F&B is still a game for TOP brands

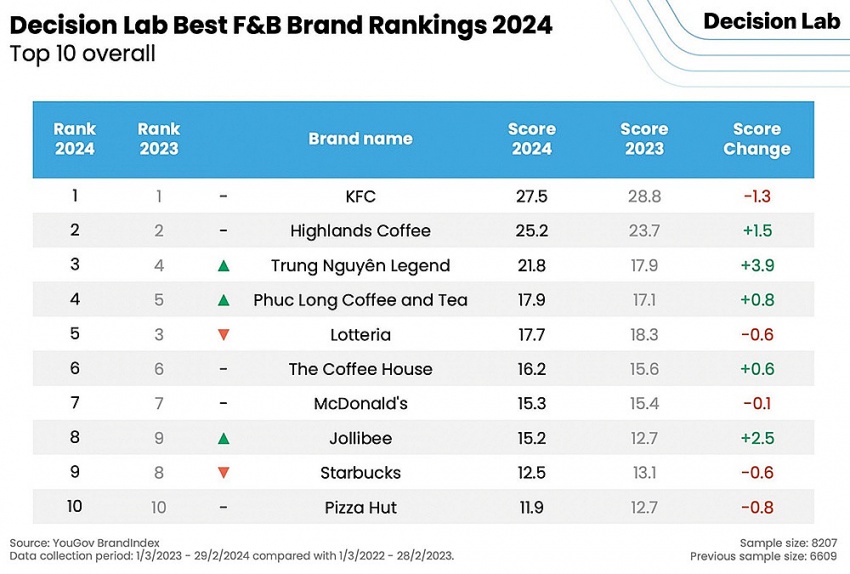

The Best F&B Rankings 2024 published by Decision Lab in early May continued to record solid rankings of food and beverage (F&B) brands such as KFC, Highlands Coffee, Phuc Long Coffee & Tea, and Jollibee.

According to the results, KFC and Highlands Coffee successfully defended the top two positions for the second consecutive years, while Trung Nguyen Legend and Jollibee recorded an increase of one place in the rankings, at ranks three and eight respectively.

Decision Lab CEO Thue Quist Thomasen said, “The rankings indicates strong brand loyalty among Vietnamese consumers. Despite some changes in their scores, the top companies remain.”

|

The rankings are calculated based on the indicators of impression, quality, value, satisfaction, recommendations, and reputation.

“The key takeaway here is the power of branding. Brands that want to grow sustainably must invest in high-quality products and services and brand reputation. This will help to build long-term brand engagement and customer loyalty,” Thomasen added.

Investing in product and service quality has become a long-term strategy for F&B businesses in the journey towards sustainable development, in parallel with promoting the expansion of restaurant and drink chains.

Sibojyoti Chatterjee, general director of KFC Vietnam, said that the brand’s goal is to maintain a pioneering position in adapting to changes and conquering customer tastes.

“We have carefully planned resources, personnel, people, and technology to adapt to the speed of the market and always listen to customers’ opinions to improve service quality,” he said.

The reason KFC can achieve a leading position in the fierce competition of the F&B industry is due to its continuous efforts to improve product and service quality, Chatterjee added.

KFC boasts more than 200 stores in Vietnam and is also one of the pioneering restaurant systems to apply technology in ordering food. The use of ordering kiosks at KFC restaurants has provided a simple, convenient, and wait-free experience for customers.

|

In addition, the American fast-food brand also develops product diversity by regularly introducing customised menus according to consumer needs including lunch menus, festival menus, and continuously creating new or trending dishes.

In a similar vein, Philippine fried chicken brand Jollibee prioritises diversifying its menu and providing customers with satisfying culinary experiences. Jollibee owned about 170 stores in Vietnam by the end of last year. Although specific business figures have not been announced, the company said that it continues to achieve double-digit sales growth throughout the system and at each store.

Lam Hong Nguyen, general manager at Jollibee, commented, “This achievement reflects our dedication to providing delicious, high-quality food experiences that resonate with Vietnamese consumers. We’re committed to continuous innovation and growth, and we look forward to serving Vietnam for many years to come.”

According to a report published by iPOS.vn in April, the market value of the F&B industry this year is expected to reach more than $27.3 billion, an increase of 10.9 per cent compared to 2023. However, the growth between the two fields of food and beverages is distinctive.

While the dine-in market contributed the vast majority of revenues of the entire industry in 2023, the beverage market in Vietnam has recorded more modest revenue at a time when a series of beverage chains have conducted restructuring of business strategies to achieve goals more effectively.

“2024 will witness the strong development of small- and medium-sized beverage models,” iPOS.vn’s report noted. “These stores were opened to meet criteria of moderate investment costs, convenient store location, being suitable for take-away and delivery, and product prices in the mid-range segments.”

Brands such as Phuc Long Coffee & Tea and Starbucks last year began eliminating ineffective business branches and diversifying models and products to optimise profits at each point of sale.

Starbucks successfully opened store number 107 in Vietnam last month, continuing its expansion strategy and increasing the presence of this beverage brand. The American beverage chain also continuously adds seasonal and hot trend drinks, such as salted coffee, to the menu to attract more customers.

At the end of last year, Starbucks Vietnam witnessed the transfer of the CEO role from Patricia Marques, who made an important contribution to the brand’s development for 10 years in Vietnam, to Mai Ho, a Vietnamese national with experience in both the retail and fast-moving consumer goods spheres.

Mai Ho said, “I had a strong impression of Starbucks’ development before joining it, and want to bring more new experiences to customers in the following years.”

Meanwhile, Phuc Long Coffee & Tea has started to scale back its previous kiosk model after two years of extensive expansion, reaching a peak of 760 kiosks. They are now returning to their flagship model, with 44 newly opened stores last year.

According to Phuc Long CEO Joanne Jihyun Lee, the brand has reached maturity in a saturated market and is now strategising for the next phase of growth amidst increasing competition from new market entrants.

In Q1, Phuc Long began opening new stores and optimising the customer experience with a focus on sustainability and efficiency.

“Phuc Long has plans to go global after gathering consumer insights through its two stores in the United States. The company is taking steps and implementing innovative initiatives to expand its network in Vietnam while also venturing into other countries worldwide,” noted Lee.

According to projections from parent company Masan Group, the Phuc Long chain is expected to generate revenues in the range of $74-90 million, representing a growth rate of 17-40 per cent compared to 2023.

Last year, F&B industry revenue grew by nearly 11.5 per cent, reaching over $23.6 billion. Specifically, the dining market contributed $21.6 billion, representing a 10.9 per cent increase compared to 2022.

Vietnam’s food service market is expected to record an impressive annual compound growth rate of 9.7 per cent and reach a scale of about $36.86 billion by 2027, according to data released in February by Research and Markets.

| F&B prioritising green development moves Dedicating more resources to research and development of greener products is being called essential for food and beverage businesses. |

| F&B titans injecting new cash for facilities The domestic food and beverage industry remains one of the most attractive segments in Vietnam, with local and foreign companies beefing up investment. |

| GEA Procomac's technology has transformed the F&B industry The number of resources consumed by countries is increasing, causing their depletion and a decline in quality of life. As a result, many countries are shifting to a circular economic model with sustainable production that restores, regenerates, and gradually reduces the number of resources exploited and limits emissions. |

| F&B still attractive for players old and new The food and beverages market in 2024 is expected to become more competitive, with the appearance of a number of foreign brands and the rankings of domestic brands ever-changing. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Dong Ho folk painting added to UNESCO’s urgent safeguarding list (December 11, 2025 | 18:09)

- Conference focuses on switch from dog and cat meat trade to sustainable, safe jobs (December 11, 2025 | 12:13)

- 3F Plus clean pork amazes Michelin-starred chefs (December 09, 2025 | 12:15)

- The Rhythm of Blues – Colours of the Year 2026 (December 06, 2025 | 12:10)

- Pan Pacific Hanoi kicks off 2026 art awards celebrating young and disabled artists (November 06, 2025 | 18:25)

- PREP AI Language Fair 2025 highlights AI-powered language learning (November 03, 2025 | 09:00)

- Hanoi strengthens rabies control and supports transition of dog and cat meat trade (October 28, 2025 | 18:09)

- World-famous Gaia Earth installation touches down at UNIS Hanoi (October 07, 2025 | 13:40)

- Sidecar passion drives Vietnamese motor enthusiasts wild (September 05, 2025 | 09:00)

- Sheraton Saigon unveils artistic mooncake collection for 2025 (August 08, 2025 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version