Advanced search

Search Results: 738 results for keyword "M&A".

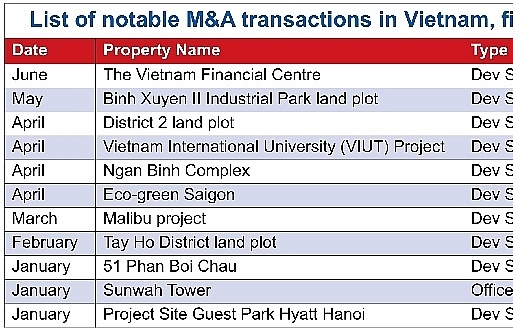

Vietnam M&A Forum: Top ten deals in 2009-2018

24-07-2018 17:35

During the past ten years, Vietnam continued to witness high-value mergers and acquisitions (M&A) transactions in a variety of sectors, such as food manufacturing, real estate, banking, and retail, among others.

Retail, consumer goods, and real estate will lead 2018 M&A market

24-07-2018 17:31

Retail, consumer goods, and real estate are forecasted to lead the Vietnamese mergers and acquisitions (M&A) market in 2018. In addition, the value of the M&A market is forecast to stay above $6 billion.

M&A market poised for “New Thrust, New Era”

24-07-2018 15:05

Mergers and acquisitions (M&A) in Vietnam are opening up new opportunities to create a new thrust and a new era building on the record high value of $10.2 billion in 2017, promising new opportunities for both foreign and local investors this year.

Vietnam remains an M&A magnet

24-07-2018 09:00

Despite recent drops in the VN-Index, Vietnam is still seen as a major destination for mergers and acquisitions in Asia.

Cultural integration is a key to post-M&A success

24-07-2018 08:00

The merger and acquisition trend seems to be showing rapid growth along with investment flows from international enterprises to Vietnam. It is believed that they are the fastest way for outside corporations to join domestic markets compared to having to build facilities and establish employee systems.

M&As saw new highlights in the first half of the year

24-07-2018 08:00

Vietnam has become an attractive destination for many foreign investors, largely due to the country’s friendly policies encouraging foreign direct investment, its political stability, and its strong economy.

Ample room for M&A activity

24-07-2018 08:00

Vietnam’s total merger and acquisition value is estimated to reach just over $6.5 billion in 2018, a lower number than in 2017. The country, however, could do better, should it rectify a number of issues that currently prevent such activity from thriving. Trang Nguyen reports.

Vietnam M&A Forum 2018 returns this August

23-07-2018 16:17

Tomorrow, VIR and AVM Vietnam will co-organise a press-conference to officially announce Vietnam M&A Forum 2018, which is scheduled to take place on August 8, 2018 at GEM Centre in Ho Chi Minh City.

Vietnam reports first billion-dollar FDI projects of 2018

29-06-2018 17:44

Soaring foreign investment in the M&A sector may turn the tides of continuously decreasing FDI inflows in the first six months of the year, especially with the appearance of billion-dollar projects.

Nguyen Kim has not given up on Ladophar

19-06-2018 12:39

As no firms occupy more than 20 per cent of the $5.2-billion domestic pharmaceutical market, it remains an appetising cake for many chains, such as Mobile World, FPT, and lately Nguyen Kim, which has been repeatedly planning to acquire 51.14 per cent in Lam Dong Pharmaceutical JSC (Ladophar, code: LDP).

Vinataxi and Savico Taxi to merge to compete with Grab

18-06-2018 13:00

Backed by ComfortDelGro Corporation Limited from Singapore, the merger between Vinataxi and Savico Taxi may help them overcome the competition with Grab and other ride-hailing applications.

Letting the market take care of M&As

11-06-2018 08:00

Vietnam has witnessed numerous merger and acquisitions (M&A) deals with foreign partners completed in recent years, with many more in the pipeline.

F&N hands in 15th registration to increase Vinamilk holding

06-06-2018 23:02

Aiming to raise ownership in Vinamilk, Singapore-based F&N Dairy Investment has been repeatedly registering to buy over 14 million shares. This is the 15th time the investor has professed to its ambition of raising ownership in Vinamilk.

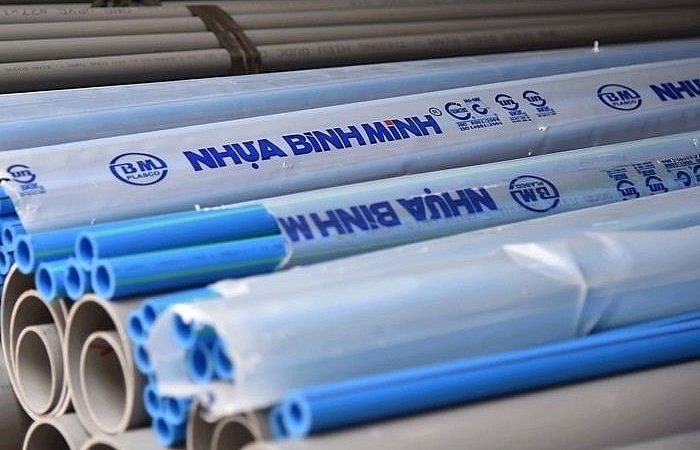

Nawaplastic reports immense savings on BMP acquisition

04-06-2018 14:37

Nawaplastic Industry Co., Ltd. makes massive savings by acquiring the shares of Binh Minh Plastic (BMP) step-by-step rather than buying a major share volume in a single purchase.

CISS refutes information on foreign acquisition

31-05-2018 17:08

Canadian International School System (CISS) in Ho Chi Minh City refutes the information published by Bloomberg that International Schools Partnership Ltd. (ISP) will acquire it for $150 million, according to vtc.vn.

Mobile Version

Mobile Version