Taiwanese interest in electronics continues to surge

The rise in interest is in line with Taiwan’s New Southbound Policy, enhancing cooperation with Southeast Asian nations. Since its inception in 2016, the policy has markedly increased cooperation with Southeast Asia, significantly benefiting Vietnam's high-tech electronics sector.

| Taiwanese investment in Vietnam since 2018. Source: Savills Vietnam |

John Campbell, associate director of Industrial Services Savills Vietnam, told media on July 23 that Taiwanese investors favour Vietnam’s young and increasingly skilled workforce, stable business environment, competitive labour and construction costs, geographical location near source and destination markets, and its active participation in a multitude of free trade agreements.

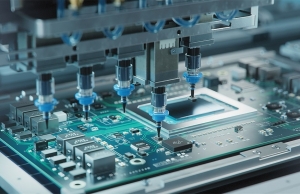

In recent times, a growing number of Taiwanese manufacturers have established firm footholds in Vietnam to diversify supply chains and mitigate product risks, among them electronics giants like Foxconn, Pegatron, Compal, and Wistron.

"Vietnam is ambitious to become a semiconductor hub, whilst Taiwan is renowned for its successful semiconductor industry and can therefore offer valuable expertise that Vietnam can leverage to achieve its objectives," Campbell said. "The north of Vietnam is expected to continue to attract Taiwanese electronics and semiconductor investments, whilst the south is likely to receive mid-value-added manufacturing projects."

According to the Foreign Investment Agency under the Ministry of Planning and Investment, Vietnam attracted foreign direct investment (FDI) of $36.6 billion in 2023, increasing over four-fold from 2022. Taiwan was the sixth-largest contributor with $2.88 billion, representing 8 per cent of total registered FDI and up 13 per cent from 2022.

This performance reinforced the strong economic ties and long-standing relationship between the two regions. Electronics remain the largest manufacturing industry in Taiwan in 2023.

In the first seven month of 2024, Vietnam attracted registered FDI totalling $18 billion, up nearly 11 per cent on year. Manufacturing accounted for 70.3 per cent registering $12.65 billion, up a significant 15.7 per cent on year.

Of these, Taiwan was the sixth-largest contributor with nearly $1.19 billion or 6.6 per cent of the total, with 103 new projects registering $588.5 million, 57 existing projects increasing capital of $436 million, and 151 projects with capital contributions and share purchasing amounting to $160.2 million.

| Largest Taiwanese manufacturing projects in the first half of the year. Source: Savills Vietnam |

Taiwan had 39 new manufacturing projects registering $513.37 million in the first six months of the year, representing 49 per cent of Taiwan’s total FDI during the period. Of these, 22 projects were in northern Vietnam and 17 were in southern Vietnam.

"Although the north had more new Taiwanese manufacturing projects, the south received the bigger portion with $285.4 million or 56 per cent mostly due to a significant investment of $250 million by Tripod Technology in Chau Duc IP in Ba Ria-Vung Tau province," Campbell said.

Of the 39 new Taiwanese manufacturing projects in the first half, 24 were land deals and 15 were factory deals. Land deals dominated in revenue, accounting for 92 per cent of investment capital. However, factory deals, comprising 38 per cent of the total number of projects, indicate growing demand from various Taiwanese manufacturers, from suppliers to large electronic conglomerates to mid-value-added industries and small- and medium-sized enterprises.

By industry, electronics was in first place with four projects totalling $255 million or 50 per cent. Clothing was in second place accounting for 24 per cent with five projects, followed by electrical equipment with 11 per cent and seven projects.

"When examining Taiwan's manufacturing FDI in recent years, the most notable trend is the monumental increase from 2022 to 2023, emphasising the seriousness of Taiwanese investors in diversifying their supply chains to Southeast Asia after the pandemic," Campbell said.

For context, Taiwan’s newly registered manufacturing FDI in 2023 was $1.87 billion, which is almost a staggering 8.7 times that of 2022. In the first half of the year, Vietnam has already attracted over $513 million in new Taiwanese manufacturing investments, with expectations of further substantial increases by year-end when more major electronics projects complete their registrations.

Accumulated to end-July, Taiwan ranked as the fourth-largest investment source with 3,197 projects and $40.3 billion, representing 8.2 per cent of total FDI in Vietnam since 1988.

| Vietnam remains an attractive investment for Taiwanese firms SSI Asset Management (SSIAM) and Union Securities Investment Trust Company (USITC), a subsidiary of Union Bank of Taiwan (UBOT), have agreed to establish a cooperative relationship that covers customer development, investment funds, and the sharing of investment opportunities, and more. |

| Investors from Taiwan keen on diversification Taiwanese investors, especially those operating in electronics and high-tech manufacturing, are increasingly paying attention to Vietnam, to relocate or diversify their supply chains. |

| Taiwanese investments expand horizons in Vietnam Despite global economic challenges, trade ties and investment cooperation between Vietnam and Taiwan continue to flourish. |

| Vietnam benefits from China+1 policy shift Chinese and Taiwanese groups continue to seek strategic investment opportunities in Vietnam as the country emerges as one of the top gainers from the China+1 strategy. |

| Taiwan aims to become global supply chain centre in six key industries Taiwan's Ministry of Economic Affairs' (MoEA) Industrial Development Administration has highlighted semiconductors, AI healthcare, machine tools, electric vehicles (EVs), bicycles, and textiles as six of its outstanding industries. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Kim Long Motor and AOJ Suzhou enter strategic partnership (February 16, 2026 | 13:27)

Tag:

Tag:

Mobile Version

Mobile Version