Vietnam's industrial property sector to benefit from stable growth of FDI

|

The report released on July 12 pointed out that industrial parks (IPs) and economic zones (EZs) account for 35-40 per cent of total annual registered FDI, or 70-80 per cent of annual registered FDI in the manufacturing sector. Meanwhile, industrial land rental fees for building a factory account for about 10 per cent of the total cost of an FDI project. Thus, the industrial property segment is expected to continue to benefit directly from stable growth of FDI.

In the first half of 2024, registered FDI reached $15.2 billion (up 13.1 per cent on-year) and disbursed FDI reached $10.8 billion (up 8.2 per cent). Bac Ninh rose to become the top province in the country for attracting registered FDI in the first half of 2024 thanks to Amkor's semiconductor material production project with additional investment of $1.07 billion.

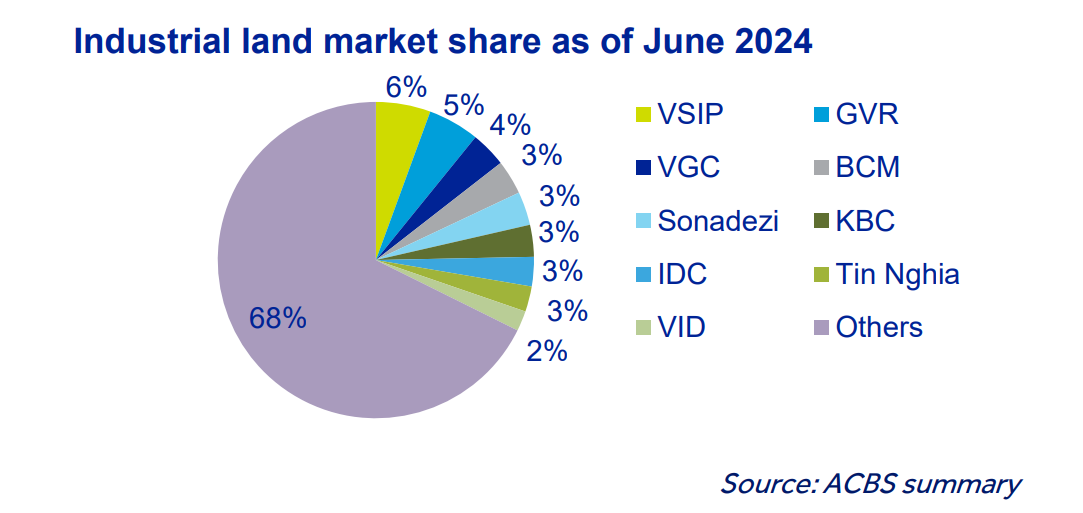

By the end of June 2024, Vietnam had 429 established IPs with a total area of over 134,500 hectares. The industrial land market in Vietnam remains fragmented, with VSIP (a joint venture between Becamex owning 49 per cent and Sempcorp owning 51 per cent) continuing to lead with more than 7,500ha of industrial land and a market share of 5.6 per cent. Vietnam Rubber Group ranks second with over 7,000ha, accounting for a 5.2 per cent market share.

|

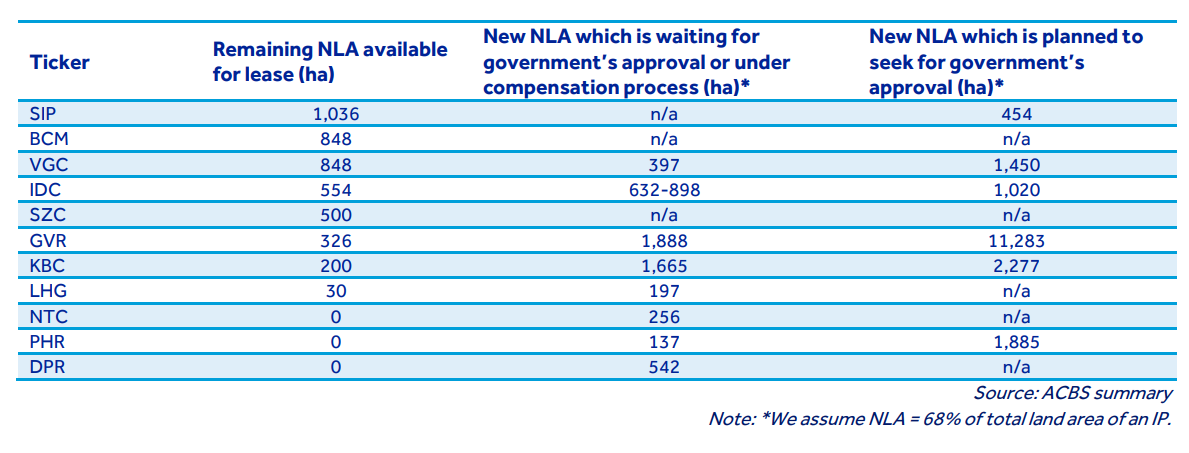

The report shows that the remaining land available for lease is limited, especially in the southern region, so companies are actively expanding their land banks. This is favouring companies with rubber plantations that are permitted to be converted into industrial land such as Vietnam Rubber Group (GVR) and Phuoc Hoa Rubber (PHR).

According to ACBS' statistics, among listed companies, Saigon VRG (SIP) has the largest remaining net leasable area (NLA) of over 1,000ha concentrated in Tay Ninh (772ha), Dong Nai (133ha) and Ho Chi Minh City (130ha). Next is Becamex (BCM) with the remaining NLA of 848ha in Binh Duong, and Viglacera (VGC) with 848ha.

In the first half of 2024, three listed companies were approved for new IPs. Viglacera (VGC) was approved to invest in Song Cong 2 IP in Thai Nguyen (296ha) and Doc Da Trang IP in Khanh Hoa (288ha), while GVR was approved to invest in Hiep Thanh IP - Phase 1 in Tay Ninh (495ha). IDICO (IDC) also received the green light to invest in Tan Phuoc 1 IP in Tien Giang (470ha).

|

According to CBRE, by the end of the second quarter of 2024, average land rental prices in the tier-1 market in the north (including Hanoi, Haiphong, Bac Ninh, Hung Yen and Hai Duong) reached $134 per square metre per remaining term (up 4.5 per cent year-on-year), while occupancy rate was 83 per cent, a slight increase compared to 82.6 per cent in the same period last year.

The tier-1 markets in the south (including Ho Chi Minh City, Binh Duong, Dong Nai and Long An) had an average land rental price of $173 per sq.m per remaining term (up one per cent year-on-year). Occupancy rate increased to 92 per cent compared to 85.5 per cent in the second quarter of 2023.

It is expected that land rental prices from 2024-2026 will continue to grow by 6-7 per cent per year in the north and 3-7 per cent in the south. New supply is gradually moving to tier-2 markets (Quang Ninh, Bac Giang, Vinh Phuc, Ha Nam, Thai Binh, Nam Dinh, Ba Ria-Vung Tau, Tay Ninh and Binh Phuoc) where there are lower rents and improved traffic connections to tier-1 markets thanks to ongoing and planned expressway and ring road projects.

The trend of developing smart and ecological IPs using renewable energy and better water and waste treatment systems will become increasingly popular as manufacturing corporations try to reduce emissions and save energy to meet their net-zero commitments.

| Capital flows strongly into industrial real estate As the economy is still facing difficulties, industrial real estate has become one of the most attractive sectors for investors. |

| Ready-built factory market on the up In the first half of 2024, the industrial real estate market continued to show positive developments. |

| Industrial property market heats up on trade recovery The industrial realty market has recorded robust development on the back of recovering foreign trade which grew 15.7 per cent year-on-year to 368.53 billion USD in the first half of the year, insiders have said. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnam breaks into Top 10 countries and regions for LEED outside the US (February 05, 2026 | 17:56)

- Fairmont opens first Vietnam property in Hanoi (February 04, 2026 | 16:09)

- Real estate investment trusts pivotal for long-term success (February 02, 2026 | 11:09)

- Dong Nai experiences shifting expectations and new industrial cycle (January 28, 2026 | 09:00)

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

- Decree opens incentives for green urban development (January 24, 2026 | 11:18)

- Public investment is reshaping real estate’s role in Vietnam (January 21, 2026 | 10:04)

- Ho Chi Minh City seeks investor to revive Binh Quoi–Thanh Da project (January 19, 2026 | 11:58)

- Sun Group launches construction of Rach Chiec sports complex (January 16, 2026 | 16:17)

- CEO Group breaks ground on first industrial park in Haiphong Free Trade Zone (January 15, 2026 | 15:47)

Tag:

Tag:

Mobile Version

Mobile Version