Global movements set scene for 2024’s export orientation

|

| It is projected that import/export activities will continue to build momentum for the rest of the year |

The government has estimated that in 2023, the country may reap $358.7 billion in export turnover, 3.4 per below the initial targets.

The Ministry of Industry and Trade (MoIT) said that in the first 10 months of this year, a decline in export turnover has been gradually narrowed down, reflecting the export situation becoming more positive.

“With positive and synchronous measures used to remove difficulties and support domestic production activities and trade promotion, and expand export markets, export activities have been witnessing positive signals, with growth momentum regained in October following a standstill in September,” the MoIT said.

Freshly updated figures from the MoIT showed that following an on-year decline of 6.3 per cent in September, the export value in October was estimated at $32.3 billion, up 5.3 per cent on-month. In which domestic exporters raked in $8.49 billion, up 5.7 per cent, and foreign exporters fetched $23.82 billion (including crude oil exports), up 5.2 per cent.

Compared to the same period last year, the October export turnover increased 5.9 per cent – with Vietnamese exporters up 15.1 per cent and foreign exporters up 3 per cent (including crude oil exports).

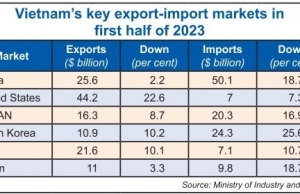

Cumulatively, in the first 10 months of this year, the total export turnover is estimated to come at$291.28 billion, down 7.1 per cent on-year.

“This indicates that a drop in export turnover growth has significantly reduced as compared to the on-year fall of 12 per cent in the first half of 2023,” the MoIT said.

In which, Vietnamese companies reaped $77.09 billion, down 4.1 per cent and accounting for 26.5 per cent of total export value. Foreign companies earned $214.2 billion (including crude oil exports), down 8.1 per cent.

Also in this period, the reduction in export turnover of Vietnamese companies was half of that of foreign companies (including crude oil exports), meaning 4.4 versus 8.1 per cent, mirroring Vietnamese enterprises’ “great efforts in maintaining and expanding the export markets”, the MoIT added.

Vietnam saw a trade surplus of about $3 billion in October and $24.61 billion in the first 10 months, far higher than the $9.56 billion in the corresponding period last year.

“Such a trade surplus has contributed to ensuring macroeconomic stability, ensuring major balances of the economy, and at the same time providing a big support for the country’s international payment balance,” said MoIT Deputy Minister Phan Thi Thang.

It is expected that the trade surplus for the whole year will be about $15 billion, far above the initial target of $1 billion set early this year.

Uptrend continuing

The MoIT is expecting that Vietnam’s export and import activities will continue flourishing in the remaining months of this year, largely backed by favourable factors at home and in the international market, where the global economy has shown positive recovery signals with better-than-expected growth.

In fact, almost all international organisations have made forecasts that the global economy will increase slightly this year as compared to their projections made in the first half.

The EU predicted that the rate will be 3.2 per cent, up 0.1 per cent from the projection made in May. The Organisation for Economic Co-operation and Development also followed suit, at 3 per cent, up 0.3 per cent from its forecast made in June.

The International Monetary Fund revised its prediction to 3 from 2.8 per cent made in April. Meanwhile, the World Bank has also said that the global economy will increase 2.1 per cent in 2023, up 0.4 per cent from its projection in early this year.

In particular, there have been signs of positive economic recovery in the US and China, Vietnam’s two top trading partners. This has had a positive impact on Vietnam’s export activities.

The Purchasing Managers’ Index (PMI) in the US and China are now both above the 50-point threshold, higher than forecast, while inflation in the EU in September was the lowest in the past two years.

According to a report from the US Department of Commerce in October, the third quarter GDP growth rate in the US increased 4.9 per cent. This is the strongest Q3 increase in nearly two years, higher than the growth rate of 2.1 per cent in the second quarter and higher than the earlier-expected growth rate of 4.7 per cent.

The main driving force for US economic growth in the third quarter came from the consumption sector: Q3 consumption climbed 4 per cent, the strongest increase since Q4 of 2021. At the same time, the US manufacturing PMI in October also ascended, reaching 50 points, higher than the forecast 49.5 points, and higher than September’s level of 49.8 points, showing positive signs for restoring production and consumption.

Meanwhile in China, GDP growth in Q3 hit 4.9 per cent, higher than the forecast 4.6 per cent, and also higher than the growth rate in Q1 of 4.6 per cent. At the same time, China’s gross industrial output in September climbed 4.5 per cent over the same period last year, retail sales also increased 5.5 per cent, both higher than forecast. This has also shown signs of improvement in the economy.

New targets

The government has set a target that in 2024, total export turnover will be $380 billion, up 6 per cent from the recorded figure this year. Total import turnover will be $365 billion next year, also up 6 per cent from the implemented figure for 2023. The total trade surplus is targeted at $15 billion.

The government in its resolution for its October cabinet meeting, released last week, required the MoIT to apply more solutions to increase exports and closely control imports, and take advantages of commitments signed free trade agreements to swell export markets.

The MoIT is also ordered to direct Vietnam’s trade offices overseas to seek more information from the markets where they are located to provide timely consultancy for the government and the prime minister on how to expand exports.

The government told the National Assembly that from now until late 2024, the government will deploy a series of sturdy solutions to spur on investment, consumption, and exports.

“We will closely monitor and accurately forecast the world and domestic situation, developments in fiscal, monetary and trade policies of major economies, which are Vietnam’s main trade and investment partners, to have timely, appropriate, and effective policy responses,” said a government report.

“It is also necessary to regularly update scenarios on growth, inflation, and major balances to increase proactivity in consulting and administration. Efforts are to be made for GDP growth of over 5 per cent in 2023.”

| Nguyen Hong Dien - Minister of Industry and Trade

The exploitation of free trade agreements (FTAs) has been welcomed by leaders at all levels, and many positive results have been achieved. The most obvious point is that in the last three years, Vietnam has been ranked as one of the 20 countries with the largest international trade scale in the world, with a high-growth rate of about 12.5 per cent or more and continuously achieving a trade surplus. In addition to the implementation of many trade agreements with wide coverage of more than 60 countries and territories, including most major economies in the world, Vietnam is also continuing to negotiate with the European Free Trade Association members of Switzerland, Norway, Iceland, and Liechtenstein. Vietnam is also preparing to negotiate with the Southern Common Market. In November, Vietnam and the UAE will likely conclude negotiations on a new trade deal. Moreover, Vietnam will continue to study the feasibility of negotiating and signing FTAs and trade incentives with a number of new potential partners and partners with complementary economies to the Vietnamese economy, as well as partners with potential in sci-tech to negotiate a new trade agreement in the near future. Secondly, Vietnam will also promote the effective implementation of international commitments within the framework of FTAs that Vietnam has participated in, ensuring sustainable development, and focusing on implementing the action programmes to implement new-generation FTAs. Thirdly, we will also promote the role of Vietnamese trade agencies abroad to capture timely information and fluctuations in the world economy as well as new policies of host countries, contributing to orientating domestic production and helping businesses build and adjust production and business plans. Finally, we will continue promoting admin reform, facilitating import and export activities, and developing e-commerce logistics services. The MoIT will coordinate with the Ministry of Agriculture and Rural Development to open export markets for fruit and crop products. We will also centre on removing technical barriers so that businesses can penetrate new potential markets. |

| Export picture enjoys benefits from restart In defiance of massive woes, Vietnam’s export-import landscape is gaining momentum on the back of the gradual recovery in domestic manufacturing and bit-by-bit reopening of many foreign markets, promising a brighter trade picture for the country this year. |

| Extending Vietnam’s export value chain via hybrid promotion Using hybrid trade promotion models, including online methods, have helped Vietnamese exporters save costs, shorten distances and time, and increase the number of accessible markets and potential customers, thereby contributing to Vietnam’s positive export performance in the past two years. Last year, Vietnam’s total export turnover reached $336.25 billion, up 19 per cent over the previous year. |

| Dynamism underlined for Vietnam’s export economy The relationship between the growth of domestic content of exports and other output growth is quite close. Balance of payments constraint and economic growth are based on numerous factors. Countries need dollars to pay for essential imports and to meet payments obligations associated with interest payments on debt and profits of foreign companies. Countries receive dollars for their net exports, profits from or interest on assets held abroad, remittances, inward investment, and foreign borrowing. |

| Acceleration of export orders help create momentum for Vietnam’s trade landscape Vietnam’s export-import landscape is beginning to regain momentum on the back of some foreign markets gradually recovering. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Carlsberg Vietnam delivers Lunar New Year support in central region (January 28, 2026 | 17:19)

- TikTok penalised $35,000 in Vietnam for consumer protection violations (January 28, 2026 | 17:15)

Tag:

Tag:

Mobile Version

Mobile Version