Taiwan aims to become global supply chain centre in six key industries

|

| Taiwan aims to be global supply chain centre in six key industries |

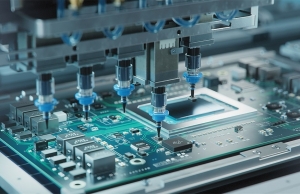

At a meeting with international press agencies regarding supply chains on July 22, Lin Der-Sheng, director general of MoEA's Industrial Development Administration, said that semiconductors are at the core of technology and critical to national competitiveness, including advanced computing, aerospace and defence, and consumer application.

Taiwan takes a key role in the global semiconductor ecosystem, and leads the world with advanced manufacturing processes and 3D packaging. In 2023, the total output value of Taiwan’s semiconductor industry ranked second in the world, only behind the United States.

Of this, IC design was valued at $35.2 billion, and also ranked second, while foundry services were valued at $80 billion, ranking first in the world. Outsourced semiconductor assembly and test services were valued at $18.7 billion, also ranking first.

Taiwan’s biomedical industry covers five major sub-industries: applied biotechnology, pharmaceuticals, medical devices, digital health, and healthcare. The total revenue in 2023 was about $23.3 billion.

They can offer a wide range of services covering interdisciplinary technologies with about 2,500 companies and institutions in innovative research and development, about 2,600 companies and facilities in customisable manufacturing, and 260 centres and hospitals involved in high-quality clinical research.

In the machinery tool and equipment industry, Taiwan is primarily export-oriented, making it susceptible to global economic conditions. However, events like conflicts and trade wars and inflation rate hikes are causing a slowdown in orders, impacting Taiwan’s industry. Total output value last year was $3.25 billion (down about 10 per cent on year), 70 per cent of which came from exports.

Benefiting from the continuous rise in demand for end applications such as AI, the Internet of Things, EVs, and aerospace, the machine tool industry is growing, driving the development of the entire supply chain.

Taiwan’s key EV systems are plentiful in capacity. They have entered into many international car manufacturers’ supply chains, covering automotive electronics, charging systems, motor systems, and body systems for EVs, e-buses, and e-bikes.

Taiwan’s bicycle production focuses on mid-to-high-end products, and the export market is primarily for sports, leisure, and transportation purposes in Europe (45 per cent of total export turnover at $4.3 billion), and the US (30 per cent). Total output last year was almost $6.3 billion, ranking second worldwide.

In the textile industry, the fabric sector is the main focus with functional textiles as its leading products, being the world’s third-largest producer of polyester and nylon fibres. 70 per cent of functional fabrics used by re-own international outdoor brands are sourced from Taiwan.

Taiwan is was the seventh-largest textile exporter in the world in 2022. With more than 4,400 manufacturers, it earned about $10 billion in 2023, with $6.6 billion coming from exports.

Lin Der-Sheng said, "We are establishing a vision to position ourselves as an economy that plays an important role in the global supply chain through the six strategic industries, and plan to grow into a stable and reliable partner."

According to the Taiwan Institute of Economic Research, the evolution of Taiwan's industrial links with global value chains have changed over the decades. In the 1960s, the industrial structure was light industry and family workshops, based on low-costs labour with compulsory education.

It focused on petrochemicals, plastics, and steels in the 1970s based on specialised industrial zones. These moved to ICE components, chemicals materials (1990s); semiconductors optical electronics precision machinery (2000s); 5+N industrial innovation (2010s); and six core strategic industries since 2020.

| Vietnam remains an attractive investment for Taiwanese firms SSI Asset Management (SSIAM) and Union Securities Investment Trust Company (USITC), a subsidiary of Union Bank of Taiwan (UBOT), have agreed to establish a cooperative relationship that covers customer development, investment funds, and the sharing of investment opportunities, and more. |

| Investors from Taiwan keen on diversification Taiwanese investors, especially those operating in electronics and high-tech manufacturing, are increasingly paying attention to Vietnam, to relocate or diversify their supply chains. |

| Taiwanese investments expand horizons in Vietnam Despite global economic challenges, trade ties and investment cooperation between Vietnam and Taiwan continue to flourish. |

| Vietnam benefits from China+1 policy shift Chinese and Taiwanese groups continue to seek strategic investment opportunities in Vietnam as the country emerges as one of the top gainers from the China+1 strategy. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Kim Long Motor and AOJ Suzhou enter strategic partnership (February 16, 2026 | 13:27)

Tag:

Tag:

Mobile Version

Mobile Version