Dampening bank profit picture in coming months

Banks’ profits in the third quarter this year have gained exposure among the public with upbeat results.

In the first nine months of 2022, TPBank reached 72 per cent of its full-year profit target, counting $257.6 million in pre-tax profit, equal to a 35 per cent jump on-year.

|

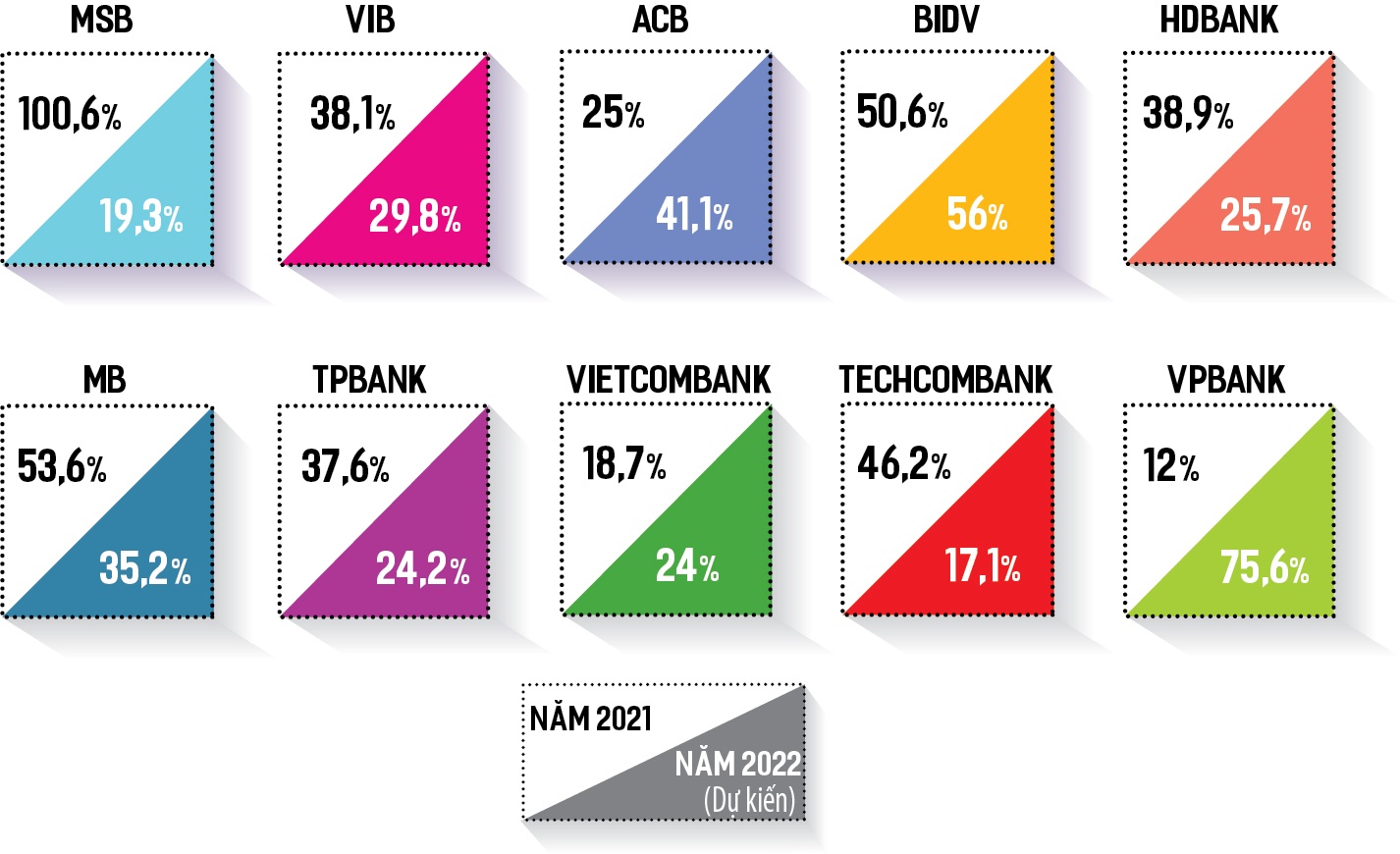

| The profit growth forecasts of several banks (Source: SSI Securities) |

VIB reported that its nine-month pre-tax profit spiked at 46 per cent on-year to hit $339 million, meanwhile, during the period Ho Chi Minh City-based Sacombank raked in $193 million in profit, reaching 84.1 per cent of its full-year projection.

A recent forecast by SSI – a leading Hanoi-based securities company – shows that of the 10 listed banks whose profits were assessed, their full-year profit growth ranges from 18 per cent to nearly 76 per cent.

Despite such positive figures, it is apparent that banks’ profit growth pace has been slowing down, particularly in the fourth quarter of this year due to higher capital costs.

| The slowing profit growth has been attributed to a rising mobilising rate, leading to a dwindling net interest margin. |

As highlighted in the SSI forecast, this year Maritime Bank will see its net profit growing at 19.3 per cent instead of 92 per cent in 2020 and 100.6 per cent in 2021.

Similarly, VIB’s net profit growth will be growing at nearly 30 per cent for the whole of 2022 compared to more than 42 per cent in 2020 and above 38 per cent in 2021.

At southern-based commercial lender HDBank, its 2022 profit growth is expected to be significantly lower at 25.7 per cent compared to a 39 per cent hike in 2021. MB’s net profit growth is estimated at 35.2 per cent compared to a 53.6 per cent rise last year.

The slowing profit growth has been attributed to a rising mobilising rate, leading to a dwindling net interest margin.

In addition, the rising bad debt threat in the fourth quarter this year and in 2023 has pushed banks to scale up loan loss provisioning.

The unfavourable situation in the corporate bond and real estate market has not only dampened banks’ profit outlooks but also exaggerated the bad debt threat, particularly regarding banks having injected large sums into corporate bond and real estate markets.

Based on their second-quarter financial statements, the banks holding the most corporate bonds include TPBank, Techcombank, MB, VPBank, Sacombank, and OCB, among others.

| Businesses post buoyant profit picture in the year to date Amid the economic rebound post-pandemic, many businesses aspire rosy profit picture in the second quarter of this year. |

| Export picture enjoys benefits from restart In defiance of massive woes, Vietnam’s export-import landscape is gaining momentum on the back of the gradual recovery in domestic manufacturing and bit-by-bit reopening of many foreign markets, promising a brighter trade picture for the country this year. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version