Vietnam benefits from China+1 policy shift

China International Capital Corporation (CICC) is witnessing more opportunities for Chinese corporate clients in Vietnam. In June, it opened a representative office in the country, expanding its presence in Southeast Asia.

Stephen Ng, head of Southeast Asia and Singapore CEO at CICC, said that in Vietnam, CICC’s mission extends beyond establishing a physical presence. It aims to plant the seeds for long-term partnerships. Its goal is to integrate its expertise with Vietnam’s entrepreneurial spirit, empowering local businesses and connecting them with the global capital market.

“We are committed to deepening our engagement, forging strategic alliances, and dedicating ourselves to the sustainable development of Vietnam’s economic landscape. We foresee a synergistic relationship with shared knowledge, resources, and visions, cultivating a fertile ground for mutual success and long-lasting impact,” Ng said.

|

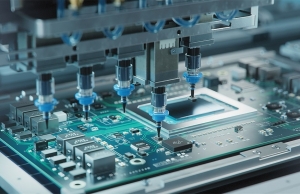

| Vietnam benefits from China+1 policy shift, Photo: foxconn.com.vn |

Taiwan-based manufacturing giant Hon Hai Precision Industry Co., better known as Foxconn, has become a forerunner of relocation trends in the manufacturing industry, as its customers increasingly demand China+1 production. At the beginning of July, Foxconn received investment certificates for two projects worth $551 million in the northeastern province of Quang Ninh, reaffirming its commitment to this diversification strategy.

According to World Investment Report 2024 published on June 20, Hon Hai Precision Industry and Samsung Electronics have reassessed their manufacturing footprint in China because of trade tensions. A significant portion of their products, especially chips and high technology electronics, are produced in fabrication plants in China and exported to the United States. Hon Hai reduced its greenfield projects in China from 23 to 6, while Samsung reduced its ventures from 9 to 1.

The report pointed out both companies have started investing in new manufacturing facilities in their home markets and in other countries such as Vietnam, India and Mexico. Hon Hai Precision Industry tripled the number of manufacturing projects in Vietnam.

At a meeting in China with Vietnamese Prime Minister Pham Minh Chinh in late June, Sun Rongkun, chairman of Dalian Locomotive and Rolling Stock, said that the company, which currently exports its railway products to Vietnam, wants to continue to expand its exports to Vietnam, and boost cooperation in producing rail transport and new energy products here.

It also wishes to cooperate in interregional, interprovincial, and urban railway projects in Vietnam, particularly urban railway lines in Hanoi and Ho Chi Minh City.

In terms of the China+1 strategy, Vietnam has stood out as a well-connected country compared to the likes of Laos and Myanmar. Its extensive network of free trade agreements also enhances its attractiveness as a manufacturing and export hub.

Hence, experts say Vietnam would be best advised to adapt and leverage its unique strengths by improving its infrastructure connections with China, which includes enhancing rail connections between Haiphong, Hanoi, Kunming, and Nanning, which are currently under discussion.

Meanwhile, Michael Kokalari, chief economist of VinaCapital, said there are concerns about the competition in foreign direct investment (FDI) attraction from India, Indonesia, and Malaysia.

“In Indonesia, there are some FDI activities going on there, mainly to produce battery metals for electric vehicles. There is also some FDI going into Malaysia, which includes higher-end microchips and also some data centres. Meanwhile, most of the FDI flows into India in recent years have been primarily to produce local items and so, for now, India is not really a threat to FDI in Vietnam.”

According to a report by the Ministry of Planning and Investment, as of June, China is the fifth-largest foreign investor in Vietnam with a total registered capital of $1.3 billion, up two-thirds against the same period last year. China also takes a lead in terms of the number of new projects, accounting for 29 per cent of foreign-led ventures.

Stephen Olson, who is a senior adjunct fellow of the Pacific Forum and visiting lecturer at the US-based Yeutter Institute told VIR that as trade tensions rise between China and the US, Vietnam a logical and attractive production alternative for China-based electronics manufacturing.

“Lower labour costs in Vietnam are certainly one important factor to consider, but the Vietnamese government has also been offering tax breaks and other incentives to encourage Chinese firms to relocate. Other cost considerations are more neutral. The cost of electricity, water, and other utilities is about in the same in both countries,” Olson said.

Most recently, Vietnam has been stepping up plans to set up an investment support fund to lure foreign investments. “Money and financial considerations are important but they are not the only factor for multinational corporations. They will also want to see evidence that Vietnam has the skilled labour force and infrastructure to support their operations,” Olson explained.

Finally, Vietnam must be careful not to get caught in a bidding war with other countries to see who can offer the highest incentives, Olson added.

| Vietnam remains an attractive investment for Taiwanese firms SSI Asset Management (SSIAM) and Union Securities Investment Trust Company (USITC), a subsidiary of Union Bank of Taiwan (UBOT), have agreed to establish a cooperative relationship that covers customer development, investment funds, and the sharing of investment opportunities, and more. |

| Investors from Taiwan keen on diversification Taiwanese investors, especially those operating in electronics and high-tech manufacturing, are increasingly paying attention to Vietnam, to relocate or diversify their supply chains. |

| Taiwanese investments expand horizons in Vietnam Despite global economic challenges, trade ties and investment cooperation between Vietnam and Taiwan continue to flourish. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Kim Long Motor and AOJ Suzhou enter strategic partnership (February 16, 2026 | 13:27)

Tag:

Tag:

Mobile Version

Mobile Version