Advanced search

Search Results: 65 results for keyword "SK Group".

Hydrogen fuel cell maker Plug Power to expand operations with SK Group

05-05-2021 17:54

Hydrogen fuel cell maker Plug Power, the leading provider of comprehensive hydrogen fuel cell turnkey solutions, is signalling interest in potential markets, including Vietnam, South Korea, and China through a joint venture with SK Group.

South Korean investors back from recess

22-04-2021 10:00

The South Korean investment landscape in Vietnam is brightening up, following new investments worth billions of dollars, with SK and Hanwha pouring a great deal into their projects.

M&A on cusp of post-COVID-19 surge

20-04-2021 20:00

As global mergers and acquisitions activity continues to rebound following a pandemic-fuelled freeze, Vietnam is expected to benefit from the growth of deal-making.

Robust growth trends projected for investment in healthcare

09-04-2021 10:00

Vietnam’s healthcare and pharmacy chains are increasingly getting new funds to expand their operations in local market, thereby securing access and availability of medical supplies and drugs for locals. However, concerns over adequate human resources in the sector dampen the bright prospects and could cause supply issues.

SK Group to acquire 16.26 per cent stake in VinCommerce

06-04-2021 12:12

Masan Group Corporation and SK Group today announced the signing of definitive agreements for SK’s acquisition of a 16.26 per cent stake in VinCommerce (VCM) for a total cash consideration of $410 million. The transaction values VCM at $2.5 billion.

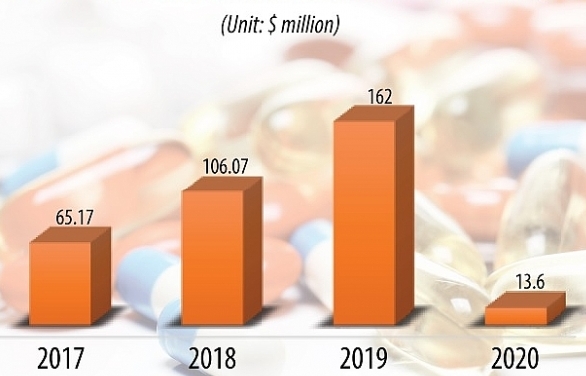

New M&As in healthcare can evade pandemic uncertainties

20-11-2020 20:59

Mergers and acquisitions in Vietnam’s healthcare and pharmaceutical sector in 2020 have been held up due to the global health crisis – but prospects remaining enticing thanks to new drivers of interest.

South Koreans grow presence through substantial M&A

19-08-2020 14:30

South Korean investors are employing mergers and acquisitions as a critical strategic instrument to secure a stronger footing in Vietnam.

M&A set for a bustling second half

08-07-2020 08:00

Mergers and acquisitions (M&A) deal-making will probably increase at a steady pace in the second half of 2020, led by the upcoming mega deal of Vietnam’s leading brewer Sabeco.

SK Group expands pharma foothold

18-06-2020 09:00

With SK Group recently joining the mergers and acquisitions race, Vietnam’s pharma and healthcare market is becoming more robust. However, newcomers are expected to face challenges amid increasingly mounting competition in the lucrative pharmaceutical market in the months to come, driven by the enforcement of the EU-Vietnam Free Trade Agreement.

SK Group acquires 25 per cent of Imexpharm

01-06-2020 14:44

South Korean conglomerate SK Group has become a large shareholder of Imexpharm (IMP), adding to its considerable portfolio of shares in Vingroup, Masan, and PV Oil.

Local businesses in foreign bid risk

12-05-2020 13:01

While the ongoing pandemic is taking a severe human and economic toll worldwide, deal-making activity in Vietnam is likely to maintain momentum as corporate leaders are being asked to make strategic decisions for hunting capital. However, experts have raised concerns that the virus has left local companies vulnerable to bids from overseas.

Protecting at-risk groups with timely fiscal policies

18-04-2020 20:54

The Vietnamese government has been urgently deploying sturdy solutions to assist enterprises and investors, and those hit by the coronavirus pandemic. Dr. Chi Tran, researcher/associate lecturer from the School of Economics and Finance at Queen Mary University of London, delves into the government’s policies in conditions of financial constraints to fight against the health crisis, with a reflection in the case of the United Kingdom.

Cash-strapped local businesses hunting for foreign M&A deals

18-04-2020 08:00

The coronavirus crisis is expected to create mergers and acquisitions opportunities for foreign dealmakers in the coming months as cash-starved Vietnamese companies seek funding to overcome their difficulties.

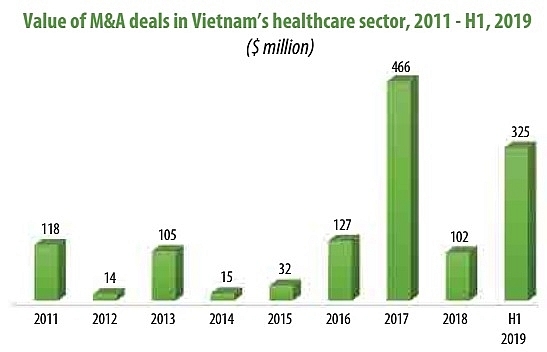

Vietnam turns tide of M&A downturn

08-02-2020 16:40

Vietnam is going against the flow of slowing merger and acquisition (M&A) deal-making across the Asia-Pacific region, with a vibrant market forecast for 2020. Building on his wealth of experience in cross-border investment and M&A transactions, Dang Thanh Son, partner at Baker McKenzie’s Hanoi office, discusses Vietnam’s M&A performance in 2019 and shares his expectations for the coming year.

SK establishes $850 million fund to invest in Vietnam

22-12-2019 17:01

Building on its already tremendous investment in Vietnam and the active support from local authorities, SK Group established a $860 million investment fund, half of which it plans to establish in Vietnam.

Mobile Version

Mobile Version