An agile approach to data analytics

|

| By Pham Do Nhat Vinh - Director, Consulting Services KPMG Vietnam |

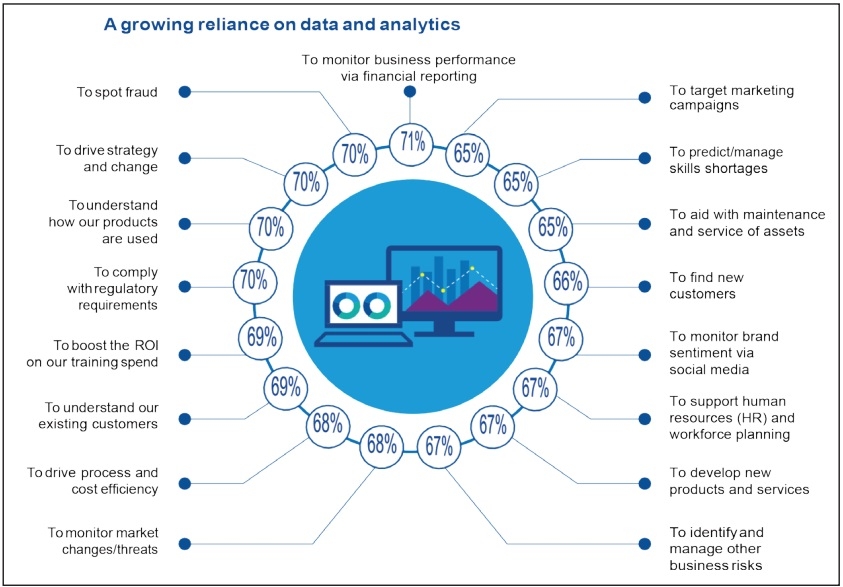

Financial entities in Vietnam have explored these techniques in customer acquisition, smart lending, marketing campaigns, debt collection, fraud monitoring, and development of intelligent dashboards. Terms such as big data, AI, and machine learning are mentioned as methods that banks need to invest in order to enhance their competitiveness ahead.

Everyone would think that the traditional analytical methods are outdated and sooner replaced by modern, advanced techniques.

However, we may need to take a closer look at the current level of trust about the results obtained from data and analytics (D&A) in banks. Does the advantage of advanced techniques satisfy the bank’s expectation? Does investment for a “big bang” approach justify the realised business benefit?

To discover more, we can look at recent survey results with senior executives of many global financial entities, with participation of more than 2,000 organisations and from our practical experiences from working with many clients.

Key pain-points

Our research shows that bank executives are frustrated with how long it takes to get useful insights from big data analytics and AI, and they are also not confident in the results received. They do not think that they get the meaningful insights as they would expect. In many cases, it takes too much waiting to get the results and when they do, they struggle to find meaning. Consequently, business leaders lose faith in advanced analytics, creating a bigger gap of trust and leading them to go back to traditional methods.

In a survey, about 60 per cent of organisations share that they are not really confident in the results from D&A. Only about 10 per cent believe they are already at the D&A quality management level. Only 13 per cent of organisations say they have control over privacy and ethical issues when using data analytics, and only 16 per cent say they have ensured the accuracy of their analytics models.

From many conversations with clients, we have found that one of the reasons that bank leaders feel reluctant to provide resources for D&A is because they do not feel certain about the reliability of data. In some cases, they are not sure whether to trust the capability of the people performing the analysis. Moreover, another significant challenge is that some really advanced techniques by definition are like black boxes. This leads to a situation where they are forced to believe that these analytical tools will work where in fact they are not sure how it works. This contributes to the reason why 70 per cent of the surveyed organisations say that using D&A will expose them to reputational risks such as data regulation breaches, data privacy, and mis-selling of products/services.

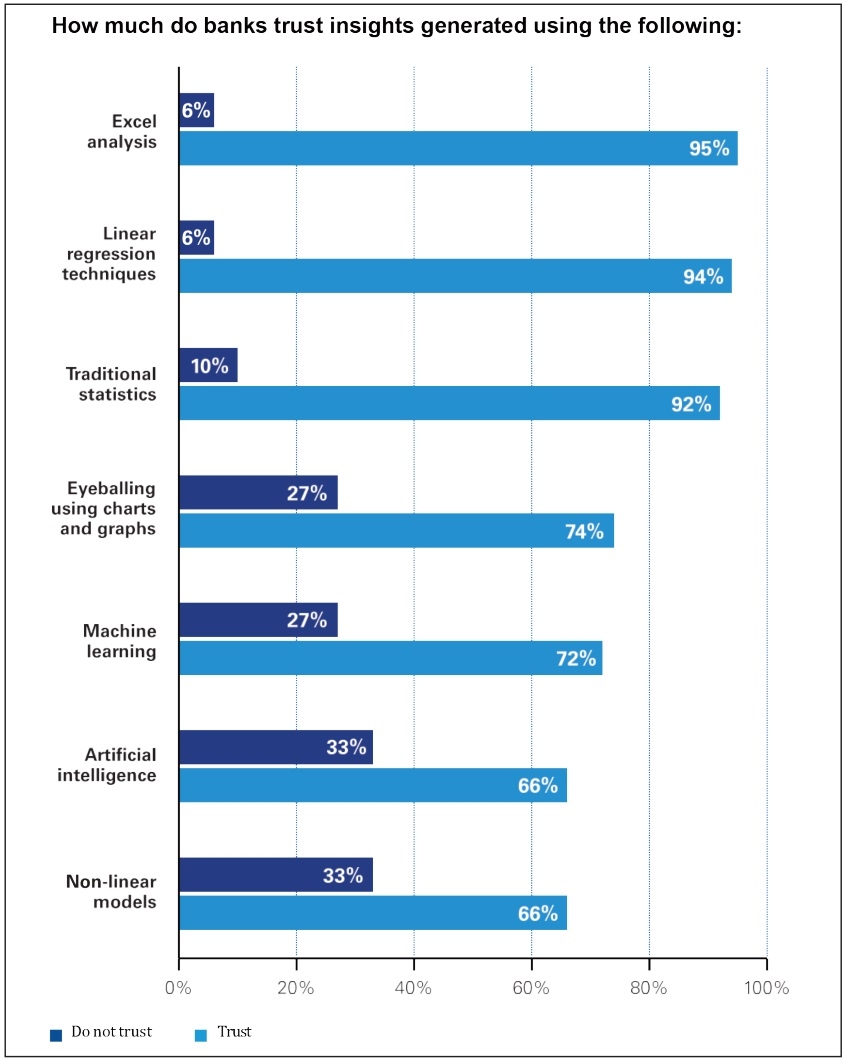

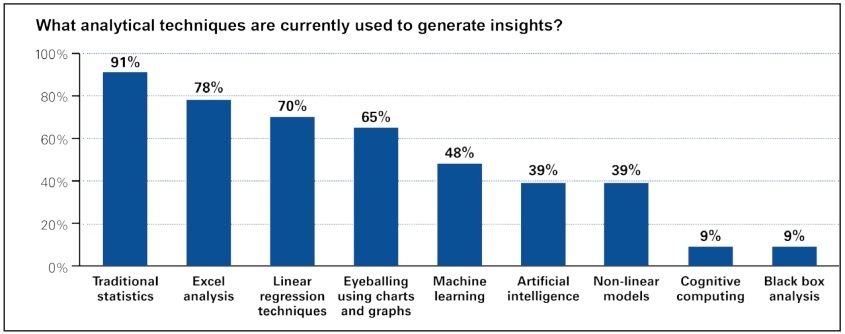

Similarly, in our recent survey with 20 banks in the United States, we found that respondents had little confidence in advanced analytical techniques such as AI and machine learning. The methods in which respondents expressed confidence were Excel spreadsheets and traditional statistical techniques such as correlation and regression. Around 65 per cent say they eyeball charts and graphs to discern characteristics and trends. Perhaps the biggest frustration for banking executives is how long it takes to gain insights from D&A. Almost half (48 per cent) of the respondents said it took more than four months to turn an initial analytical idea into actionable insights.

When asked about the trade-off between speed and accuracy, 90 per cent of respondents said they would rather have an analysis in six weeks with 90 per cent accuracy than wait six months for one with accuracy of 95 per cent — or one year for 99.99 per cent.

|

|

|

|

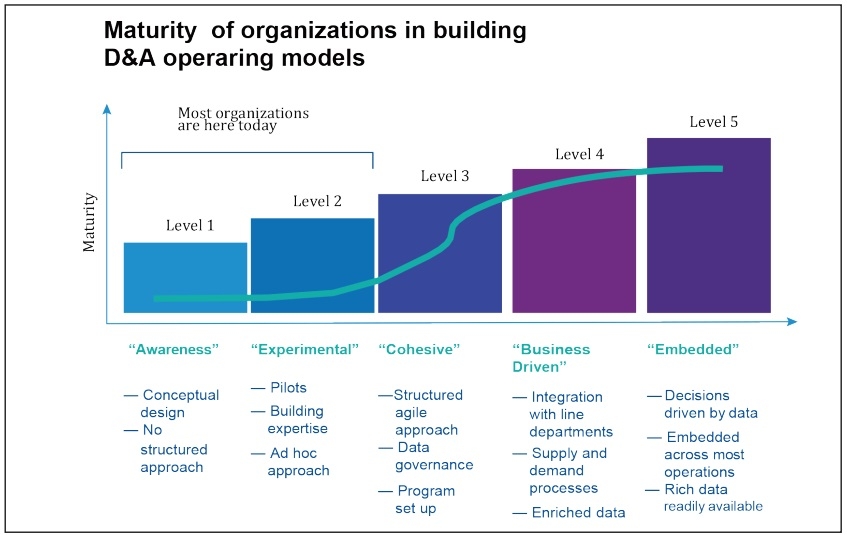

Effective operating models

To develop confidence in new methods and set reasonable expectations, executives and other decision-makers first need to be equipped with basic understanding of new techniques and learn about how the technology works.

Some organisations arrange D&A work spread out in different departments; others rely on a number of specialised separate experts and work in a silo-mode. This approach causes systemic problems because it creates a barrier that hinders D&A officers from building a partnership with the business department, making it difficult to deliver valuable insights for the organisation. In addition, over-reliance on IT tools with rigid structures will not create a flexible environment to implement projects smoothly and effectively.

The D&A department needs to be designed in a way that ensures that it is a collection of staff with IT and data science skills, working in close conjunction with the business units so that they can launch initiatives serving the business and strategic purposes of the organisation. With this structure, the trust gap will be gradually narrowed as leaders get more reliable results to make important decisions.

There are many different models of D&A operation, but in general, they can be put into three main groups:

- Centralisation: Advanced analytics and periodic reports are created by a centralised unit and shared for business units to use;

- Local: Analytics and reports are performed by the business units and supported by a central unit; and

- Hybrid: A mix of both – D&A is located in the business units, while the periodic reports and support are provided by a centralised department.

At the start of forming a D&A function, banks should provide options for stakeholders to evaluate and test results. Evaluate the effectiveness and practicality of each option before a final decision.

A pragmatic and agile approach

Not all problems require big D&A projects. By using smaller data sets and agile approaches, banks can get the answers they need to act in time – while they continue to develop their advanced capabilities. In an effort to build robust operations, companies have created expensive and overly complex systems that simpler solutions can replace. This “crack a nut with a sledgehammer” approach will cause more frustration and costs than the benefit it brings.

The truth is that complex problems do not always require complex technological solutions. In our experience, with an agile and simple approach, companies can still gain deep insights that can support faster decision-making. Instead of going with a big bang approach, start with a single business case/issue and scale up later.

Start with using smaller data sets and traditional analytical methods. Feel comfortable with 90 per cent confidence. Assemble flexible teams to tackle problems in a few weeks, not months. With this agile approach, projects are divided into short, intensive work phases and they are completed faster and with higher quality than traditional “waterfall” methods that strive to deliver a massive finishing result. Using an agile approach by approaching data analytics in a different way – smaller, more agile, faster, and scalable – banks can gain the benefits of advanced analytics in much shorter period of time.

It is clear that in a strong digital transformation trend, banks understand that they need the insights that might require use of advanced methods. However, they do not always have enough time to wait until these methods yield results. To stay on track and strengthen their competitive edge, we recommend that banks focus on agile and small analytics projects.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- KPMG launches tariff modeller in Vietnam to navigate US tariff risks (July 29, 2025 | 12:11)

- Removing hidden barriers to unlock ASEAN trade (June 29, 2025 | 11:31)

- New report charts path for Vietnam’s clinical trial growth (May 21, 2025 | 08:58)

- TTC Agris strengthens market position with investment in Bien Hoa Consumer JSC (May 19, 2025 | 10:14)

- World Bank to help SBV build shared database for banking industry (April 09, 2025 | 08:55)

- New trade alliances and investment hubs are redefining global power dynamics (April 03, 2025 | 17:00)

- ACCA and KPMG forge path for business leaders to pioneer ESG excellence (March 07, 2025 | 10:09)

- VietBank signs MoU with KPMG (February 26, 2025 | 18:47)

- Warrick Cleine MBE: an honour for services to British trade and investment in Vietnam (December 31, 2024 | 20:16)

- KPMG report offers fresh insight into leveraging AI (December 24, 2024 | 09:23)

Tag:

Tag:

Mobile Version

Mobile Version