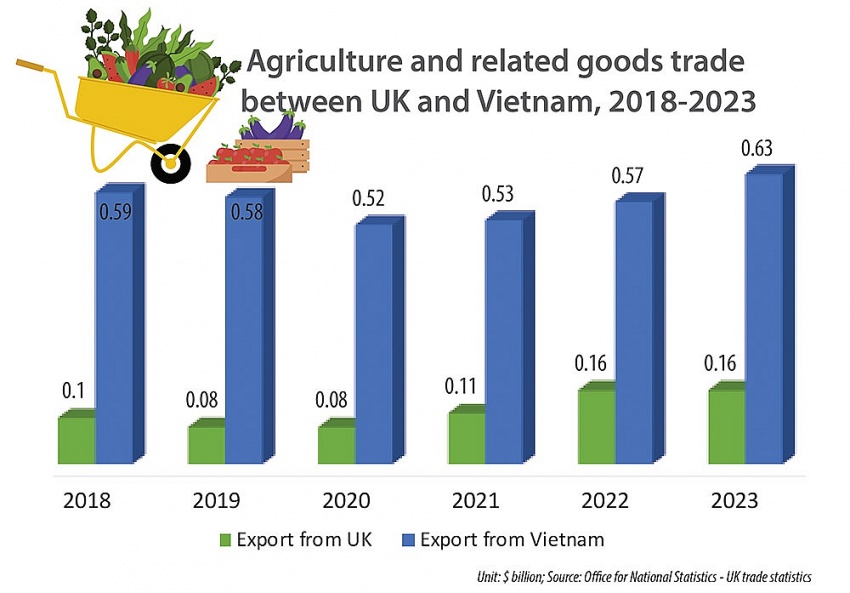

The total F&B trade between the two countries in 2023 amounted to nearly $800 million, with further expected expansion following the November 2022 cooperation agreement signed between Vietnam’s Ministry of Agriculture and Rural Development and the UK’s Department of Environment, Food, and Rural Affairs. The agreement will streamline regulatory frameworks, ensure compliance with international standards, and reduce barriers to entry for agricultural and F&B produce.

Meat exports are also expected to benefit directly, following a simultaneous bilateral agreement on export health certificates that permits British pork and poultry product exports to Vietnam for the first time.

Vietnam is one of the world’s top meat importers, boasting an import surplus of over $1.4 billion in 2023. It already contributes 2.5 per cent of total global pork production and is ranked sixth in pork production globally.

Last month, the UK’s post-EU import requirements came into force. Vietnam is one of only 23 non-EU countries that have been specifically ‘risk assessed’.

“Due to Vietnam’s historical compliance, it can benefit from a lower frequency of checks, and simplified procedures, demonstrating the UK’s commitment to increasing bilateral agri-trade,” said UK trade commissioner for Asia-Pacific Martin Kent. “Whilst these requirements will be continuously reassessed and could go up as well as down, this presents an exciting new opportunity for Vietnamese exporters to utilise.”

“This relationship is poised to improve further, with our accession to the CPTPP which brings a wealth of new tariff and rule of origin benefits on top of our existing UKVFTA, particularly for the seafood and snacking sectors,” he added.

| Firms must work to fully benefit from UKVFTA: Insiders The UK-Vietnam Free Trade Agreement (UKVFTA) has given a big push to Vietnamese exports, but insiders said firms still have much to do to make the most of the deal. |

| New motivation for bilateral investment through UKVFTA The United Kingdom and Vietnam have made positive moves in bilateral trade and investment after one year of enforcement of a special free trade deal. Kenneth Atkinson, chairman of the British Chamber of Commerce Vietnam, talked to VIR’s Bich Thuy about what could lay ahead. |

| UK-Vietnam trade pact already demonstrating value The United Kingdom-Vietnam trade relationship is poised to reach new heights, buoyed by the celebration of 50 years of UK-Vietnam bilateral relations last year, guided by the continued implementation of the UK-Vietnam Free Trade Agreement (UKVFTA), and further boosted by the UK joining the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP). |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Haiphong gains new growth impetus from strategic planning and integrated infrastructure (February 27, 2026 | 16:40)

- Kurz Vietnam expands Gia Lai factory (February 27, 2026 | 16:37)

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

Mobile Version

Mobile Version