E-payments head for a boom

|

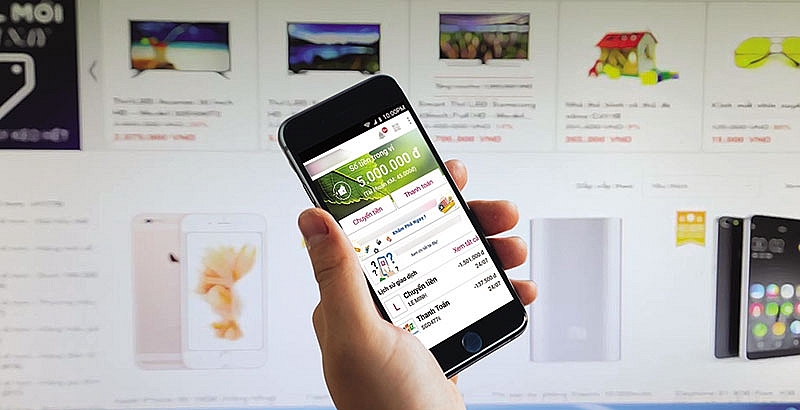

| The growth of e-payments in Vietnam is enabling the rapid proliferation of e-commerce platform in the country, Photo: Dung Minh |

E-commerce grows like grass

Browsing Tiki.vn for sun block on an extremely hot summer’s day in Hanoi has never been so easy and convenient. With just a few clicks of a button and the useful debit or credit card on the side, everything is done and the sun block is on its way to the buyer’s address in less than a day. It is the combined power of e-commerce and e-payments, with transactions completed entirely through smart devices that are replacing the traditional shopping experience.

The shift from bricks to clicks, as Visa stressed in its report entitled ‘Rise of the digitally engaged consumer’ that incorporating the 4th annual Visa Consumer Payment Attitudes Survey conducted last July-August in Southeast Asia, is fundamentally driven by two key factors, namely innovation and changing consumer experience. “Technology advances have hastened the innovation process and as a result, consumers have higher expectations when it comes to experience,” the report highlighted.

The 2017 Visa Consumer Payment Attitudes Survey (based on a sample size of 4,160 consumers, including 517 from Vietnam, representing the online populations of seven Southeast Asia economies) showed that 78 per cent of respondents in the region and 84 per cent of Vietnamese respondents, in particular, shopped online at least once a month.

According to Statista, Vietnam had around 35.4 million e-commerce users out of a total population of over 90 million in 2017. In 2018, the number of e-commerce users is forecast to reach 37.3 million. By 2021, it could go up to 42 million, representing 58 per cent of the country’s total population. On average, a user spent $62 online in 2017 and the amount is anticipated to rise to $96 by 2021.

Statista also revealed that total revenue of the local e-commerce market was estimated at some $2.2 billion in 2017, with a compound annual growth rate for the period of 2018-2022 of 13.5 per cent, resulting in market volume estimated at $4.54 billion by 2022.

These figures speak for the solid enlargement of the e-commerce market in Vietnam at present, with ample room for additional growth of the sector, thanks to the nation’s demographic golden age, growing middle class, and intensifying internet and mobile phone adoption.

Online shopping platform Lazada Vietnam, whilst remarking that the local e-commerce market is still in the early stages of development with multiple challenges to overcome, said that it has recorded a growing number of customers on a daily basis. Such promising records are regarded as the impetus for its future growth strategy.

“With the investment of Alibaba, Lazada is able to provide more products and services and expand our logistics services to serve customers all over the country. Ever since, Lazada has attracted more and more customers every day, now reaching more than 31 million visits every month,” said Lazada customer care officer Vu Ngoc Lam.

“From our perspective, there are three particular elements that are driving our company strategy: a massive number of customer contacts, government policies for e-commerce sellers, and a desire to build a better customer experience.”

Hello e-payment

The rise of e-commerce, ideally, would not rely on cash, but pair up perfectly with e-payments, though this does not always necessarily happen in reality.

While Vietnam is reportedly still heavily dependant on cash, the country’s usage rate of device-initiated payment or e-payments is the highest amongst its neighbouring countries at 91 per cent, as per the Visa Consumer Payment Attitudes Survey.

“The availability of smart devices has empowered consumers to demand for things “right here and right now”. Anything less than that is increasingly perceived as a flaw,” read the Visa report.

According to Visa, increased connectivity, coupled with new payment methods and form factors, has transformed consumer experience in commerce. The introduction of various payment solutions such as Visa contactless payments, Visa Checkout, and Visa Token Service have transformed the way consumers conduct their daily lives – from shopping and booking a taxi to ordering and paying for food in a variety of restaurants.

“These technologies have enabled consumers to perform device-initiated payments anywhere, at any time, with their smartphones, and are fast becoming the norm as consumers forego cash for a more seamless, reliable, and secure mode of payment,” said Visa.

Meanwhile, according to Harmander Mahal, head of retail banking at Standard Chartered Bank (Vietnam), the enlargement of e-commerce in Vietnam is paving the way for development of e-payments.

“I think e-commerce/card-not-present (CNP) platforms are the biggest engine of growth for electronic payments in Vietnam, driven by very high smartphone and mobile device penetration and one of the highest per-capita time spend on social media in Southeast Asia,” said Mahal.

With clients are increasingly looking to mobile payment solutions and Standard Chartered is very active in this space, the UK-backed lender, as Mahal noted, have partnered with leading local e-commerce merchants like Lazada, Tiki, Agoda, Adayroi, Shoppe.vn, and more to bring attractive offers to their Vietnamese clients.

“We have also partnered with international e-commerce merchants through our global network to create a specific e-commerce proposition for our credit and debit cards holders,” Mahal said. “Today, more than 50 per cent of our card transactions are CNP transactions, which helps us to deliver superior client experience and drive business growth.”

Commenting on the payment ecosystem in Vietnam, Mahal said that it is developing at an accelerated pace both at the issuing and the acquiring end.

He told VIR that while there is a proliferation of payment methods and apps, there is some amount of consolidation that is happening globally. “There are faster inter-operable platforms being driven by regulators, there are global EMVCO QR code payments, and then there are scheme-based (Visa/Master) card payments that can be done offline and online. The payment apps apply to different use cases and improve client experiences.”

Referring to retail payments, Mahal noted that there is much innovation happening everywhere. One big shift happening globally is the evolution of faster payments, which is not only enabling 24/7, instant, domestic peer-to-peer (P2P), person-to-merchant (P2M), business-to-business (B2B), and business-to-consumer (B2C) payments, but, as automated clearing houses (ACHs) get faster, this also makes international payments much faster as banks use International ACH as a mode of moving money across borders.

Contactless payments, he noted, are expanding, as they enable fast P2M transactions. Transit payments are looking at moving from closed loops to open standards with existing payment methods like cards, emulating developments in the UK and Singapore. The original equipment manufacturer (OEM) and large local wallets will expand to promote mobile payments. Payments, Mahal said, are a means to an end and everybody wants a share of the transactions as part of the larger ecosystem between individuals, merchants, and businesses.

| Sean Preston, Visa country manager for Vietnam, Cambodia, and Laos

The development of e-commerce and e-payment on the horizon can provide a great deal of benefits for the country, with potentially a reduced reliance on cash. Our “Cashless Cities: Realizing the Benefits of Digital Payments” identifies the immediate and long-term benefits for three main groups, including consumers, businesses and governments, through reducing the reliance on cash. Accordinly, these benefits could add up to combined direct net benefits of approximately $470 billion across the 100 cities that were analyzed. Consumers across the 100 cities could achieve nearly $28 billion per year in estimated direct net benefits. This impact would be derived from factors including up to 3.2 billion hours in time savings conducting banking, retail and transit transactions, in addition to a reduction in cash-related crime. Businesses across the 100 cities could achieve more than $312 billion per year in estimated direct benefits. This impact would derived from factors including up to 3.1 billion hours in time savings processing incoming and outgoing payments and increased sales revenues stemming from extended online and in-store customer bases. The study also found that accepting cash and checks costs businesses 7.1 cents of every dollar received compared to 5 cents of every dollar collected from digital sources. Governments across the 100 cities could achieve nearly $130 billion per year in estimated direct benefits. This impact would be derived from factors including increased tax revenues, increased economic growth, cost savings from administrative efficiencies and lower criminal justice costs due to reduced cash-related crime. While Vietnam is still a heavily cash-oriented society, we’re seeing very positive moves across the board from consumers, merchants, and the government, with attitudes towards electronic payments now better than ever before. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VIB named Best Customer Satisfaction Bank in Vietnam 2025 (December 26, 2025 | 16:40)

- Visa and Techcombank win AmCham’s 2025 ESG Tech Innovation Award for Eco Card (December 09, 2025 | 12:16)

- Visa brings tap-to-ride payments to Hanoi Metro Line 2A (December 05, 2025 | 17:35)

- Cross-border QR payments launched for Chinese tourists (December 03, 2025 | 19:12)

- VIB honoured by JP Morgan with 2025 US Dollar Clearing Elite Quality Recognition Award (December 02, 2025 | 17:04)

- Home Credit Vietnam brings financial literacy closer to women and students (November 20, 2025 | 11:25)

- MB partners with Visa, KOTRA to launch new MB Visa Hi BIZ card (November 20, 2025 | 11:24)

- VPBank upgrades core banking with Temenos and Systems Limited (November 14, 2025 | 17:54)

- CPO Home Credit shares how to build an AI-driven but human-centric workplace (October 30, 2025 | 09:56)

- VIB hits $267.4 million in pre-tax profit over first nine months (October 29, 2025 | 12:12)

Tag:

Tag:

Mobile Version

Mobile Version