Cashless payments in Vietnam open for a bright future of retail

According to Dung Dang, Visa country manager for Vietnam and Laos, Visa remains committed to driving innovation and enhancing digital payment experiences for consumers.

| The findings from the CPA study validate the growing trend towards contactless transactions, exemplified by a significant 53 per cent increase in contactless transactions made on Visa cards, a 19 per cent surge in purchases made on Visa cards, along with a substantial rise in the total value of cross-border transactions underscores the region's increasing connectivity and economic activity. |

She added that as Visa continues to collaborate with partners and stakeholders, it is dedicated to further advancing digital payment solutions and delivering seamless, secure experiences for consumers.

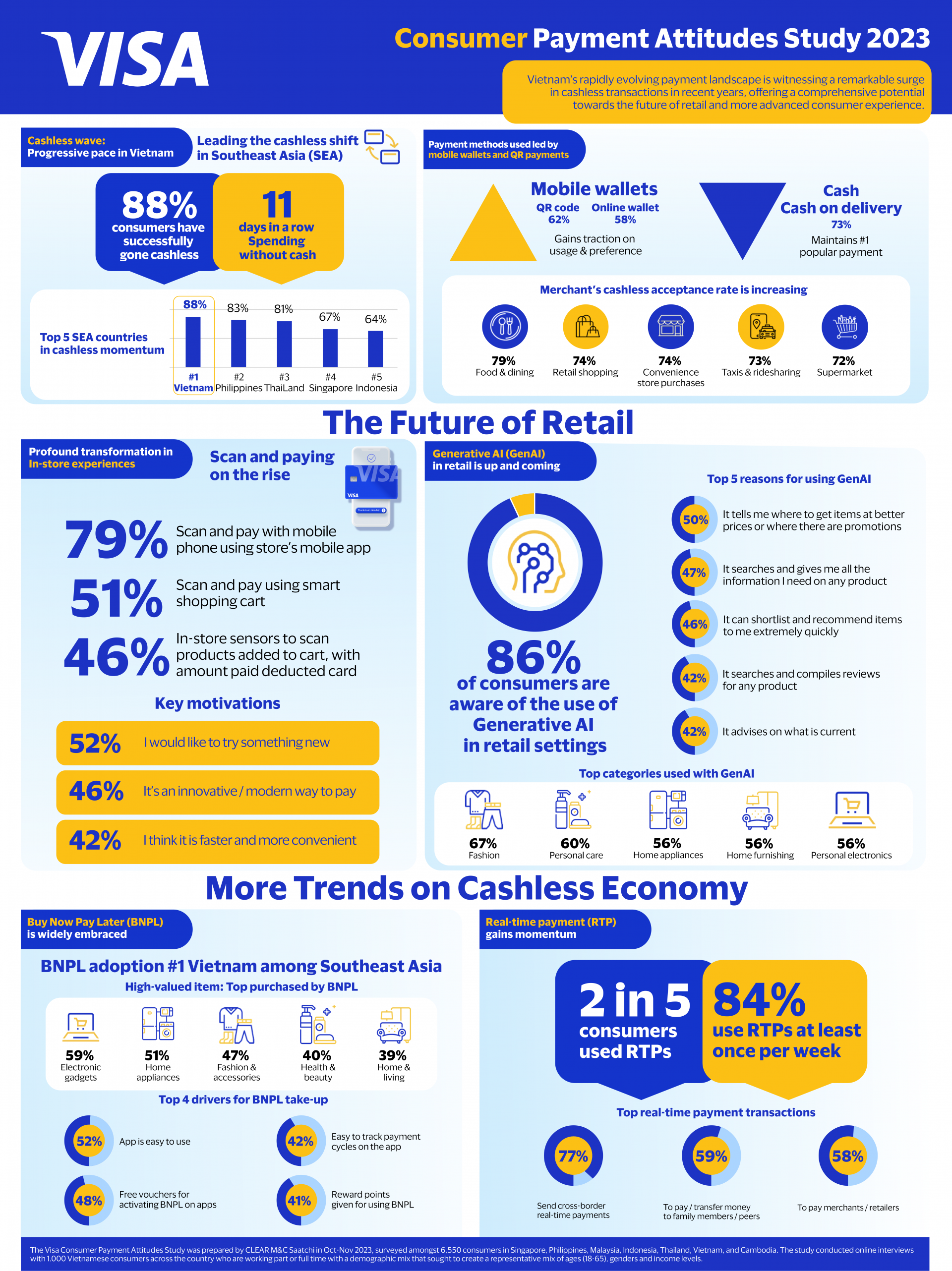

Visa's report delves into the prevailing trends shaping Vietnam's cashless economy, shedding light on key developments that are reshaping the financial landscape of mobile wallets, real-time payments, and buy-now-pay-later.

Vietnam is among the top Southeast Asian markets for the adoption of mobile wallets as the preferred method of making payments, and is poised to accelerate the growth of digital finance.

At least four in every five Vietnamese consumers utilise mobile wallets, primarily influenced by Gen X and more affluent consumers, Vietnam is poised to emerge as one of the regional leaders in mobile finance.

Meanwhile, the adoption of real-time payment solutions has gained significant momentum in Vietnam, underscoring the nation's embrace of cutting-edge financial technologies.

Real-time payments (RTPs) offer unparalleled convenience and efficiency, driving further digitisation of the economy.

In Vietnam, RTPs are growing in popularity, with at least two in five consumers having used them. Use cases for RTPs are slowly diversifying, and now include cross-border transactions, peer-to-peer transfers, merchant/retailer payments, and bill payments.

Buy-now-pay later (BNPL) is a popular service availed by Vietnamese consumers, offering flexible payment options and driving consumer engagement.

Visa has partnered with leading Vietnamese retailers for Visa Instalment Solutions to demonstrate the transformative impact of such solutions in fostering financial inclusion and driving business growth.

Credit cards, although less utilised for wallet top-ups and funding, are the preferred choice for BNPL plans in Vietnam. Easy to use apps, free vouchers, rewards points, and the ease of tracking payments were the key drivers for the uptake of BNPL offers.

Vietnam's cashless payment revolution presents unprecedented opportunities for economic growth and innovation, unlocking opportunities for consumers and businesses alike in the continued shift to a cashless society.

As consumers and merchants embrace the convenience and security of digital transactions, Visa remains at the forefront of driving this transformative journey towards a cashless future.

The acceptance of cashless payments by merchants, particularly mobile wallet payments, is increasing, especially in categories such as food and dining, retail shopping, and convenience store purchases. In-store commerce experiences are undergoing a profound transformation, with merchants increasingly using generative AI technologies to enhance customer engagement and drive sales.

Visa empowers merchants to thrive in an increasingly digital marketplace that saw more than 275 billion Visa-enabled transactions made worldwide last year.

|

| Vietnam grapples with challenges in cashless payments The evolution of cashless payments in Vietnam came under the spotlight at a recent conference convened by the Institute for Digital Economy Strategy (IDS) in Ho Chi Minh City. The seminar aimed to analyse the existing legislative landscape, identify barriers to advancement, and propose potential regulatory enhancements to bolster cashless transactions. |

| Cashless payments in e-commerce to account for 50 per cent by 2025 The Ministry of Industry and Trade (MoIT) has set a target to increase the cashless payment ratio in e-commerce, especially e-payments through payment intermediaries or applications, to 50 per cent by 2025. |

| Cashless society ambitions offered a helping hand Vietnam is swiftly revolutionising its financial sector by phasing out outdated card technologies, embracing non-cash solutions, and enacting laws to enhance security. |

| Cashless payments surge by over 63 per cent Non-cash payment transactions increased by 63.3 per cent in volume and 41.45 per cent in value in January, compared to the same period last year, the State Bank of Vietnam (SBV) has announced. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Visa launches card-based trade payment platform (January 08, 2026 | 09:14)

- Corporate Excellence Award affirms VIB’s leadership in sustainable retail banking (December 30, 2025 | 16:03)

- VIB named Best Customer Satisfaction Bank in Vietnam 2025 (December 26, 2025 | 16:40)

- Visa and Techcombank win AmCham’s 2025 ESG Tech Innovation Award for Eco Card (December 09, 2025 | 12:16)

- Visa brings tap-to-ride payments to Hanoi Metro Line 2A (December 05, 2025 | 17:35)

- Cross-border QR payments launched for Chinese tourists (December 03, 2025 | 19:12)

- VIB honoured by JP Morgan with 2025 US Dollar Clearing Elite Quality Recognition Award (December 02, 2025 | 17:04)

- Home Credit Vietnam brings financial literacy closer to women and students (November 20, 2025 | 11:25)

- MB partners with Visa, KOTRA to launch new MB Visa Hi BIZ card (November 20, 2025 | 11:24)

- VPBank upgrades core banking with Temenos and Systems Limited (November 14, 2025 | 17:54)

Tag:

Tag:

Mobile Version

Mobile Version