Advanced search

Search Results: 260 results for keyword "bad debt".

Banks raise provisions in anticipation of bad debt

10-11-2021 21:41

In the face of rising bad debt amid the ongoing COVID-19 pandemic, commercial banks have been forced to write up their loan loss provisions, according to industry sources.

Debt trading interest creates call for new framework

29-10-2021 08:00

New legislation is needed to secure the future of debt trading – and with prudent tweaks to the current regime, Vietnam could open up the market for retail trading on its newest platform, bringing together banks and investors.

HDBank on track to hit 2021 targets

25-10-2021 16:44

HDBank has announced preliminary business results for the first nine months of 2021 with positive growth, standalone bad debt ratio at less than 1 per cent, and constrained bad debt ratio at 1.4 per cent – both lower than in the same period last year.

Perspectives on SBV’s debt rescheduling alterations

02-09-2021 21:36

The current wave of COVID-19’s Delta variant has pushed the Vietnamese government into implementing strict social distancing measures and lockdowns, which also significantly impedes the domestic economy. So, it should come as no surprise that the State Bank of Vietnam (SBV) has proposed amendments to Circular No.03/2021/TT-NHNN dated April 2 that would extend the circular’s effectiveness while widening the protections it provides for pandemic-impacted borrowers.

SHB focuses on handling debts at Vinashin and VAMC

02-08-2021 10:43

SHB will soon handle all debts of Vinashin and purchase all bonds held by Vietnam Asset Management Company this year thanks to increasing loan-loss provisioning.

SBV considering proposal for developing framework for tackling NPLs

28-07-2021 11:03

The State Bank of Viet Nam is studying a proposal for developing a law on resolving the non-performing loans (NPLs) of credit institutions over the risk of rising bad debts as the COVID-19 pandemic weighs on production and business.

Debt under control thanks to prudent and effective actions

09-07-2021 08:00

Effective usage of the state budget has helped Vietnam succeed in bringing public debt under control since 2016, ensuring national financial security.

VAMC bad debts platform facilitates market options

07-07-2021 15:13

The upcoming bad debt exchange platform from Vietnam Asset Management Company is being viewed as a promising legal intermediary which can effectively deal with sour loans, as well as help lenders simplify procedures for collateral disputes while enhancing transparency.

VAMC to establish a bad debt trading platform in Vietnam

28-06-2021 21:36

VAMC is about to establish a bad debt trading floor to buy and sell bad debts.

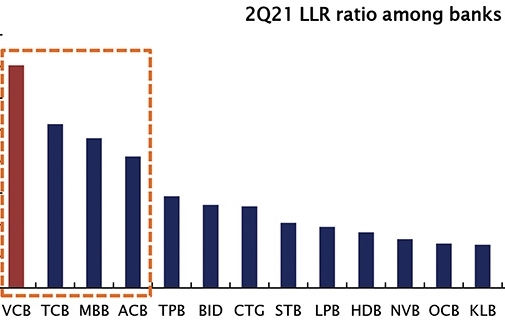

Non-performing loans rise with restructuring

19-05-2021 09:00

Banks have experienced a significant bad debt formation while implementing strict provisioning to control non-performing loans amid pandemic struggles – however, debt restructuring portfolios will slightly increase in 2021 as related conditions are expanded.

VAMC bad debts exchange platform to soon receive approval

02-02-2021 09:05

The Vietnam Asset Management Company (VAMC) bad debts exchange platform will be approved by the central bank at the beginning of 2021.

Banks to make provisions for COVID-19 affected loans this year

24-01-2021 10:04

Banks will have to set aside money for potentially unrecoverable COVID-19 affected loans from this year, according to an amended circular drafted by the State Bank of Vietnam (SBV).

Vietcombank to maintain resilience despite possible bad debt formation and lower profit

09-12-2020 17:02

Vietcombank is expected to maintain its resilience despite possible significant bad debt formation and lower profit due to the pandemic. The bank has implemented strict provisions to control the non-performing loans ratio.

State Bank proposes expanding VAMC's operation

09-12-2020 12:37

The State Bank of Viet Nam (SBV) proposes expanding the Viet Nam Asset Management Company's (VAMC) operations, saying the agency should purchase and sell bad debts and assets of all sectors in the economy.

What investors must notice in NPLs

06-11-2020 08:55

Bad debts have become a common problem for the worldwide credit system. Managing partner Le Tien Dat and associate Thieu Thi Kieu Thu of APOLAT Legal write about bad debt investment in Vietnam and the factors financiers have to take into account.

Mobile Version

Mobile Version