Emerging markets venture into MES

DKSH and Roland Berger examined the growing strength of companies in emerging markets,

and how they are rising to the global challenge

The Global Market Expansion Services report, published last week, highlighted the influence of emerging market players and provided insights into market expansion services providers and their clients.

Continued globalisation is challenging companies to optimise the utilisation of resources and focus on their core competencies. This constellation has given rise to a breed of specialist companies: Market Expansion Services (MES) providers. These providers help multinationals and small-to-medium-sized enterprises reduce costs by outsourcing non-core activities, improve revenues and increase market shares.

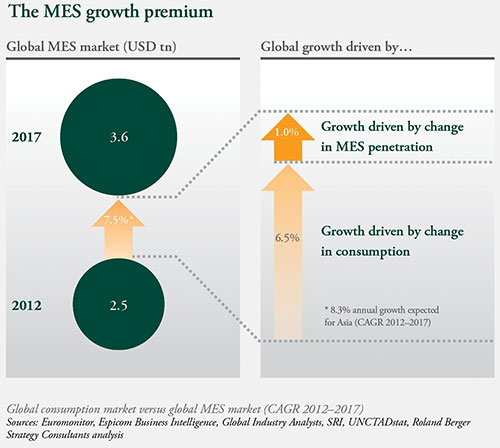

According to the report, the MES industry took in $2.5 trillion last year, an increase of more than $300 billion in terms of transaction value in the past two years alone. This growth is expected to continue until 2017, when the forecast volume will stand at $3.6 trillion, an indication that the global MES market is outperforming the global consumption market by 1 per cent per annum. Strong growth, forecast through 2017, will drive the Asia Pacific MES market up to a total volume of roughly $1.1 trillion, making it by far the largest such market in the world.

In Asia over the past five years, the top ten emerging market players have grown at an annual rate of 22 per cent, almost four times faster than the 6 per cent annual growth of the world’s top ten developed market players. At the same time, many emerging market players have realised they can partner with MES providers for even greater success in their expansion into new markets.

The authors explained that as Western developed market players were facing saturated home markets and seeking new growth opportunities, emerging market players were proving formidable competitors on a playing field that increasingly favours them. Their advantages include established local networks, knowledge of, and an affinity for, local customs and habits, and the flexibility to adapt quickly to a dynamic environment.

Based on the authors’ survey of around 250 emerging market players, the six types of players are growth speeders, cost cutters, efficient expanders, innovative expanders, international networkers and regional contenders.

In terms of the market expansion readiness index across Asia Pacific, the report identified four groups of economies - Globalisers, Expanders, Explorers and Scouts. Vietnam ranked fourth in the Explorers group with an index of 53. Within the same group, Thailand topped with 65, followed by New Zealand (64) and India (57). Indonesia (50) also joined the group. The Philippines, Cambodia, Sri Lanka, Myanmar and Laos were grouped as Scouts.

The report highlighted how emerging market players from not yet highly developed economies such as Laos and Cambodia are still primarily focused on satisfying local demand. By contrast, companies from more mature economies such as Malaysia and China are often internationally active and expanding both within Asia and further afield.

The demand for MES providers’ expertise is growing among emerging market players as their focus turned to growth and efficiency, said the report. Emerging market players in Asia are primarily looking for providers that offer strong corporate governance, integrity of the value chain, and the ability to provide market feedback.

Dr. Martin Wittig, chairman of Roland Berger Strategy Consultants Switzerland, said: “MES are gaining popularity because they allow companies to implement a market expansion approach that combines quick market access with the asset-light business model found in the export model, plus the proximity to target customers.”

Dr. Joerg Wolle, president and CEO of DKSH, commented: “I strongly believe that DKSH has the ability to meet the increasing demand for MES throughout Asia, a region home to diverse cultures, languages, business traditions and legal systems.”

DKSH is a leading MES provider that focuses on Asia, helping other companies and brands to growth their business in new or existing markets. Roland Berger is a top strategy consultancy that advises major international industry and service companies as well as public institutions.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Carlsberg Vietnam delivers Lunar New Year support in central region (January 28, 2026 | 17:19)

- TikTok penalised $35,000 in Vietnam for consumer protection violations (January 28, 2026 | 17:15)

Mobile Version

Mobile Version