Hopes high for year-end rally to reverse shaky trade balance

The Ministry of Industry and Trade last week reported that in the first nine months of minent examples.

Nguyen Hai Hoang, vice director of electronics manufacturer Duc Hoang Electronics JSC in the southern province of Binh Duong, recently had online meetings with three partners from Malaysia and China to negotiate new export orders. His firm will provide them with electronics items at a total value of nearly $10 million for the fourth quarter and about $5 million for the first three months of 2022.

“We earned export turnover of $11 million in the first nine months of 2021, up from $10 billion in the corresponding period last year. If our partners hadn’t reduced production, we could have earned about $15 million in the first nine months of this year,” Hoang said.

The firm has also imported electronic items for its production. The import turnover in the same period rose 5 per cent on-year. “It is expected that if COVID-19 is well controlled in the foreign markets in the rest of 2021, our company’s export and import turnover will climb about 6 per cent this year,” Hoang said.

Duc Hoang Electronics has contributed to a rise in Binh Duong’s electronics export turnover of 32.6 per cent on-year, at over $1 billion in the first nine months, and also contributed to an expansion in the Vietnamese electronics industry’s nine-month export turnover of $36.4 billion, up 13.1 per cent on-year.

Vietnam also earned $41.33 billion from exporting mobile phones and their spare parts in this period, up 12.4 per cent on-year. South Korea’s Samsung holds more than 90 per cent of Vietnam’s total export turnover from electronics and mobile phones.

As for garments and textiles, over the past few weeks producer No.26 JSC, based in Hanoi, has boosted recruitment of new employees who will work for the company’s new facilities in the city, with high allowances and bonuses in addition to salaries.

“We need many new workers as we are expanding exports to a number of new markets in Europe, ASEAN, and Japan, besides our traditional markets of South Korea and the US,” explained company representative Nguyen Viet Thang, adding the nine-month export and import turnover hit about 5 per cent on-year.

The company’s exports and imports were boosted during January and June in particular. However, since July exports have slowed down due to the pandemic. “However, we expect that with the new orders we will be able to increase exports thanks to the new markets gradually reopening their doors to import activities.”

The Ministry of Industry and Trade (MoIT) said in the first nine months of 2021, Vietnam’s garment and textile export turnover hit $23.46 billion, up 5.8 per cent on-year.

On the rise

|

The MoIT reported that while many items in the period witnessed a cut in export turnover, garments and textiles as well as electronics are among key export items with an on-year rise in export turnover, such as assorted steel ($8.23 billion, up 125.4 per cent), machinery and equipment ($26.25 billion, 44.5 per cent), wood and wooden products ($11.14 billion, 30.9 per cent), footwear ($13.33 billion, 9.8 per cent), transportation means and equipment ($7.86 billion, 23.1 per cent), plastics ($3.57 billion, 37.4 per cent), and chemicals ($1.66 billion, 32.5 per cent).

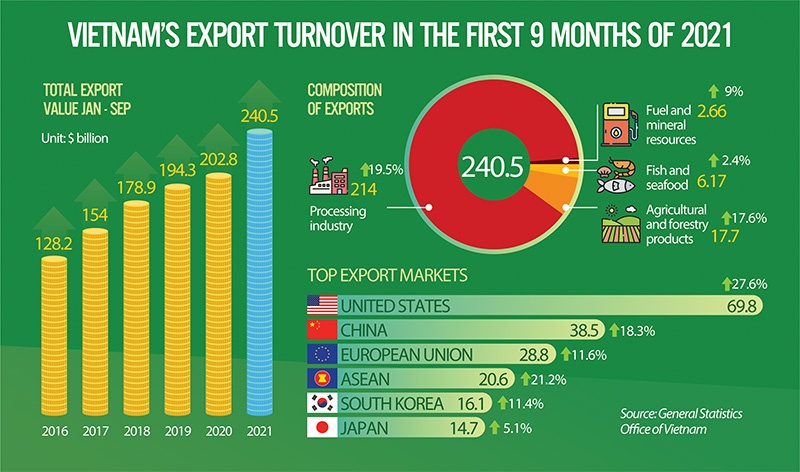

In the first nine months, Vietnam’s total export turnover reached $240.52 billion, up 18.8 per cent over the same period last year – in which local exporters fetched $62.72 billion, up 8.5 per cent and foreign firms raked in $188.8 billion (including crude oil exports), up 22.8 per cent.

Meanwhile, total import turnover hit $242.65 billion, up 30.5 per cent on-year - in which local importers spent $83.72 billion, up 25 per cent and foreign firms forked out $158.93 billion, up 33.6 per cent. Thirty-six items had an import turnover of over $1 billion, holding over 90 per cent of the economy’s total import value.

In the same period, Vietnam saw a trade deficit of $2.13 billion, with domestic firms suffering from a trade deficit of $21 billion and foreign businesses enjoying a trade surplus of $18.87 billion.

However, according to the MoIT, the majority of the imported products are used for domestic production, and only $14.77 billion (or 6 per cent of the total import value) worth of imported goods needs to be controlled.

Big expectations

Tran Thanh Hai, vice director of the MoIT’s Foreign Trade Agency, was optimistic about the nine-month trade picture which contributed greatly to the GDP growth of 1.42 per cent, especially amid the health crisis.

“This is a big effort of all sectors, localities, and enterprises,” Hai said. “Vietnam’s export activities are enjoying advantages from free trade agreements and global markets’ growing demands for goods in the remaining months of the year.”

“In the fourth quarter, if COVID-19 is well controlled, the southern region will strongly recover, boost exports, and regain growth momentum. It is strongly believed that by late 2021, the country will see a trade balance, and if more favourable conditions come, there may be a trade surplus,” he said.

The MoIT forecasted that Vietnam’s total export turnover will be around $313 billion this year, up 10.7 per cent on-year. This will help the economy grow at about 3-3.5 per cent this year.

Under a General Statistics Office survey conducted in the third quarter, covering around 5,700 manufacturing and processing firms and nearly 6,200 construction businesses, 77.6 per cent of respondents believed their new export orders in the fourth quarter will “increase or be unchanged” as compared to the third quarter. Only 22.4 per cent of the surveyed firms predicted that their new orders will be reduced in the fourth quarter.

Standard Chartered revised down its GDP growth forecast for Vietnam in 2021 to 2.7 per cent from 4.7 per cent, reflecting the unexpected third-quarter contraction of 6.17 per cent on-year. The bank expects recovery to accelerate in 2022 and maintains its growth forecast for next year at 7 per cent.

“While we expect growth to start recovering in Q4, this hinges on progress towards reopening businesses. We expect post-pandemic acceleration but turn more cautious pending clearer signs of recovery. Vietnam’s pandemic management is crucial to the near-term outlook,” said Tim Leelahaphan, economist for Thailand and Vietnam at Standard Chartered.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Carlsberg Vietnam delivers Lunar New Year support in central region (January 28, 2026 | 17:19)

- TikTok penalised $35,000 in Vietnam for consumer protection violations (January 28, 2026 | 17:15)

Tag:

Tag:

Mobile Version

Mobile Version