Ample room for M&A activity

|

| Ample room for M&A activity |

The outlook

According to Vietnam M&A Forum (MAF), the value of mergers and acquisitions (M&A) in Vietnam in 2018 is forecast to weaken, to settle at around 58.8 per cent of the $10.2 billion achieved last year.

|

This is in part because the country does not anticipate any multi-billion-dollar deals like 2017’s Sabeco stake sale. The local M&A market this year could anticipate a growth rate of 15.3 per cent on-year.

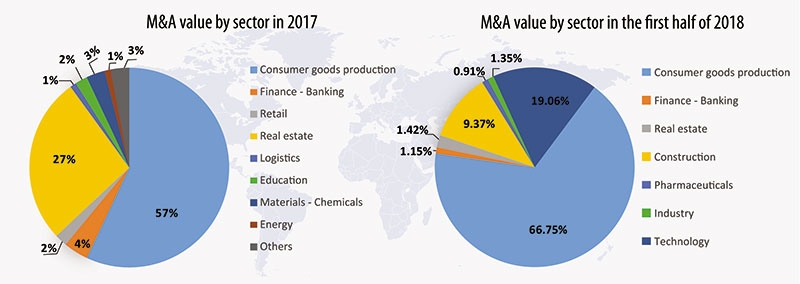

As MAF suggested, the sectors of consumer goods, retail, and real estate will continue to be magnets for M&A activities. Telecommunications, energy, infrastructure, pharmaceuticals, and education are the other areas that could also contribute significantly towards the total M&A value for Vietnam in 2018 and subsequent years.

In the first half of 2018, the value of M&A transactions has been reported at $4.1 billion, up 82.4 per cent on-year.

In 2017, Vietnam achieved a record-high M&A volume, posting a growth of 175 per cent on-year. The sudden surge was attributed to the $5 billion deal between ThaiBev and state-owned Sabeco, in which ThaiBev acquired over 53 per cent of stakes in the Vietnamese brewer.

“Many observers, however, said that the success of the Sabeco deal would not necessarily carry optimism to the entire market. By leaving Sabeco out of the big picture, the scale of the local M&A market would be deemed relatively modest, with the lingering constraints and drawbacks identified in recent years,” said the MAF’s report.

|

| Ample room for M&A activity, illustration photo - source: internet |

To-do list

Accounting for only 0.1 per cent of global M&A transactions, Vietnam has room for more M&A activities to take place in future, should the country and local enterprises make efforts to overcome the current obstacles, which include the quality of business, the foreign ownership limit, financial transparency, and value appraisal.

|

The scale of local enterprises, which often sits in the range of $5-10 million in chartered capital, is a disadvantage, with many investors instead looking for mid- to large-scale businesses to merge with or take over.

Although Vietnam is pushing for the equitisation of state-owned enterprises (SOEs), the percentage of divestment is said to be not sufficiently appealing to foreign investors, who are looking to acquire controlling stakes in those SOEs. This same scenario has also occurred at numerous private companies, where the owners still want to retain veto powers in the business.

Transparency in financial reporting and information disclosure is another area that local enterprises should pay attention to. With dual book-keeping schemes seen at various Vietnamese businesses, foreign investors are reluctant to trust the accounting information given.

The appraisal practice is another key feature that may deter foreign investors from considering M&As with local firms. Many Vietnamese enterprises tend to overvalue their business in a bid to sell it for a high price, resulting in parties not being able to agree on a fair price.

Despite such limitations, the trend of M&A activities in 2018, according to Michael Piro, chief operating officer of Indochina Capital, is quite promising, with the market becoming more professional and transparent - a welcome transformation.

“As a foreign investor ourselves, Indochina Capital always makes its investments via capital contributions or share acquisitions for transparency and ease of execution,” Piro said. “Unfortunately, not that many sellers are able to accommodate this type of structure, since setting this up for an acquisition requires strong legal support, which is lacking with local vendors in most cases .”

He added that more and more transactions are being carried out under these methods, showing that Vietnamese businesses are making the conscious decision to streamline and facilitate the transaction.

Attractiveness

Baker McKenzie, in its Global Transactions Forecast 2018 report, gave Vietnam an overall Transaction Attractiveness Indicator score of 3 out of 10 in 2017. This indicator reflects the attractiveness of a country’s current environment for M&A and initial public offering (IPO) activities.

The score is based on a weighted average of 10 key economic, financial, and regulatory factors associated with M&A and IPO activities.

|

Vietnam is highly appreciated for its openness to trade, which scored at over 8, as well as government effectiveness, money supply, and ease of doing business, which each received scores of just under 5.

The size of the stock market, freedom to trade, business regulation, legal structure, and sovereign credit risk are, however, the limitations that drag down Vietnam’s overall score.

The global law firm projects a total volume of M&A transactions at 331 deals for Vietnam in 2018, with 263 domestic and 68 cross-border inbound deals. In the following years, Vietnam could expect slightly more deals, at 338 in 2019, but in 2020, the figure is expected to drop to 204 transactions.

“Dealmaking in Vietnam has suffered from a number of knocks to confidence in its economy, including weaker oil prices and the new US administration’s rejection of the Trans-Pacific Partnership. But domestic drivers are solid, and the programme of economic liberalisation, equitisation of state enterprises, and new investment in the energy sector should support a recovery in M&A activity to $2 billion in 2018, and slightly higher in 2019,” noted the Baker McKenzie report.

Vietnam, according to Indochina Capital’s Piro, has always been a hotspot for attracting foreign investment. By World Bank figures, the country ranked third in 2016 in terms of foreign direct investment (FDI) attraction in Southeast Asia, behind Singapore and Malaysia. Looking at recent trends in FDI, Vietnam continues to perform extremely well, with 2017 being the most successful year since 2009 in terms of both registered FDI ($35.88 billion) and disbursed FDI ($17.5 billion). The majority of this investment has been directed towards the manufacturing industry (44.2 per cent), and the real estate sector ranked third (8.5 per cent).

“To us at Indochina Capital, this is an extremely encouraging sign and it speaks to the opportunities that exist here in the country,” Piro said.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- New rules ease foreign access to Vietnam equities (February 05, 2026 | 17:29)

- Vietnam’s IFC creates bigger stage for M&As (February 01, 2026 | 08:16)

- Game startup Panthera raises $1.5 million in seed funding (January 29, 2026 | 15:13)

- Cool Japan Fund transfers shares of CLK Cold Storage (January 28, 2026 | 17:16)

- Nissha acquires majority stake in Vietnam medical device maker (January 26, 2026 | 15:40)

- BJC to spend $723 million acquiring MM Mega Market Vietnam (January 22, 2026 | 20:29)

- NamiTech raises $4 million in funding (January 20, 2026 | 16:33)

- Livzon subsidiary seeks control of Imexpharm (January 17, 2026 | 15:54)

- Consumer deals drive Vietnam’s M&A rebound in December (January 16, 2026 | 16:08)

- Southeast Asia tech funding rebounds on late-stage deals (January 08, 2026 | 10:35)

Tag:

Tag:

Mobile Version

Mobile Version