Transfer pricing is firmly in authorities’ firing line

|

Foreign-invested enterprises’ transfer pricing practices to evade taxes are set to be curtailed.

Minister of Finance (MoF) Vu Van Ninh announced that a new anti-transfer pricing project was being worked on to knock firms into line. Accordingly, tax and customs agencies will closely work to define market prices in aggregated transactions. The tax agency will play the decisive role, while the customs agency will be responsible for watching global product and services prices.

“This project is being carefully built because it affects the rights and obligations of enterprises, as well as benefits of the state,” said Ninh.

Transfer pricing involves enterprises raising the prices of materials bought from parent companies abroad to evade taxes.

In Vietnam, since the implementation of Circular 117/2005/TT-BTC providing guidelines to determine market prices of related party transactions, there have been some concerns regarding its practical application. Therefore, the MoF issued Circular 66/2010/TT-BTC, effective from July 1, 2010, to amend Circular 117’s transfer pricing regulations.

“From 2005 till now, the MoF has carried out many methods to crack down tax evasion via transfer pricing. However, these methods are not simultaneous, leading to enterprises having abused the situation. With the new project, the MoF is showing its determination to limit this situation,” Ninh said.

In Vietnam, many economists and authorities have labeled transfer pricing as the primary reason explaining why so many foreign-invested enterprises (FIEs) reported losses for several consecutive years, while continually expanding their business and production.

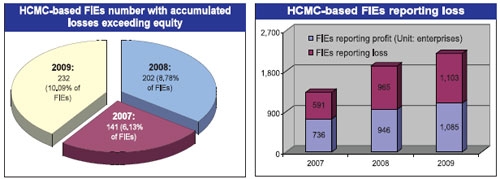

According to the Ho Chi Minh City Taxation Department, 60 per cent of the FIEs operating in the city reported losses in 2009 and 50 per cent in 2008.

Department investigation results show that in the same industry, domestic enterprises’ average profit was always higher than FIEs, especially in some labour intensive sectors such as textiles and leather.

Specifically, in 2009, among 235 textiles FIEs operating in Ho Chi Minh City, there were up to 109 enterprises reporting losses, while the number of domestic ones was 28.

A similar situation happened in the leather sector when FIEs reporting losses accounted for 53.4 per cent of the sector, while the proportion of domestic enterprises was 27 per cent in 2009.

Ninh said it would be complicated for a customs agency to check the provided pricing levels. “Therefore, with this new project, the tax and customs agencies will set up a database on world and local market prices, on the information of enterprises’ business activities, combined with foreign tax and customs agencies and consult other resources to define prices in aggregated transactions.

Formerly, MoF vice minister Do Hoang Anh Tuan said transfer pricing would both create a state budget deficit and hurt the local business environment.

“Apart from asking for competent authorities to continue to watch for this situation, the MoF also asked the local tax departments to carry out supervising at some enterprises that are showing doubtful signals,” he said.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version