FMCG slowdown shows market vulnerability

|

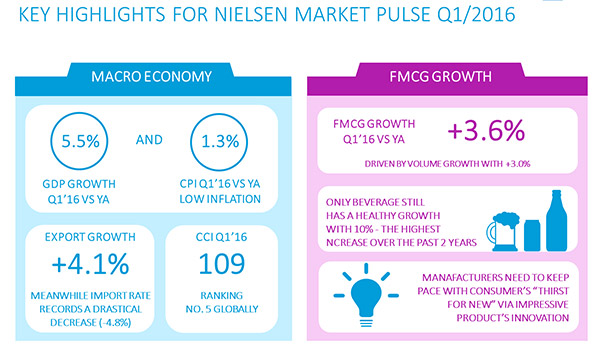

The dip mainly comes from a 3.0 per cent volume growth (against 4.9 per cent in Q4 2015), according to the quarterly Market Pulse report released by global performance measurement company Nielsen.

Of the seven super FMCG categories (beverages (including beer), food, milk based products, household care, personal care, cigarettes, and baby care), beverages continue to make the largest contribution to total FMCG sales, with 39 per cent in the first quarter of 2016, while remaining categories stagnate.

For eight quarters in a row, beverages show a healthy growth, which peaked in the first quarter of 2016 with 10 per cent. This is also the highest increase produced by the product category over the past two years, mainly led by a volume increase of 8.1 per cent.

Market Pulse Report is based on the results of Nielsen’s Retail Measurement study of the major FMCG categories. The Nielsen Retail Measurement provides continuous tracking of product movement through defined retail outlets. The data are used to measure manufacturer and retailer effort as well as consumer off-take.

“FMCG growth (in the six key cities) is 3.6 per cent, lower than the GDP growth of 5.5 per cent in the first quarter of 2016. It is believed that when consumer income reaches a certain level, consumption aspirations change. Urban consumers grow increasingly demanding in terms of quality and choice. They are looking for more innovations and new consumption experience. With lack of innovation, FMCGs are becoming basic items that consumers would still buy, but only at a sufficient level,” said Nguyen Anh Dung, Nielsen Vietnam’s director of Retail Measurement Services.

Dung added that according to the Product Innovation Report, Vietnam has the highest score for trying new products in Southeast Asia, with close to 90 per cent of Vietnamese consumers (88 per cent) saying they purchased a new product during their last grocery-shopping trip - 19 percentage points higher than the region average of 69 per cent.

This presents a sizeable challenge for manufacturers to provide true innovations for consumers. Currently, only beverage and beers can keep pace with consumer’s “thirst for new” via impressive product innovations that cater for new needs.

“Beverage and beer manufactures run several intensive marketing campaigns which create new emotional bonding and exciting emerging premium channels (beer gardens, for instance) that providea new consumption environment. More importantly, manufacturers also need to gain retailers’ support introducing new products/promotion to consumers,” said Dung.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Vietnam startup funding enters a period of capital reset (January 30, 2026 | 11:06)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- PM inspects APEC 2027 project progress in An Giang province (January 29, 2026 | 09:00)

- Vietnam among the world’s top 15 trading nations (January 28, 2026 | 17:12)

- Vietnam accelerates preparations for arbitration centre linked to new financial hub (January 28, 2026 | 17:09)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

- Digital economy takes centre stage in Vietnam’s new growth model (January 28, 2026 | 11:43)

- EU Council president to visit Vietnam amid partnership upgrade (January 28, 2026 | 11:00)

Mobile Version

Mobile Version