Fourth wave of pandemic spurs insurance demand in Vietnam

|

| The fourth wave of pandemic spurs insurance demand in Vietnam |

Accordingly, the social, economic, and health impacts of the pandemic are creating a rising demand for medical, life, and home insurance policies as more people look to protect themselves and their families from the current challenges to their lives and livelihoods.

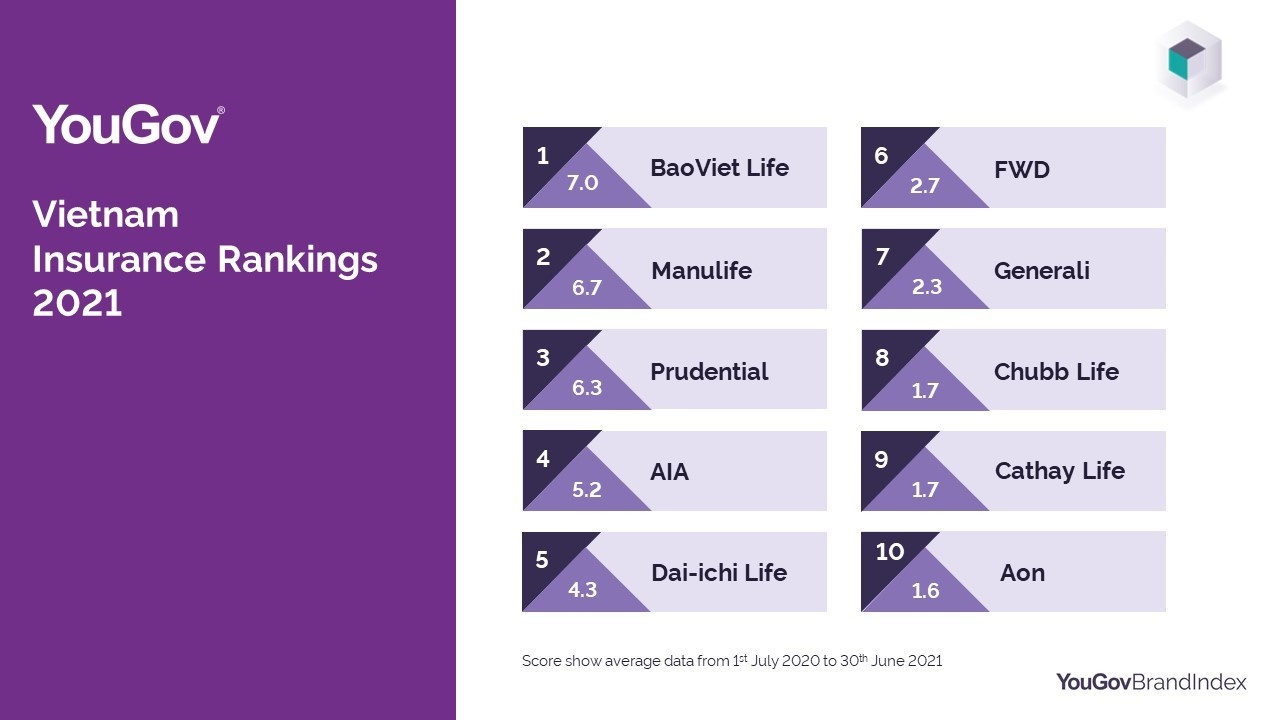

Some insurance companies are in a strong position to benefit from this new demand. The YouGov Banking & Insurance rankings found that BaoViet Life is the strongest insurance brand for Vietnamese consumers. Based on over 45,000 interviews, the rankings reveal what Vietnamese consumers think about insurance companies based on an average of six unique criteria. Each insurer is rated on its customer satisfaction, corporate reputation, value-for-money, quality, overall impression, and whether or not people would recommend it to others.

BaoViet Life topped the table with an aggregate score of 7.0. Canadian financial services provider Manulife (6.7) and US-owned Prudential (6.3) finished second and third. Meanwhile, fourth-placed AIA (5.2) and fifth-placed Dai-ichi Life (4.3) also recorded strong showings.

|

YouGov also measures changing trends in consumer sentiment, tracking which insurance providers have improved their brand health over time. On this score, the three "biggest improvers" are Dai-ichi Life (+ 1.4), Prudential (+ 1.2), and Manulife (+ 0.9).

One of the most important indicators of future brand growth is "Recommend", which measures the likelihood that customers would promote an insurer to their friends and families. On this metric, Manulife tops the table with a score of 71.5. However, despite taking the top spot, Manulife has seen the slowest growth with a rise of just 0.9 points. The accolade of most-improved goes to British-owned Aon, whose "Recommend" score rose 7.5 points between July 2020 and July 2021. That far outstripped the second-most-improved insurer, Chubb Life, whose score rose 4.3 points over the same period.

Commenting on the data, Thue Quist Thomasen, CEO of YouGov Vietnam, said that, "Private insurance has a lot of room to grow, with penetration rates in the Vietnamese market lower than other countries. However, the COVID-19 pandemic is making people reassess the importance of insurance products in challenging times.

“This is creating a potential new growth segment for insurance providers. But, as our data shows, some brands are better positioned than others in the minds of Vietnamese consumers. This highlights the importance of investing in market research and brand building to offer products and services that customers trust, value, and recommend,” he added.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Shinhan Life Vietnam builds growth on people strategy (October 07, 2025 | 09:45)

- Insurance sector initiates rapid response after Typhoon Bualoi devastation (October 03, 2025 | 18:25)

- Non-life insurers face mounting pressure after typhoon hits motor sector (October 02, 2025 | 18:59)

- Prudential Vietnam delivers responsible investment package (September 25, 2025 | 10:37)

- Insurers struggle to keep pace with EV rapid adoption (August 29, 2025 | 17:12)

- Non-life insurance market in sees bright spots in H1 despite rising challenges (August 28, 2025 | 16:21)

- Life insurance rebounds with renewed growth and trust (August 06, 2025 | 18:04)

- Global Care launches Vietnam’s first insurance KOL platform (July 25, 2025 | 09:42)

- Liberty Insurance leaves mark at 2025 Insurance Asia Awards with dual wins (July 14, 2025 | 07:27)

- New CEO takes helm at Prudential Vietnam (July 07, 2025 | 17:51)

Tag:

Tag:

Mobile Version

Mobile Version