Perspectives on SBV’s debt rescheduling alterations

|

| Tanh Tran - Deputy head of Research Yuanta Securities Vietnam |

The draft circular includes two key revisions to support those affected clients. First and foremost, the debt restructuring period will be extended to June 30, 2022 instead of the original date of December 31, 2021. Secondly, banks will extend rescheduling of debt repayment for borrowers located in blockaded areas and vulnerable localities.

This policy is entirely sensible from a macro perspective. Businesses and individuals have felt the brunt of the health crisis and their cashflows have been diminished.

Banks are shouldering a considerable portion of the economic burden, and we believe that more than half of total bank credit falls into the “pandemic-impacted” category, including restructured but unclassified loans, loans with exempted/reduced rates, and new loans with preferential rates.

In our view, these loans represent the lowest quality assets of the wider range of pandemic-impacted assets. We think it is obvious that at least some of these loans will require increased provisioning because not all affected borrowers will be able to cover their debts – this seems intuitively obvious even before the increasingly stringent lockdowns of the past few months.

The current situation is a systemic issue that requires systemic solutions. Thus, allowing creditors and borrowers additional time to work through these debts is thus critical from a macro point of view.

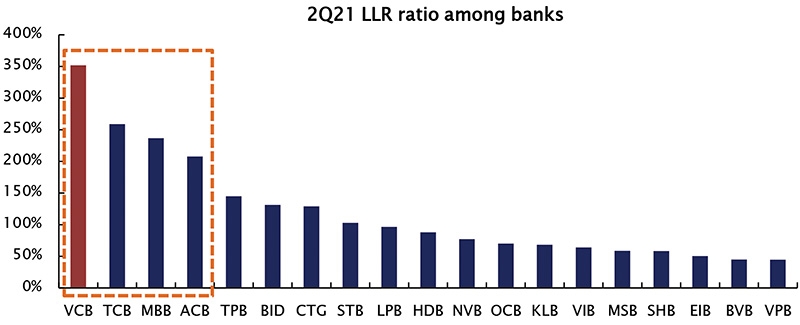

However, there is a possibility that not all clients will receive the same support or it might take a long time and complicated procedures to handle documents. From our perspective, the effectiveness of the policy, in reality, might be bank-dependent. Banks with low loan loss coverage are under pressure. Banks with low loan loss reserves (LLRs) ratios will have to increase provisioning for potential losses from their restructured loans, which could herald a decline in earnings growth from what may have been peak levels in the first half of 2021.

|

The draft circular may be disappointing to some bankers. The SBV will maintain the timeline for banks to provision for restructured loans at three years, as in the original Circular 03, instead of extending the provisioning period to five years as suggested by the Vietnam Banks Association.

For the banks and for banks’ shareholders, asset quality is a key concern. Reported non-performing loans (NPLs) have remained low under the SBV’s forbearance policies. However, in our opinion, this does not fully reflect the underlying asset quality deterioration.

We believe that real NPLs have already increased due to the pandemic, and provisioning should increase as a result. Therefore, we recommend investors focus on quality banks with high LLR ratios, such as Vietcombank, ACB, MB, and Techcombank.

Most banks increased provisioning in the second quarter, but not all banks have high provisioning coverage. Though many bankers argue that provisioning coverage should depend on collateral values, we believe that certain types of collateral (for example, auto loans and other consumer finance) might see fluctuations in market value and might also take a long time to liquidate amid the pandemic.

Banks’ earnings in the second half of 2021 and into 2022 will partly depend on the ability to collect payments from restructured loan borrowers. If those assets become bad loans, banks – and especially those with low LLR ratios – will have to put aside additional provisions, which will thus drag down their earnings.

Thus, we believe that banks with high LLR ratios have stronger buffers to weather asset quality deterioration due to the pandemic. Vietcombank, ACB, MB, and Techcombank all have high LLR ratios of above 200 per cent. VCB remains Vietnam’s highest-quality bank based on our sector-wide rankings for capital adequacy, asset quality, management, earnings, liquidity, and sensitivity, and its valuation premium is justified. VCB’s LLR ratio of 352 per cent is the highest in the sector, which provides VCB with the flexibility to lower provisioning to boost earnings in the period of 2021-2022 without sacrificing its asset quality.

Overall, a gradual approach – given the support from the SBV’s policy to resolving the loans that do not recover – should also avert negative shocks to market sentiment. We also believe that the SBV will continue to loosen its monetary policy as banks are guided to reduce interest rates for vulnerable borrowers hard hit by the pandemic. Low interest rates will also continue to support stock market liquidity.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version