New M&As in healthcare can evade pandemic uncertainties

|

Pymepharco JSC will this week close registration to join this year’s Extraordinary General Meeting of Shareholders scheduled to be organised on December 7, focusing on an ownership increase by Stada Service Holding B.V. to 100 per cent of chartered capital without a public offering.

Stada Service, a unit of Germany’s Stada Arzneimittel AG, is said to have already raised its holding in Pymepharco from 61.99 per cent to 69.99 per cent earlier this month.

Established in 1989, Pymepharco deals in drug production and trading as well as in medical devices. Operating two factories meeting EU-GMP standards and ranking among Vietnam’s top 50 listed firms, the drugmaker is expected to enable Stada to strengthen its foothold in the local lucrative pharmaceutical market.

The Pymepharco-Stada deal might be one of the few merger and acquisition (M&A) agreements announced in the healthcare and pharma sector this year. In August, Japan-based ASKA Pharmaceutical Co., Ltd. announced that it had completed negotiations to acquire 24.9 per cent of Ha Tay Pharmaceutical JSC (Hataphar), which in 2019 was the second-largest pharm firm in Vietnam by sales.

In late May, the market also saw SK Investment Vina III, a subsidiary of South Korea’s third-largest conglomerate SK Group, receive 12.32 million shares or equivalent to 24.9 per cent of Imexpharm Corporation – Vietnam’s fourth-largest pharmaceutical company.

Mark on the market

According to industry insiders, COVID-19 does not only have potential implications for the healthcare and pharmaceutical market, but also for the entire M&A realm.

An analyst at FPT Securities told VIR, “We have seen few M&A transactions in the sector so far this year as, even though there was some interest in the opportunities, deals have been delayed because of the pandemic.”

The process of state stake divestment by the Ministry of Health (MoH) in Vinapharm is one such example. The MoH, holding 65 per cent stake in the major market player, has been trying to complete the work by early next year at the latest. However, progress is reported to be somewhat slow, partially due to the global health crisis.

According to the Japanese Chamber of Commerce and Industry (JCCI), despite all the attention Vietnam receives from investors, COVID-19 has left a mark on the progress of M&A deals.

“Although improved IT infrastructure and web conferencing systems help sellers and buyers meet virtually, site visits are quite difficult to organise, thus it is important to keep in mind that deals may not proceed as scheduled,” Daisuke Imaichi, from the Finance & Insurance Department at the JCCI in Vietnam, told VIR. “In addition, investors should pay attention to the fact that the valuations of Vietnamese targets may fluctuate under COVID-19 circumstances.”

Similar worries were reported among other investors, including those from South Korea, Singapore, and elsewhere. South Korea and Japan are the biggest contributors of M&A value in the local market, with healthcare and pharmacy being among their key interests.

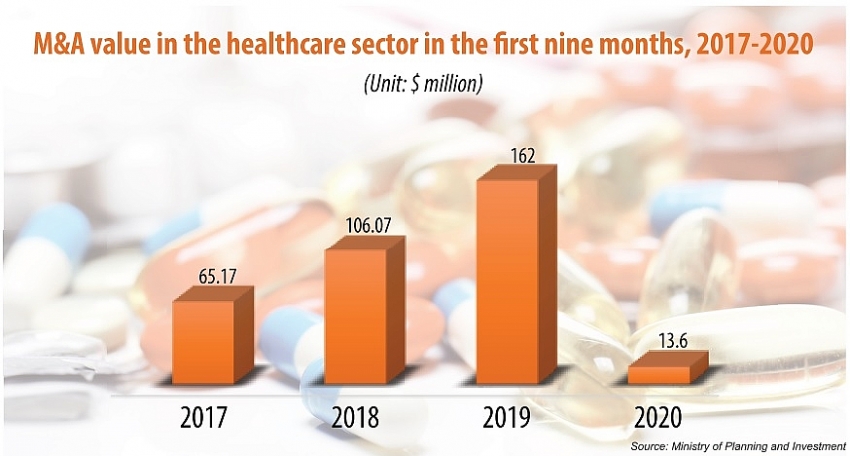

According to statistics from the Ministry of Planning and Investment, foreign investors poured only $13.6 million into M&A transactions in the healthcare sector in the first nine months of 2020, compared to the nearly $162 million in the same period last year.

Meanwhile, 2019 and previous years marked a number of M&A deals valued at trillions of VND and involving major foreign investors including Abbott’s investment into Domesco, Taisho Pharmaceutical Holdings into Hau Giang Pharmaceutical JSC, Adamed Group of Poland into Dat Vi Phu Pharmaceutical JSC, and the aforementioned Stada Service’s ownership increase in Pymepharco.

COVID-19 has also forced the market to depart from initial predictions. Earlier, Vu Thi Que, partner and chairwoman of law firm Rajah & Tann LCT Lawyers, said that pharma and healthcare M&A deals were still on an increasing trend in the second half of 2020.

She also noted that pharmaceutical companies from India, Thailand, Japan, Malaysia, South Korea, and Europe were still seeking investment opportunities in Vietnam.

Bright but uncertain

According to industry insiders, the M&A picture in the healthcare and pharmaceutical market will be backed by a number of encouraging factors like the EU-Vietnam Free Trade Agreement (EVFTA), digital transformation, and legal improvements. However, uncertainty remains until the global health crisis is controlled globally.

Imexpharm, Traphaco, and Vinapharm may be the most promising names for M&A. Currently, the foreign ownership rates of Imexpharm and Traphaco are 47.8 and 47.1 per cent, respectively. Moreover, private hospitals and innovation startups will be other key targets.

According to Hong Sun, vice chairman of the Korea Chamber of Business in Vietnam, an analysis of the new tastes shown by chamber members shows that sectors like telecommunications, energy, infrastructure, and pharmaceuticals are expected to attract more investment from South Korean firms, bringing about significant value for the M&A market.

“We have already seen several M&A deals in healthcare over the past few years, showing increasing attraction. Mobile World, FPT Retail, and Digiworld – all leaders in electronics retail – have been diving into pharmaceuticals by acquiring pharmaceutical chains. Private hospitals will also be in the crosshairs, driven by growing local demand for healthcare,” Sun told VIR.

On the innovation front, Singaporean investors have been attracted to Vietnam’s fast-developing technology and innovation landscape, with the country ranking 42nd out of 131 economies in the Global Innovation Index for the second consecutive year.

Singaporean-based venture capital firm Vertex Holdings recently invested into newly-launched Do Ventures, which focuses on early-stage Vietnamese startups that provide services via business-to-consumer and business-to-business platforms in the sectors of education, healthcare, and social commerce.

Experts said that digital transformation is also a keystone to kick M&A in the healthcare sector into a higher gear. Alexander Feldman, chairman of the US-ASEAN Business Council, said that healthcare equipment and pharmaceuticals are the most appealing sectors for companies. Many Silicon Valley-based technology firms are planning to set foot in Vietnam by either direct investment or M&As.

Elsewhere the EVFTA, which came into effect in August, is expected to make Vietnam more accessible to pharmaceutical imports from the EU. This will drive their businesses to invest directly or conduct M&As in the sector.

Moreover, recent improvements in Vietnam’s legal framework in this area also elevates the prospects of future M&A deals.

The adoption of the amended Law on Investment, which comes into effect in January, has made major changes. It has amended the list of conditional sectors and business lines and highlighted specific conditions for sectors that are entitled to investment incentives. It also made investment procedures simpler while at the same time extending the scope of state-owned enterprises.

In addition, the revised Law on Securities will take effect in January 2021. This law would not only simplify procedures but also tighten the criteria and conditions for initial public offerings.

For state-owned enterprises, decrees No.126/2017/ND-CP and No.32/2018/ND-CP are making divestment and equitisation processes clearer, enabling overseas investors to carry out more activities.

Despite the advantages, there remains uncertainty about future M&A deals in the healthcare and pharmaceutical sector as there is little sign of a slowdown in COVID-19 developments, and no clear intention to conduct M&A deals just yet.

Le Duc Khanh, head of Research VPS Securities Inc., projected in October that the M&A market would see few deals in the healthcare and pharmaceutical sector this year. “Next year’s prospects may be better if the pandemic is better controlled globally,” he added.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- New rules ease foreign access to Vietnam equities (February 05, 2026 | 17:29)

- Vietnam’s IFC creates bigger stage for M&As (February 01, 2026 | 08:16)

- Game startup Panthera raises $1.5 million in seed funding (January 29, 2026 | 15:13)

- Cool Japan Fund transfers shares of CLK Cold Storage (January 28, 2026 | 17:16)

- Nissha acquires majority stake in Vietnam medical device maker (January 26, 2026 | 15:40)

- BJC to spend $723 million acquiring MM Mega Market Vietnam (January 22, 2026 | 20:29)

- NamiTech raises $4 million in funding (January 20, 2026 | 16:33)

- Livzon subsidiary seeks control of Imexpharm (January 17, 2026 | 15:54)

- Consumer deals drive Vietnam’s M&A rebound in December (January 16, 2026 | 16:08)

- Southeast Asia tech funding rebounds on late-stage deals (January 08, 2026 | 10:35)

Tag:

Tag:

Mobile Version

Mobile Version