Advanced search

Search Results: 2,237 results for keyword "banks".

PM underlines banking system's role as arteries of economy

16-10-2022 20:37

Prime Minister Pham Minh Chinh said the banking system plays the role as arteries of the economy while addressing a meeting with chairpersons and CEOs of commercial banks in Hanoi on October 16.

Dampening bank profit picture in coming months

14-10-2022 21:14

Interest rates trending higher and vulnerabilities in the corporate bond and real estate markets are expected to dampen banks' profit prospects in the coming time.

Temporary interest rate package requiring second look

13-10-2022 10:00

The reach of the 2 per cent lending rate support policy has been lower than expected after banks applied common credit standards to businesses that wanted to benefit from the scheme – leading to both sides asking for more assistance in improving the situation.

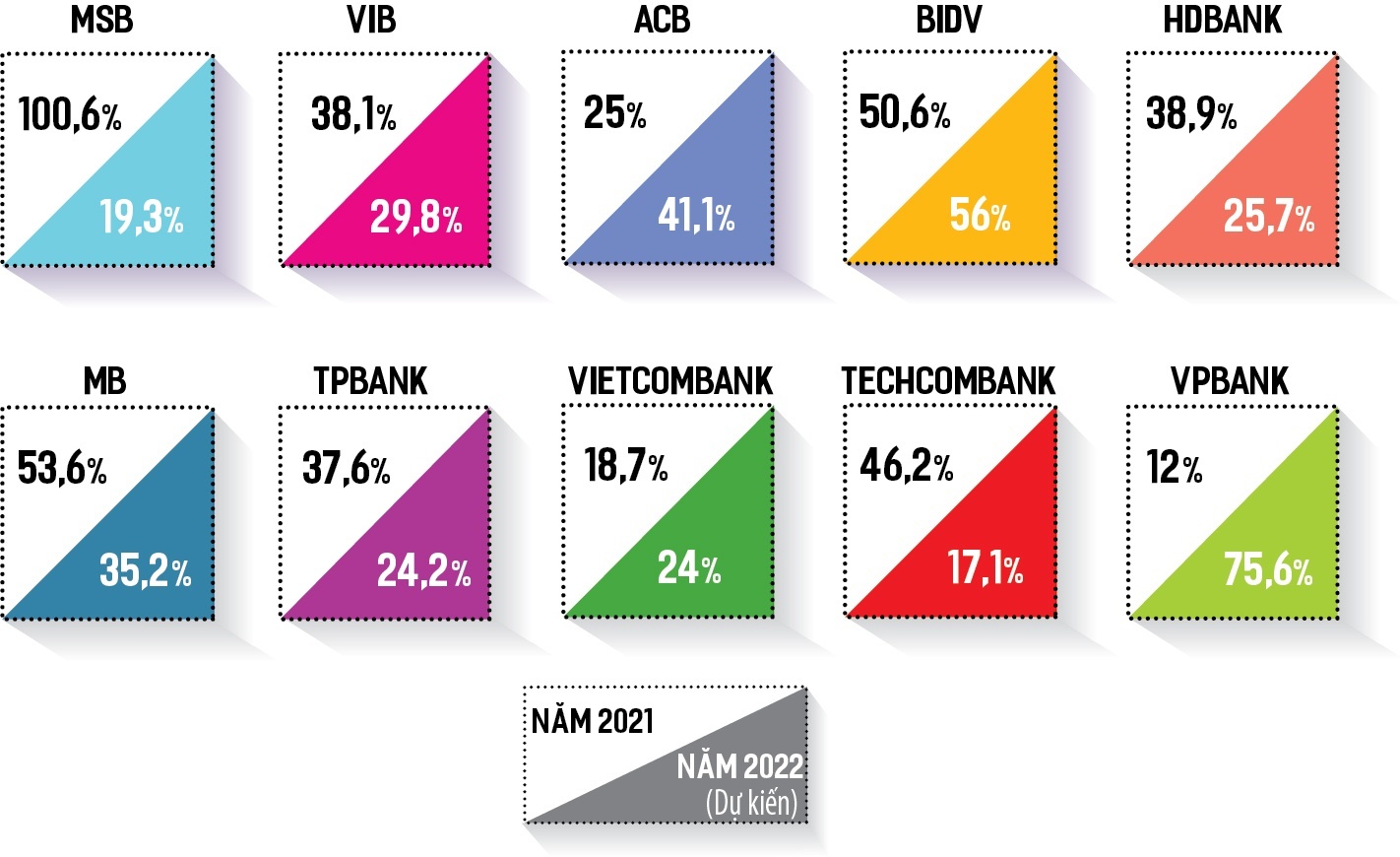

Banking activities paying off through third-quarter progress

12-10-2022 09:00

In contrast to previous years, it is possible that the official third-quarter profit for banks will climb faster than the fourth quarter, since credit will increase primarily in Q3 and decelerate afterwards.

Oil jumps but dollar bruised on US data

10-10-2022 14:50

Oil prices jumped Monday on expectations of an OPEC output cut, while weak US data sent stocks higher amid rising hopes central banks may be able to ease off interest rate hikes.

Four banks have adjusted credit room

07-10-2022 08:16

The State Bank of Vietnam (SBV) has officially adjusted the credit room for four banks in a bid to support weak credit institutions according to the government's policy.

SBV shifts up interest rates to combat US Fed adjustments

06-10-2022 09:30

After the State Bank of Vietnam implemented the new operational interest rate on September 23, all joint-stock commercial banks, with the exception of state-owned ones, have adjusted the deposit interest rate for most terms.

Home Credit becomes member of Vietnam Bank Card Association

05-10-2022 17:25

Home Credit Vietnam has joined the Vietnam Bank Card Association (VBCA) under the Vietnam Banks Association (VNBA), marking a milestone in the development of the digital consumer financier in Vietnam’s financial market.

Banking industry steps up digital transformation

05-10-2022 16:20

The pandemic has been prompting banks to adapt. As digital transformation has become inevitable, banks have stepped up their efforts to adopt more new technologies in the digitalisation race.

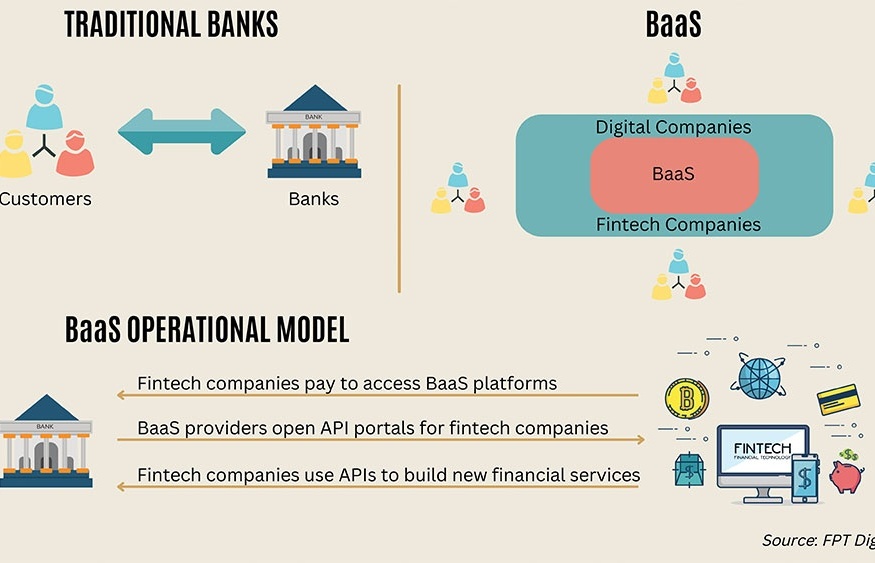

Banking-as-a-Service picks up steam to aid growth strategies

05-10-2022 15:20

As embedded finance is rising in the financial sector, Banking-as-a-Service platforms are now being widely looked at and adopted by Vietnamese banks.

Credit growth cap remains indispensable for macroeconomic stability

04-10-2022 09:09

Businesses have faced difficulties in access to capital and commercial banks want to be able to lend freely to meet market demand. However, experts said the imposition of the credit growth cap is still necessary to keep the country’s macro economy stable in the short run.

The 10th anniversary VietinBank - MUFG strategic alliance

30-09-2022 10:59

The year 2023 will mark the 10th anniversary of the VietinBank - MUFG strategic alliance. This is a significant milestone on the collaboration journey of the two banks and triggers so many special memories.

Trading volumes increase in spite of money market jitters

28-09-2022 10:00

As financial fragility is pushed by uncomfortably high expansion and national banks’ arrangements push investigators to pile back into the market, forex trading volumes are rising again.

Banks moving to restructure bad debts

26-09-2022 16:31

As a circular on debt rescheduling for clients affected by the pandemic has expired, banks will face several scenarios to deal with in terms of debt restructuring.

Keeping on top of crypto legislation

26-09-2022 10:00

The growth of central bank involvement in the digital currency sector has significantly been increased in recent years, with many central banks considering launching a central bank digital currency.

Mobile Version

Mobile Version